Record-Breaking Demand: Dream VC Ignites Over 4000 Interests in African Investment Landscape

Dream VC, the pioneering program aimed at empowering African investment talent, has set a new record with an overwhelming response from aspiring entrepreneurs across the continent. With a staggering 4000+ applications received in three cohort cycles, Dream VC is revolutionizing the African venture ecosystem and generating excitement among investors and innovators alike.

The program, launched in 2021, has witnessed remarkable growth and increasing interest year after year. In its inaugural year, Dream VC attracted over a thousand applications (1002 to be precise), signaling a promising start for the initiative. The following year, the program’s allure expanded even further, with 1375 applicants vying for a coveted spot in the 2022 cohort across both programs.

However, it was the 2023 application cycle that witnessed an explosive surge of interest, as Dream VC’s reputation spread far and wide. A remarkable 2009 applicants competed for entry into both programs, demonstrating the program’s expanding reach and the rising interest among African entrepreneurs in the venture capital landscape.

One of the intriguing aspects revealed by the data is the gender dynamics within the applicant pool. In the inaugural cohort, male applicants dominated the field, accounting for 67% of the total, while female applicants represented the remaining 33%. However, the following year saw a slight decline in female representation, with only 31% of applicants identifying as female.

read also Deal Source Africa Platform Launched to Bridge the 331$bn Funding Gap for African Businesses

In a surprising turn, the 2023 application cycle showcased a resurgence of female applicants, returning to the gender ratio observed in the program’s early stages. Once again, 67% of applicants identified as male, while 33% identified as female, emphasizing Dream VC’s commitment to fostering diversity and inclusivity in the program and addressing the gender imbalance prevalent in the investment landscape.

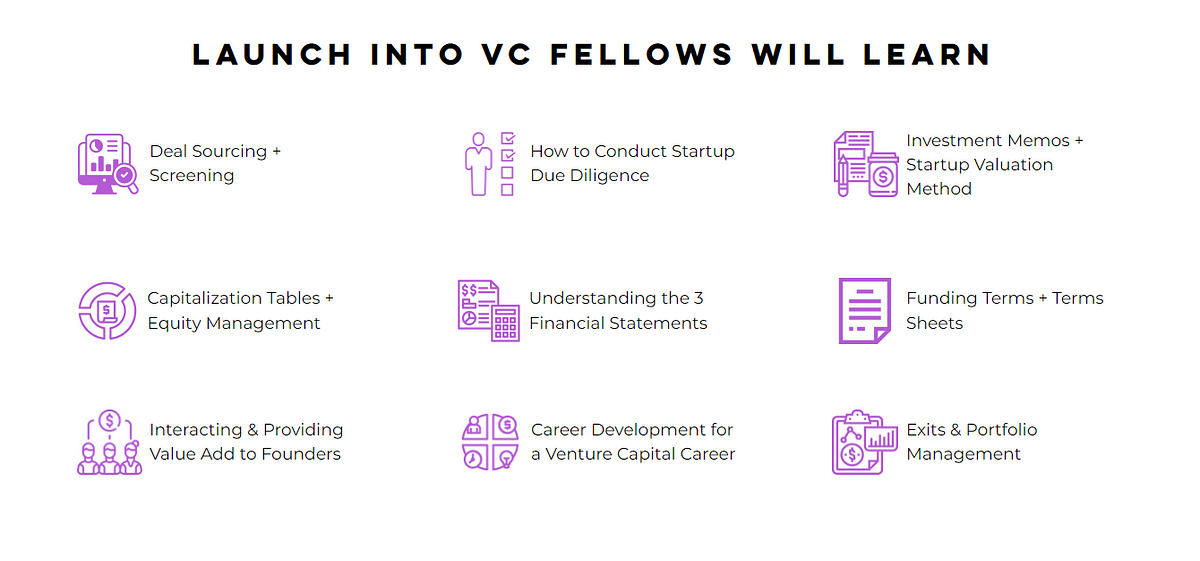

Delving deeper into the data, the breakdown of applicants between the two programs offered by Dream VC reveals intriguing trends. In 2022, the Launch into VC program garnered the majority of applications, with approximately 81% of applicants expressing their interest in this transformative program. The remaining 19% sought entry into the Investor Accelerator program, demonstrating the high demand for gaining crucial skills and insights into the world of venture capital.

Analyzing the gender composition within each program, the Launch into VC program saw a positive shift in female representation. From 29% in 2022, the percentage of female applicants increased to 33% in 2023. However, in the Investor Accelerator program, the percentage of female applicants experienced a slight decline, dropping from 37% to 34% during the same period. These figures underscore the ongoing need for concerted efforts to encourage and support more women in pursuing investment careers and closing the gender gap in the industry.

read also ConstructAfrica publishes its Ghana Construction Market Report 2023

Dream VC’s transformative impact on the African venture ecosystem is evident through its growing influence and the overwhelming response it continues to receive. As the program paves the way for the next generation of African investors, it remains committed to empowering diverse talent and fostering an inclusive environment that reflects the continent’s vibrant entrepreneurial spirit.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer, who has several years of experience working in Africa’s burgeoning tech startup industry. He has closed multi-million dollar deals bordering on venture capital, private equity, intellectual property (trademark, patent or design, etc.), mergers and acquisitions, in countries such as in the Delaware, New York, UK, Singapore, British Virgin Islands, South Africa, Nigeria etc. He’s also a corporate governance and cross-border data privacy and tax expert.

As an award-winning writer and researcher, he is passionate about telling the African startup story, and is one of the continent’s pioneers in this regard