Collective Efforts Towards Advancing Sustainable Blue Economy in Africa

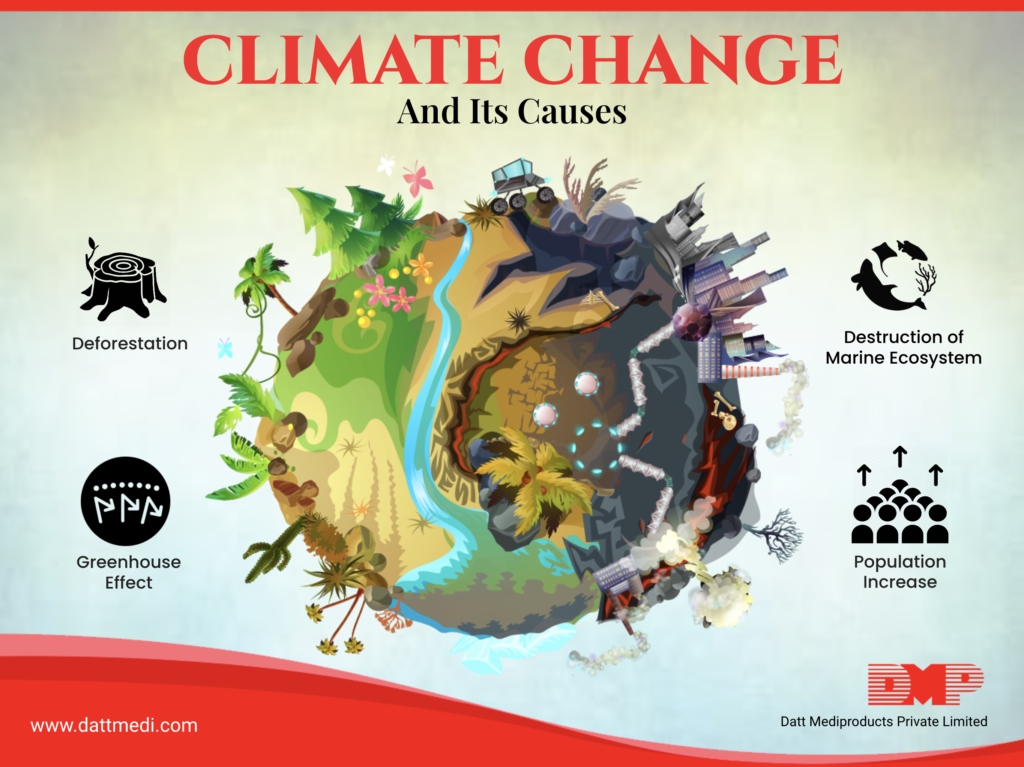

Climate change, poorly managed coastal environments, pollution, and other threats are putting immense pressure on Africa’s oceans, impacting both its environment and economy. To address these concerns, the African Union adopted a comprehensive climate change and resilience strategy in 2022 providing a robust framework to assess key challenges and priorities.

At the sidelines of the Africa Climate Summit, the African Union InterAfrican Bureau for Animal Resources together with its partners: South African Institute of International Affairs (SAIIA), SADC Secretariat, Mwambao Coastal Community Network Tanzania, MIHARI Network, Madagascar and AUDA-NEPAD participated in a panel to discuss Ocean climate and the Blue Economy.

Africa’s vulnerability to climate change is a global concern making it imperative to collaborate on building resilience and adaptation strategies. Oceans, as carbon sinks, play a crucial role in reducing emissions, presenting an opportunity for climate action.

The panel highlighted critical challenges facing marine ecosystems, emphasizing the urgent need for action. The African Union’s vision for the blue economy extends beyond the oceans, encompassing inland water bodies and emphasizing the nexus between oceans and climate. AUDA NEPAD’s commitment to translating policy decisions into actionable projects, coupled with the AU’s endorsement of the blue economy, underscores the region’s dedication to creating a sustainable environment.

Read also : Digital Payment Service PayShap Closes in on a Million Transactions

The AU-IBAR, tasked with developing and utilizing animal resources, is actively engaged in the blue economy. Conserving aquatic biodiversity projects is central to this mandate, as a healthy ocean is fundamental to the blue economy sector. Dr. Alberta Sagoe, AU-IBARs Gender Policy and Strategy Expert noted that the project focuses on supporting AU member states to align with global instruments related to the blue economy, coordinate activities, address climate change, mitigate deep-sea mining, and enhance women’s inclusion in aquatic biodiversity conservation. The gender sensitivity agenda and collaboration with organizations like IUCN are key strategies in this endeavor.

SADC’s climate change strategy includes a blue economy component, aiming to address ocean-related challenges through an ecosystem-based adaptation approach. This approach emphasizes coordinated and coherent management, fostering innovation and good practices. Tanzania’s Mwambao coastal unit talked about the positive impact of community engagement, demonstrating how management planning and resource conservation can improve ocean health and local livelihoods.

The panel discussion conveyed several key messages. There’s a pressing need to increase commitment to ocean-related issues, aligning them with broader climate discussions like the Conference of Parties (COPs). The sustainable exploitation of resources while conserving biodiversity is vital, with a focus on gender equality and the invaluable contributions of women. Close collaboration between national focal points for climate change and blue economy sectors is essential. Harnessing the benefits of carbon sequestration and engaging stakeholders at all levels will be instrumental in creating a sustainable blue economy.

Read also : Kenyan Fintech Startup FlexPay Secures Renew Capital Investment for ‘Save Now, Buy Later’ Revolution

Additionally, dialogue platforms that bring together different parties to tackle specific issues will be essential to support member states in preparing for the growth of coastal and marine tourism alongside oil and gas exploration. Ultimately, Africa’s blue economy holds great potential, but it must be developed sustainably, considering the well-being of its environment and communities.

Kelechi Deca

Kelechi Deca has over two decades of media experience, he has traveled to over 77 countries reporting on multilateral development institutions, international business, trade, travels, culture, and diplomacy. He is also a petrol head with in-depth knowledge of automobiles and the auto industry