Ethio Telecom Goes For Ethiopia’s Remittance License, Targets Lending Using Telebirr

Ethio Telecom, Ethiopia’s national telecommunications company, appears to be gaining ground on big competitors such as Safaricom, which has declared ambitions to begin commercial operations in the East African country in 2022. The telco has disclosed that it is nearing completion on plans to deploy an international remittance service system via its mobile money service, telebirr, in the near future.

Here Is What You Need To Know

- Frehiwot Tamiru, CEO of ethio telecom, said the company has finished preliminary preparations for the introduction of an international remittance service via telebirr.

- Frehiwot said application for an operating license has been made to the National Bank of Ethiopia (NBE) to engage in such activities, and is expected to be approved in a short amount of time.

- She also stated that the new service will allow clients to receive money received from other countries via their cell phones.

- Telebirr has so far given services such as purchasing airtime, transferring and receiving money, and receiving paid locally.

- Frehiwot claimed that, in addition to international remittance services, the company will shortly start providing small loans.

Late To East Africa’s Booming Mobile Money Market?

Despite being the second most populous country in Africa with a population of more than 109 million, only about 33.86% of Ethiopian adults have formal accounts at financial institutions in Ethiopia, compared to the neighboring Kenya with over 82%.

Read also:Ethiopia to Develop Social Media Platforms to Rival Facebook, Twitter and WhatsApp

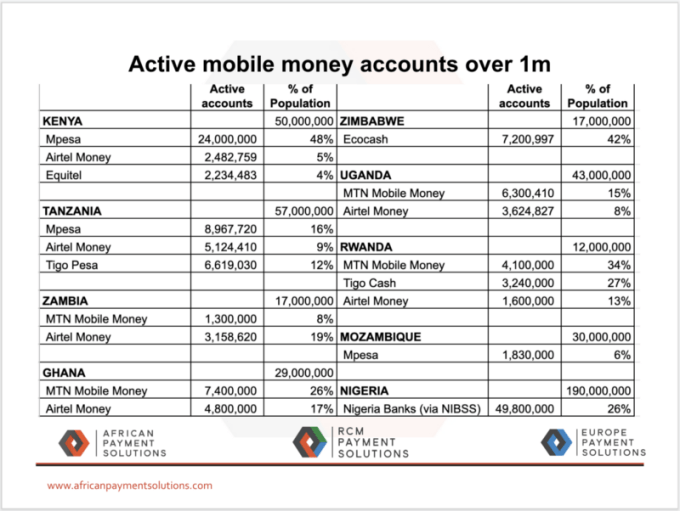

The country has also been largely left out of the booming mobile money market across the East African region. As of 2019, the total value of mobile money transactions reached $17 billion in Kenya, $12 billion in Tanzania and $5.9 billion in Uganda.

Even war-torn Somalia, with a meagre population of 15 million, about seven times smaller than Ethiopia’s, recorded approximately 155 million mobile money transactions, worth $2.7 billion, every month in 2018.

In 2019, the Global System for Mobile Communications (GSMA) declared East Africa number 1 in the world in terms of transaction volume and value of mobile money.

With more than 102 million active accounts, generating more than 17.1 billion transactions — an unmatched $293.4 billion in value and a 24% increase from 2018 — the region is the highest of any other sub-regions in the world. Sadly, none of these figures included Ethiopia.

It is therefore little wonder that a 2018 report by the GSMA described Nigeria, Ethiopia and Egypt, home to a combined adult population of over 242 million, as Africa’s mobile money sleeping giants.

Read also With Over 3.5m Downloads, Egyptian Fintech Firm Fawry Scores A Major First

Ethiopia’s low rate of mobile money usage could be attributed to the rigid regulatory walls that have ensured monopoly and lack of innovation. Telecommunication, aided by enabling legislations, has particularly driven the widespread adoption of the relatively new financial service type across Africa.

Read also:PayWay ET Secures 6-figure Grant As Fintech Landscape Takes Shape In Ethiopia

Safaricom’s M-Pesa, recently acquired by Vodacom, accounted for 655.95 million out of the 810.9 million mobile money transactions recorded in Kenya in the third quarter of 2019 alone. In Uganda, MTN enjoys over half the market share for mobile money.

“The reasons for this vary,” notes GSMA in its report about why Nigeria, Egypt and Ethiopia remain the continent’s sleeping giants when it comes to mobile money usage in Africa. “…In Ethiopia, a strictly regulated telco, restrictions on competition, lack of internet connectivity, and low levels of consumer trust and financial literacy have created barriers to uptake and market entry.”

Finally Loosening The Regulatory Barriers And Joining The League

In October 2020, after series of negotiations and deliberations, the National Bank of Ethiopia (NBE), finally granted a license to state-owned telecoms company, Ethio Telecom, to start mobile money service in the country.

This followed the issuance, in April 2020 by the bank, of a regulation called Licensing & Authorization of Payment Instrument Issuers.

For the first time in Ethiopia’s history, the regulation allowed mobile money transactions. However, there is a caveat: any company interested in the new financial service regime must set up a trust account with a deposit money bank in Ethiopia.

“As part of the application process,” the directive read, in parts, “the National Bank, may request for a preliminary meeting and demonstration of the intended payment instrument to be issued, its related services, products as well as operation. Based on requests made and written approval of the National Bank, a payment instrument issuer may be allowed to provide cash-in and cash-out; local money transfers including domestic remittances, load to card or bank account, transfer to card or bank account; domestic payments including purchase from physical merchants, bill payments; over-the-counter transactions; and inward international remittances services.”

The regulation has also opened up the country’s financial services sector to include that a licensed payment instrument issuer may, with the relevant agreement with regulated financial institutions and pension funds, be allowed to provide micro-saving products; micro-credit products; micro-insurance products; or pension products in the country.

Read also:MainOne’s Cloud Connect to Increase Business Connectivity in West Africa

The National Bank of Ethiopia also issued, that same year, a “Licensing and Authorisation of Payment System Operators Directive (ONPS/02/2020), allowing financial technology companies (fintechs) to start off payment processing and related services in Ethiopia.

Five licenses under the payment system operator directive include National Switch, Switch Operator, ATM Operator, POS Operator, and payment gateway license.

Telebirr remittance lending Telebirr remittance lending Telebirr remittance lending