eCommerce Businesses In Cameroon Will Now Pay Tax

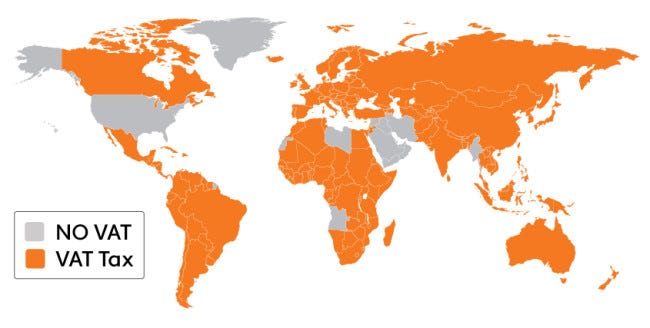

More African countries appear to be waging new tax war on online businesses . Apart from Kenya, Nigeria, and others, Cameroon has finalized arrangement to apply value-added tax (VAT) in the country’s ecommerce sector for the 2020 fiscal year. This means that by implication, online businesses would now have to pay 19.25% VAT, added to the 33% corporate tax and other additional taxes they would have to pay if they were companies.

Here Is All You Need To Know

- According to Cameroon’s Ministry of Finance (Minfi) goods and services sold on Cameroonian territory through e-commerce platforms, as well as related commissions, are now subjected to VAT.

- In addition, Cameroon’s new finance law provides for the VAT liability of e-commerce platforms, implying the obligation for them to liquidate, declare and pay VAT on digital transactions made by Cameroonian consumers.

- This law provides for the implementation of simplified modalities for the online registration, collection, and remittance of VAT for these platforms.

What This Means For Online Businesses In Cameroon

Indeed, exposing eCommerce businesses in Cameroon to 19.25% VAT would mean an additional burden on them. However, according to tax specialists, the application of VAT on e-commerce in Cameroon will not be easy, as the collection is difficult even in developed countries such as France. Indeed, a study conducted in December 2019, by the French newspaper Les Echos shows that 98% of sellers registered on the marketplaces of e-commerce sites (Amazon, Cdiscount) are not registered for VAT in France.

“During an administrative check, only 538 out of 24,459 sellers were found to be in order. This figure is all the more worrying as these ‘marketplaces’ have grown considerably in recent years. Amazon now accounts for 58% of its business, compared with 3% twenty years ago. At discount, this share would be between 30% and 40%,” Les Echos indicated.

The Kenyan Government recently introduced tax on online businesses through the Finance Bill of 2019, same with Nigeria.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award winning writer.

He could be contacted at udohrapulu@gmail.com