Would The Coronavirus Epidemic Affect Fund Raising For African Startups In 2020?

African startups fund raising in 2020 is headed for a long year, thanks to the Coronavirus epidemic.

‘‘A Singapore-based VC firm told a startup I’m working with that they’re not going to wire the entire $2m investment they committed to in the Series A, which has been in closing the last few weeks. The rationale was to conserve capital due to coronavirus. The funding risk is real,’’ tweets Tommy Leep, an angel investor and founder at Jetstream.

The Coronavirus epidemic is enveloping the whole world. At the time of writing this (8pm, March 5, 2020) a total of 97,252 cases have reportedly been confirmed, a whopping number of 3,349 deaths recorded. Alone in Africa, Senegal has reported 5 cases, Algeria 12, Egypt 2, with South Africa and Nigeria each reporting a single case so far. Startups in Africa looking to raise funds any time soon are confronting the biggest dilemma of their existence. Founders know the implications of running out of funds in emerging markets. CanGo is the most recent memory of an African startup failure inspired by a glut in funding.

‘‘The biggest…companies in the world were often founded and/or funded in way bigger crisis than this,”Dag Kittlaus Co-Founder & CEO of Siri (acquired by Apple) & Viv Labs (acquired by Samsung) joins Leep in the conversation. “Dump any VC who waffles when the slightest uncertainty arises. Imagine how much they will have your back in a REAL crisis. @shawnvc is the best example of this. “All in” 2008.’’

‘‘And by “all in 2008”, I mean that @shawnvc was looking to buy out other VC interests in Siri in the dark days of 2009, way prior to Apple interest, during the biggest financial crisis of our generation. Look for your @shawnvc, not the “no backbone” VC described here,’’ Kittlaus further stresses.

From the conversation above one thing is clear: traditional venture capital firm or angel investor’s investment mood depends very much on the environment in which both the investing and receipt of the investment are happening. While Leep talks about his Singapore-based VC firm, Kittlaus is an American who has had (and probably would continue to have) all the luxury of the Silicon Valley startup and VC ecosystems.

For startups in Africa, the case and the fear may be different entirely. However, it may be appropriate to argue that humanity, Africa in particular, has had its fair share of worst epidemics in the past.

2014, for instance, was one of the worst years for the African continent. The outbreak of the Ebola virus shook the continent’s 1.2 billion people, claiming over 11,000 lives , particularly in the countries of Liberia, Guinea, Sierra Leone, Nigeria, and Mali.

At the end of 2014, VC4Africa which tracked 104 investments in startups across Africa listed on its platform, reported a total amount of USD 27 million in funding. Out of the 104 tracked investments, most were in Nigeria (24), followed by Kenya (19), Tanzania (12), South Africa (11), Ghana (10), Uganda (10), Cameroon (9) and Egypt (9). That same year also, ecommerce startup, Jumia, singularly raised $150 million in its pre-Series C funding round, its first round of financing that crossed the $100 million funding threshold since its founding in 2012.

For one thing, it is settled that startups on the African continent, a year after in 2015, brought in more than $185.7 million, a figure which is larger in size than the previous year’s.

While it could be argued that only a few startups in the countries ravaged by Ebola in Africa raised substantial amounts of funding in 2014, investors’ confidence towards a particular geography most affected by a disease outbreak generally is often consistently biased, especially as the outbreak of the Ebola virus was accompanied by warnings to reduce the frequency of human interactions.

Perhaps the best way to look at the effects of disease outbreaks on startups and businesses generally is to take a hard look at the behaviour of stock market investors over the years. Historically, in the US, where the world’s first two most valuable stock exchanges exist (New York Stock Exchange worth $18.83 trillion; and NASDAQ worth $7.51 trillion), reactions to such epidemics and fast-moving diseases is almost always short-lived.

According to Dow Jones Market Data, the S&P 500 posted a gain of 14.59% after the first occurrence of SARS back in 2002–03, based on the end of month performance for the index in April, 2003. About 12 months after that point, the broad-market benchmark was up 20.76%, (see attached table):

SARS resulted in a total of about 8,100 people being sickened during the 2003 outbreak, with 774 people dying, according to data from WHO and the Centers for Disease Control and Prevention.

Separately, the S&P 500 rose 11.66% in the roughly six months following reports of the 2006 Avian flu virus — a fast-moving pathogen also known as H5N1. The market gained 18.36% in the following 12-month period.

