Debt vs. Equity: Which Way Should Startups Go

Is debt or equity fundraising smarter for startups?

There is more than one way to fund a new business venture and fuel its growth. For almost all, it is going to require bringing in outside money at some point. Even if that is only to multiply what is working or to create a source of emergency capital. The two primary options are to either leverage business debt financing or fundraise for equity investors.

Each method can carry its own pros and cons. It is vital for entrepreneurs not to blindly follow the herd just “because everyone else is doing it.” Discover which is best for you, at your stage in business, and stack the most advantages in your corner.

Once you have decided the course of action and have a lead investor covering at least 20% of your financing round you would typically also include in the pitch deck the form of financing in which you are raising the capital.

Debt Financing

We’re all familiar with debt. At some point, we’ve all probably at least had a student loan, signed up for a mobile phone contract, had a credit card, or an auto loan or lease. Debt means you are borrowing. Often, you will have to repay in monthly installments, over a fixed period of time, at a predetermined rate. Though this can vary depending on whether you are raising debt from investors, are using lines of credit or working capital loans, or even new hybrid convertible notes.

While non-recourse corporate financing is always preferred, some new entrepreneurs may also have to decide whether they will use their personal credit to get off the ground.

The Pros of Debt Financing

The biggest and most obvious advantage of using debt versus equity is control and ownership. With traditional types of debt financing, you are not giving up any controlling interests in your business. It’s all yours. You get to make all the decisions and keep all the profits. No one is going to kick you out of your own company.

Another big pro is that once you’ve paid back the debt your liability is over. With a fluid line of credit, you can repay and borrow just what you need at any time, and will never pay more interest than you need to. Looking at the big picture, using debt can ultimately be far cheaper.

One major benefit that is frequently overlooked is that business debt can also create more tax deductions. This may not have a big impact at the seed stage but can make a huge difference in net profits as you grow and yield positive revenues.

The Cons of Debt Financing

The most significant danger and disadvantage of using debt are that it requires repayment, no matter how well you are doing, or not. You might be burning cash for the first couple of years, with little in the way of net profits, yet still have to make monthly debt service payments. That can be a huge burden on a startup.

If entrepreneurs have not separated their personal and business credit, they may also find their entire life’s work and accomplishments are on the line if they default on the debt. Your home, cars, washing machine, and kids’ college fund can all become collateral damage.

It is also vital that borrowers understand that financing terms can change over time. Variable interest rates can dramatically change repayment terms later on. In the case of maturing balloon debt, as commercial mortgages, there is no guarantee of future availability of capital or terms when you may need to refinance. In the case of revolving credit lines, banks have a history of cutting them off, right when you need them most.

Too much debt can negatively impact profitability and valuation. Meaning, it can lead to inferior equity raising terms in the future or prevent it altogether.

Structures used by early-stage startups such are convertible notes, SAFEs, and KISS. These forms of debt eventually convert into equity on a subsequent financing round so it is a good way to bring on board people that are likely to partner with you in the long run with the business.

For later-stage companies, the route to follow is typically venturing debt.

Convertible Notes

Convertible notes are a debt instrument that also gives the investor stock options. This flexibility gives them security from the downside, and more potential upside if the start-up performs as expected. Theoretically, it can also be easier for some to justify making the loan, which has specific returns and maturity dates, versus the unknown.

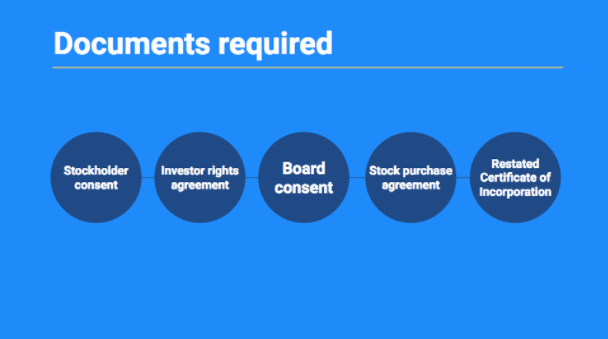

Convertible notes are much faster than equity rounds. There are only two documents in place, which are the convertible note purchase agreement outlining the terms of the investment, and the promissory note explaining the conversion and the amount that the investor is investing.

With convertible notes, there are only three main ingredients the entrepreneur needs to look after.

The first ingredient is the interest that the entrepreneur is giving to the investor. This is interest to be accrued on a yearly basis on the investment amount that the investor puts into the company. The interest will continue to be applied until the company does another equity round when the debt will convert into equity with the amount plus the interest received.

The second ingredient is the discount on the valuation. This means that if your next qualifying round is at X amount of pre-money valuation, the investor will be converting his or her debt at a discount from the valuation that has been established in the next round by the lead investor.

