The world must not sleep-walk into another debt crisis

By Patricia Scotland.

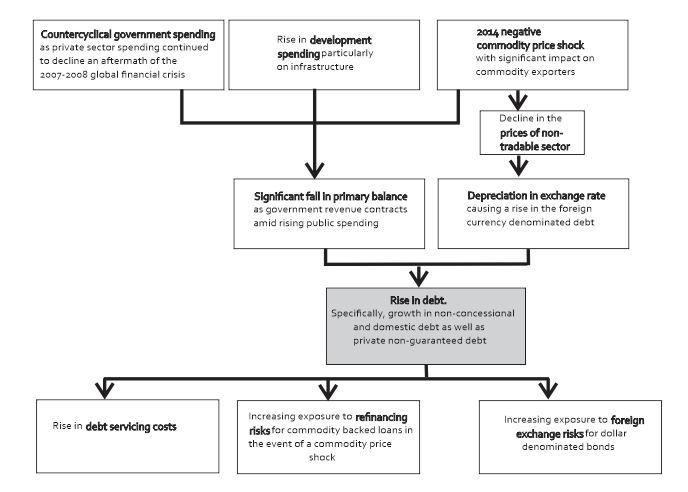

TRADE wars, protectionism, and nationalist rhetoric are combining to weave the possibility of a nightmare debt crisis that could be worse than any previously experienced. Global borrowing is now at the highest levels since the 1950s – and history suggests we should take this as a warning that a debt crisis could be looming.

Were one to materialise, it could inflict greater dislocation on international financial systems and national economic stability than ever previously witnessed, especially in this highly uncertain environment characterised by the trade war and regional disintegration.

Read also : Nigeria Is Now More Than $69 Billion In Debt

This would be particularly tragic in view of the extraordinary global commitment to delivering Sustainable Development Goals, and as so many nations seem finally to be in earnest about tackling the causes and impact of the climate crisis.

The impact of a parallel crisis in global debt would derail this and could make much needed international cooperation on poverty and progress impossible. Governments would be diverted by the need to stabilise local economies devastated by unmanageable debt. Yet such a scenario can be averted.

Haunting memories of the economic chaos, poverty and suffering caused by previous debt crises are the reason that the finance ministers of Commonwealth are working together to prevent the needless recurrence of an avoidable crisis.

Read also : Congo Republic’s Debt Is 114% of Its GDP But IMF Has Just Approved A Major Bailout

The breadth and inclusiveness of the Commonwealth mean that when our member countries meet, many perspectives are brought to the table. These can be shared to decisive effect when Commonwealth countries work together to ensure the voices and views of all are taken into account at forums such as the G20 and other international and regional gatherings.

It is no longer feasible for policies on debt, trade and other economic matters to be considered in isolation from the increasingly extensive impacts of climate change, which are becoming more frequent and more stark.

Small island states tend to be the most vulnerable to extreme weather and natural disasters, and also to have the least resilience or resources with which to recover from the damage to their infrastructures and economies.

Read also : Ethiopia Is Now $52 billion In Debt, Twice The GDP of Uganda

With interest rates at historically low levels, borrowing becomes an attractive proposition yet heightens the concomitant risk of debt ballooning to levels which are unsustainable over the longer term. This raises the possibility that countries which have ‘borrowed their way out of trouble’ following a setback will eventually face very severe debt distress. Preventing such eventualities is a global challenge which requires collective and coordinated responses.

The Commonwealth is particularly and perhaps uniquely well-placed to ensure that the perspectives and needs of developing nations are fully considered in multilateral discussions on policy for tackling future debt crises. This is the purpose of our Commonwealth Finance Ministers Meeting taking place in Washington DC alongside the annual meetings of the World Bank and International Monetary Fund.

The ministers of our 53 diverse and widely distributed yet closely connected nations will this year examine proposals designed to improve debt transparency. They will consider ways in which debt contracts can be specially amended to provide relief during disasters. Such initiatives will be supported by collating the perspectives of ministers from developing countries so that their Commonwealth counterparts from countries with advanced economies can carry them forward for the attention of the G20. The way to a stable and sustainable economic future is for developing and developed countries to work together inclusively on shaping the global debt rules which affect them all. So our Commonwealth approach is to focus on the roles of creditor and indebted countries.

Read also : Kenyans With $1000 In Their Bank Accounts Fall To A 13-year Low

There have been instances of hidden national debt burdens, and this places responsibility on creditors as well as debtors. In countries where fiscal regulation is weak, debt may be acquired or accumulated in ways which are not transparent, and very seriously to the detriment of citizens. Those who provide credit in such circumstances are also culpable, and they too must be scrutinised and be made to bear responsibility – particularly as those who suffer the most pain from unsustainable debt and carry the greatest burden at times of crisis tend to be the poor and marginalised – those least able to cope.

Among topics and actions being considered at our 2019 Commonwealth Finance Ministers meeting are:

DebtRelief – with an agreement to be sought for debt contracts with vulnerable countries to include provision for relief if a severe natural disaster strikes. Transparency in debt through innovation – encouragement to use the Commonwealth Meridian debt management system which helps to improve the accuracy with which government debt is recorded.

Dialogue on debt – the relaunch of the Commonwealth debt management forum to encourage international dialogue on the consequences of over-indebtedness so that sounder debt policies are adopted in order to prevent crises.

Easier access to financing to reduce debt burdens – through mechanisms and facilities such as the Commonwealth Climate Finance Access Hub and Commonwealth Disaster Finance Portal which offer added capacity for developing countries to access to affordable debt financing.

Read also : How ‘agritech’ could lead Africa’s rising start-up scene

By working together in such practical ways, and on programmes that draw together a broad and inclusive array of nations, crises can be averted. It is essential for there, to be honest, and open collaboration between creditors and debtors in a spirit of trust and goodwill. This the Commonwealth can offer, building on the depth of our connection and the basis of equality on which our family of nations comes together.

Rather than sleep-walking towards yet another debt crisis, and the misery such nightmare reality would bring, the Commonwealth can open up pathways toward horizons of hope, with rich and poor walking in harmony towards a fairer, more secure, more sustainable and more prosperous future in which all can share.

Patricia Scotland is the Secretary General of the Commonwealth of Nations

Kelechi Deca

Kelechi Deca has over two decades of media experience, he has traveled to over 77 countries reporting on multilateral development institutions, international business, trade, travels, culture, and diplomacy. He is also a petrol head with in-depth knowledge of automobiles and the auto industry.