South African Vehicle Rental Startup Planet42 Raises $100M For Its Car Renting Business

Planet42, an Estonian-founded and South African-based car rental firm, has launched a $100 million financing to expand its operations throughout South Africa and Mexico.

According to CEO Eerik Oja, the investment consists of $15 million in stock from new and current owners such as Naspers Limited, Andrew Rolfe, and Change Ventures, $10 million in debt from shareholders, and a $75 million credit facility from Rivonia Road Capital.

The funds will be used to expand the company’s activities in South Africa and to speed its entry into the Mexican market.

read also Kenyan Mobility Startup eWAKA Secures $543K Debt Funding To Power Growth

“In South Africa, we want to put the pedal to the metal using this new financing to quickly add about 10,000 more cars to the fleet,” said Oja. “In Mexico we are exploring where best to find customers, and how to switch on dealerships, so it takes time to get the ball rolling, but we have started to test the market and have about 250 cars that side.”

He added that they chose the Mexican market because of the parallels they discovered between the country’s operational climate and that of South Africa.

“It’s very similar to South Africa in terms of income and car penetration and development or lack thereof, of financial services,” Oja added. “Plus public transportation there is slow, unreliable and dangerous, opening up a big market opportunity.”

A Look At What The Startup Does

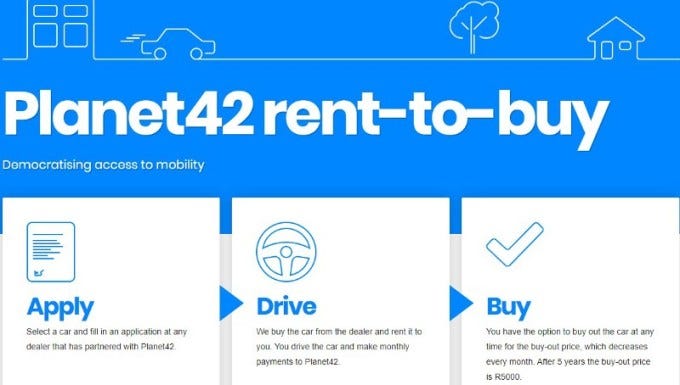

Planet42 scores a customer’s risk level and generates an offer to buy a car from a dealership of choice in minutes using proprietary algorithms and data points. The firm claims to have around a thousand vehicle dealerships in its network, which accounts for approximately 40% of its sales.

read also Kenyan Construction Tech Startup Jumba Raises $4.5M In Seed Funding Round

Planet42 also says that their product promotes mobility inclusion in South Africa by filling the gap created by the country’s main banks, which are risk adverse in granting loans to clients to enable them to buy their own automobiles, as well as solving the issue of unreliable public transportation.

Planet42’s managing director, Grant Wing, indicated that the company’s goal was to grab around 1% of the used automobile market each year, which equated to approximately 200,000 cars in total fleet size. The $100 million will be useful in doing this.

The global car rental market was worth $119.28 billion in 2021 and is expected to reach $223.07 billion by 2027, with a cumulative annual growth rate (CAGR) of more than 11% during the forecast period, according to Mordor Intelligence’s Car Rental Market — Growth, Trends, COVID-19 Impact, and Forecasts (2022–2027) report (2022–2027).

read also Meta to Launch Payment Subscription Service on Verified Accounts

Despite the fact that the study classifies Africa, along with South America and the Middle East, as a “low-growth” region in the sector, with $100 million in the bank, it appears that Planet42 and its investors are counting on the industry’s positive growth in Africa over the next several years.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer, who has several years of experience working in Africa’s burgeoning tech startup industry. He has closed multi-million dollar deals bordering on venture capital, private equity, intellectual property (trademark, patent or design, etc.), mergers and acquisitions, in countries such as in the Delaware, New York, UK, Singapore, British Virgin Islands, South Africa, Nigeria etc. He’s also a corporate governance and cross-border data privacy and tax expert.

As an award-winning writer and researcher, he is passionate about telling the African startup story, and is one of the continent’s pioneers in this regard