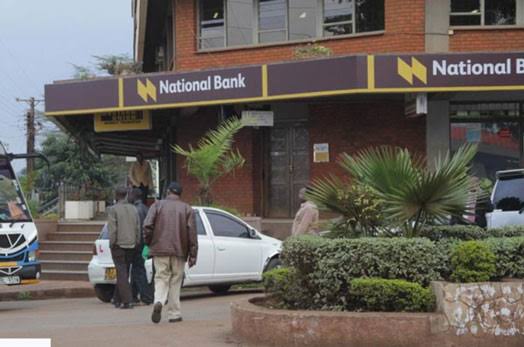

Government-owned National Bank of Kenya Finally Acquired, 51 Years After

End of the road for Kenyan government-owned National Bank of Kenya which has been in existence for the past 51 years. Kenya’s Capital Markets Authority, an independent government financial regulatory agency responsible for supervising, licensing and monitoring the activities of market intermediaries, including the stock exchange has approved the papers for Kenya Commercial Bank to acquire 100 percent of the assets and liabilities of NBK.

Here Is The Deal

- After Kenya’s Central Bank of Kenya (CBK) first approved the acquisition, the Capital Markets Authority of Kenya has gone ahead to put the final seal on the acquisition, making Kenya Commercial Bank (KCB) the largest lender in the whole of the East African region in terms of numbers as well as assets.

- KCB confirmed that it had received consent to acquire National Bank from shareholders holding 297,130,033 issued ordinary shares out of 338,781,200 issued ordinary shares, representing 87.7 percent by the offer closure date on August 30, 2019.

“We will take several integration decisions including rationalization of our branch network in order to enhance service delivery to our customers. Additionally, we will examine the overall human resource needs to enable efficient business organization” said Oigara, KCB Group CEO who says the next move will be to fully integrate NBK into KCB within the next 24 months.

- KCB is now proceeding to complete the transaction as all conditions of the offer have been satisfied (or waived, where legally capable of waiver).

- The condition for the conversion of the non-cumulative preference shares in the share capital of NBK has been met and the conversion and swap of the said shares will occur.

- On completion of these processes, KCB will hold 1,432,130,033 ordinary shares comprising 97.17 percent of the total issued share capital of NBK.

- KCB will further apply the provisions of the Capital Markets (Take-overs and Mergers) Regulations, 2002 and Part XXIV, Division 4 of the Companies Act to compulsorily acquire the remaining 41,651,167 issued ordinary shares of NBK. Requisite notices in this regard will be sent to all concerned shareholders.

- KCB first pursued NBK earlier this year after the later registered a 98 percent drop in profits from Sh400 million to Sh7 million for the year ended December 2018 as the lender struggled with bad loans.

The Implication of This Acquisition

- This acquisition does one thing in the Kenyan banking sector: it has brought the last vestiges of government ownership stakes in banks to an end. It is now therefore safe to say that Kenya’s government ownership stakes in banks in Kenya may have been completely eliminated. National Bank of Kenya was was established in 1968 as a 100 percent government-owned financial institution. In 1994, the Kenyan Government reduced its shareholding to 68 percent by selling 32 percent shareholding to the public. The government further divested from NBK over the years, until its present shareholding of 22.5 percent, as of April 2019. Following 12 years of poor financial performance, the bank became profitable again in 2010, paying out an annual dividend ever since.

- Apart from its banking business, National Bank is bringing to the table National Insurance Agency, Natbank Trustees and Investment Service Limited. These are all what Kenya Commercial Bank has now acquired.

- Obviously, this will comfortably make KCB that largest commercial lender in the whole of East Africa.

- The implication of this acquisition would also extend to the shareholders of both banks. Since both banks are all listed on Kenya’s stock exchange, with effect from next week, the NBK shareholders who swapped their shares for those of KCB will be able to freely trade the new stocks at the Nairobi Securities Exchange (NSE).

- KCB owns banking subsidiaries in Uganda, Tanzania, Rwanda, Burundi and South Sudan.

“We are thankful and excited for the goodwill and support we have received from the shareholders, our regulators and all the other stakeholders. This is a good start as we get into full transition,” said Oigara.

What Will Change

Expect a bit of readjustment in the workforce, even if it means retrenchment of workers. This first wave of that has already come earlier this week when KCB announced the appointment of Paul Russo as the designate Managing Director of National Bank of Kenya for the transactional 2-year period of integration into KCB. Russo, who was serving as the Group’s Director of Regional Businesses, has been tasked with leading the transition team that will directly report to the KCB Group Chief Executive Officer and Managing Director Joshua Oigara.

According to a statement from KCB, KCB will also particularly work towards streamlining human resources, systems, processes and procedures to fully realize the value of the envisioned combined efficiencies and productivity synergies post the acquisition.

It is also expected that the NBK Board will, of course, be reorganized.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world.