Zimbabwe Shuts Down Popular Mobile Money Service InnBucks

Zimbabwe’s central bank, which is battling inflation-inducing exchange rate distortions, has shut down the country’s popular mobile money transfer service, InnBucks, for operating without a license.

InnBucks, which is operated by fast food franchisee Simbisa, is a mobile platform that uses USSD and mobile application technology to enable consumers to send and receive money as well as make purchases at fast food locations.

Mobile money has grown in popularity as a convenient way to store and move US dollar funds across the country.

However, the Reserve Bank of Zimbabwe (RBZ) has declared that it will suspend operations a week after the EcoCash mobile money platform — operated by telco Econet Wireless — got authorisation to accept foreign currency cash-in and cash-out.

Read also : UK’s Fintech Dapio in $3.4M Gets Backing From Flutterwave on Contactless Payments

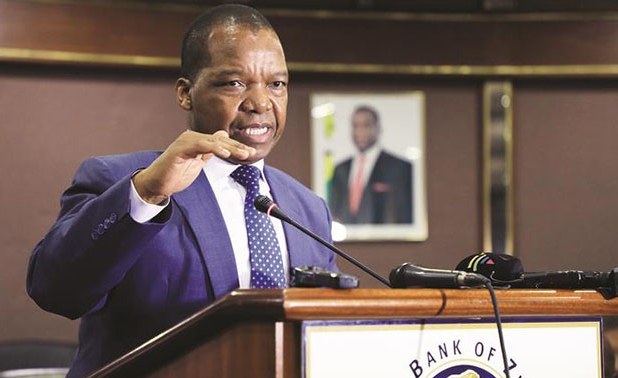

“The Reserve Bank of Zimbabwe (the Bank) wishes to inform the public that it has directed Simbisa Brands (Private) Ltd to immediately suspend operations of the money transfer service branded or styled InnBucks,” Zimbabwean central bank governor John Mangudya stated on Wednesday night.

Mangudya explained that the RBZ directed InnBucks in November 2021 to “ask for and secure appropriate approvals to continue operating the service.”

The RBZ is Zimbabwe’s central bank and has been putting the screws on mobile money carriers, accusing EcoCash at one point for igniting parallel market currency rates.

“Simbisa has not yet regularized the service as directed, necessitating the Bank’s inevitable regulatory involvement. Customers will no longer be able to deposit funds into their InnBucks account or transfer funds to third parties as a result of the service’s termination,” Mangudya stated.

With a huge and increasing user base, InnBucks is providing a service that was previously unavailable due to delays in approving telco-owned mobile money operators to offer foreign currency mobile money transfer services. Many still rely on traditional money transfer providers and banks, which demand exorbitant fees.

RBZ has extended a grace period to consumers, stating that “customers may redeem their balances for cash or merchandise at Simbisa Brands (Private) Ltd locations within a 30-day period” beginning yesterday.

Read also : Egyptian Electric Mobility Startup Shift EV Raises $9m To Scale Business

InnBucks and Simbisa issued a statement in which they stated that they “continue engaged with the regulator regarding their license” concerns. Regrettably, an impasse has formed, and the Simbisa Board is contacting the regulator in an attempt to resolve the matter quickly and amicably.”

InnBucks Zimbabwe InnBucks Zimbabwe

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer, who has several years of experience working in Africa’s burgeoning tech startup industry. He has closed multi-million dollar deals bordering on venture capital, private equity, intellectual property (trademark, patent or design, etc.), mergers and acquisitions, in countries such as in the Delaware, New York, UK, Singapore, British Virgin Islands, South Africa, Nigeria etc. He’s also a corporate governance and cross-border data privacy and tax expert.

As an award-winning writer and researcher, he is passionate about telling the African startup story, and is one of the continent’s pioneers in this regard. You can book a session and speak with him using the link: https://insightsbyexperts.com/view_expert/charles-rapulu-udoh