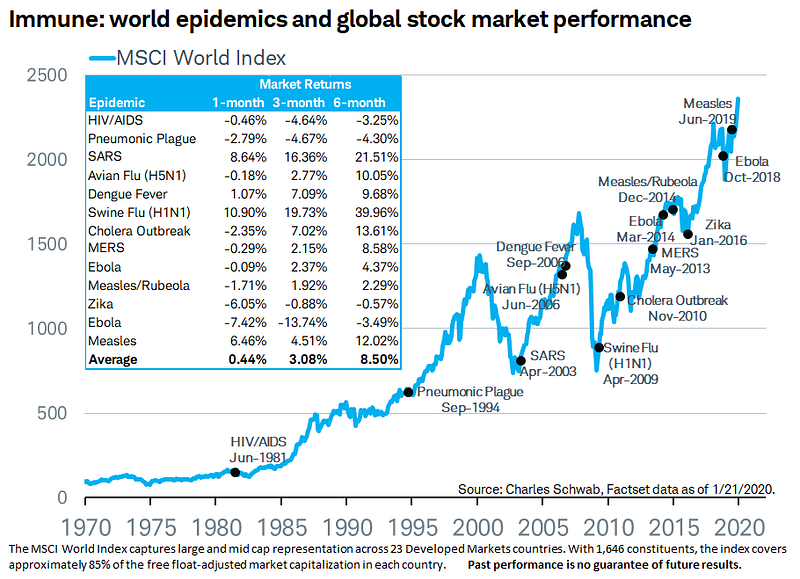

Data are almost the same for stocks performance across the globe based on data from Charles Schwab, which tracked the MSCI All Countries World Index 892400, +2.67%. The index has gained an average 0.4% in the month after an epidemic, 3.1% in the ensuing six-month period and 8.5% a year later (see graphic below):

Therefore, the severity of the virus, ultimately, will dictate the market’s reaction, and just because indexes had managed to shrug off the contagion from outbreaks in the past doesn’t mean that will be the case this time.

In any case, experts stress that it is important not to generalize the potential for unexpected results from epidemics on economies and markets.

“We cannot draw any fixed conclusions about the effects of pandemics upon stock-market performance. Equity markets react unpredictably to the unknown; nevertheless, such events should not be examined in isolation, but viewed in common with other prevailing market conditions,” according to a 2006 report commissioned by Fidelity Investments and cited by Bloomberg News.

Would the same be said about African startups pitching for funds from VCs and angels this year, in the face of the continuing Coronavirus epidemic? Ed Sim, founder and managing partner of Boldstart Ventures, an enterprise seed fund which has invested in over 50 startups in enterprise infrastructure, appears to have some answers about the whole situation.

‘‘We don’t know what next few weeks hold but seems like it will get worse before getting better,’’ he writes in a series of tweets. ‘‘If you are a top down/direct sales-led startup, you will likely miss your Q1 unless (you’re) most in procurement by now.’’

‘‘Many Fortune 500s (are) not allowing face to face meetings and travel… Continue doing all you can to close out Q1 (January-March, 2020)but my recomendation (is) to freeze all non essential hiring until we know more in few weeks,’’ he further says.

‘‘Product-led growth companies (are) in better shape as most business and conversion (are) done online and over Zoom and phone. Still if (you are) upscaling from teams to enterprise which means multiple decision makers, things will be delayed. Plan for it, ’’ he advises.

‘‘As some VC firms move to all remote as well, funding will slow down,’’ he concludes. ‘‘Hoard and protect your cash until we know more. I (pray) that this will not be as bad as we think, but having gone through a couple bubbles and doing this for 24 years, better to be safe than sorry.’’

Venture Capital firm Sequoia Capital further suggests you question every assumption about your business during this period.

‘‘Having weathered every business downturn for nearly fifty years,’’ it says, ‘‘we’ve learned an important lesson — nobody ever regrets making fast and decisive adjustments to changing circumstances. In downturns, revenue and cash levels always fall faster than expenses. In some ways, business mirrors biology. As Darwin surmised, those who survive are not the strongest or the most intelligent, but the most adaptable to change.’’

Click here to further read Sequoia’s infamous R.I.P. Good Times presentation in 2008

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer.

He could be contacted at udohrapulu@gmail.com