The third ingredient to watch is the valuation cap. This means that regardless of the amount that is established on the valuation in the next round, the investor will never convert north of whatever valuation cap is agreed. This is a safety measure in the event that the valuation goes through the roof. It is a good way to protect your early investors and to reward them for taking the risk of investing in you at a very early stage.

Convertible notes are, in my mind, the fastest and cheapest way to fundraise. While equity rounds can be north of $20,000, convertible notes should not cost you more than $7,000.

One thing to keep a very close eye on is the maturity date. This is the date by which you agree to repay unless you have not done a qualifying round of financing in which the convertible notes are converted into equity. For this reason, make sure that the maturity date is a date that you feel confident about. You need to be convinced that you will be able to raise a qualified round of financing on or before that date in order to convert the notes into equity and avoid being in default. The last thing you want to happen is to be in default and to have to shut down your business because investors are demanding their money back.

Below is a good example of how convertible notes play out in real life.

SAFE

A newer instrument created by Y Combinator which has been adopted by many early-stage companies. The Simple Agreement for Future Equity (SAFE) aims to increase simplicity while preserving flexibility.

Y Combinator argues that these notes do not accrue interest, or have maturity dates, which makes them friendlier to entrepreneurs. That relieves a degree of extra burden which can be counterproductive to both parties.

A SAFE automatically converts to preferred stock at the next equity round of funding, or when there is an IPO.

Venture Debt

Venture debt is effectively borrowing to raise working capital and growth capital. This is a valuable source of funding that doesn’t mean giving up more ownership or diluting equity.

Venture debt financing differs from other sources of money in that it is normally provided by specialist entities and banks, such as Silicon Valley Bank, that offer their services to funded start-ups and growing businesses. They understand the dynamics of a start-up, and will often lend even though asset collateral may be weak.

These lenders offset risk by tying loans to accounts receivable, equipment, or rights to purchase equity in a default. A healthy start-up can find venture debt attractive in order to create more time between equity funding rounds so that more notable milestones can be achieved. These funds can also help speed through milestones to reach the IPO

Equity Financing

This type of funding exchanges incoming capital for ownership rights in your business. This may be in the form of close partnerships, or equity fundraising from angel investors, crowdfunding platforms, venture capital firms, and eventually the public in the form of an IPO.

There are no fixed repayments to be made. Instead, your equity investors receive a percentage of the profits, according to their stock. Though there can be hybrid agreements which incorporate royalties, and other benefits to early investors.

Typically the term sheet will be summarizing what are the terms of the equity round.

The Pros of Equity Financing

Equity fundraising has the potential to bring in far more cash than debt alone. It not only means the ability to fund launch and survive but to scale to full potential. Without equity fundraising growth can be far slower, if not seriously capped. These are some of the biggest concerns around the recent talk of Elon Musk trying to take Tesla private again.

Flexibility in distributions is the biggest draw to using equity. If you aren’t making a profit, then you don’t have any debt service. You don’t have that constant drain and stress. This can empower entrepreneurs to make far wiser decisions, than being forced to make rash ones which can cripple their startups, just to make a loan payment.

Far more important than the money is that bringing in equity partners means bringing in others with a vested interest in seeing you succeed. If they have influence, connections, and experience, that can make all the difference in becoming the next unicorn success story, versus languishing as a small business for decades.

Good equity partners can also make it much easier to secure more attractive debt later on.

The Cons of Equity Financing

The primary fear of giving up equity is loss of control. Partners can mean giving up decision making control. That can affect every micro-factor in your business. It can even lead to you being replaced by your partners if you don’t retain enough board seats and voting power.

A reduced ownership percentage can also not only mean that you have to split the profits but in some cases, some investors may be entitled to any positive returns before you can get a penny.

One of the lessors appreciated cons of equity fundraising is the time and effort it takes to soak up. Loan applications and underwriting may not be fun or fast. Though without the right connections and a powerful pitch deck, equity fundraising can be even more arduous and time-consuming. Don’t let it become a detour and distraction from getting right to the important business.

Conclusion

There are advantages and disadvantages of both debt and equity fundraising. Know the pros and cons before you start searching for the money. Understand which may be the most beneficial for your current stage of business and how it could help or hurt for future fundraising needs.

Furthermore, make sure that you have the right legal counsel representing you. Make sure they are corporate lawyers that have closed several transactions before you even consider engaging them.

Alejandro Cremades is a cofounder at Panthera Advisors which is a premier investment banking and financial consulting firm specializing in M&A, Capital Fundraising, Company Valuations, and Strategic Planning.

He previously cofounded Onevest/CoFoundersLab which is with 500,000+ registered.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world.