Lessons Twiga Foods Has Taught Startups About Disrupting Africa’s Food Supply Chain

Twiga Foods, the Kenyan agri-tech startup trying to disrupt Kenya’s food demand and supply chains, understands that Kenyans need food, and need it badly. About 36.1%, representing nearly over 18 million of Kenya’s 48 million population are hungry. This figure is worsened by the facts that:

- Over 3.4 million people face acute food insecurity in the country; and

- Agricultural productivity has been stagnating in recent years due to frequent droughts, floods, and climate change, leading to only about 20 percent of Kenyan land being suitable for farming.

Interestingly, Kenya’s agricultural sector contributes about 26% — more than one-quarter — to Kenya’s entire Gross Domestic Product. This is even as about 75% of Kenya’s entire workforce, mostly spread out in rural areas, is engaged in the agricultural sector.

Its simple business model is to aggregate all food retailers and dealers, from the banana vendors buying in bulk to the avocado retailers selling in stock, and then connecting them to Kenyan farmers producing quality farm produce. This is a classic example of a business-to-business (B2B) model, so that vendors looking to purchase agricultural produce don’t have to travel miles to meet local producers of the produce, thereby saving them the transportation and logistics cost, increasing the productivity and demand for the produce of the farmers, at the same time reducing food waste.

These metrics are what TLCom Capital looked out for when it invested in Twiga Foods.

“TLcom’s general investment thesis for Africa is that given the high penetration of mobile, there are very large markets where demand is already proven and technology can play a true role in offering a superior value proposition over existing solutions,” said Ido Sum, partner at TLCom Capital which syndicated Twiga Foods’ recent $30 million fund raising led by Goldman Sachs.

Quite noteworthy is the fact that TLCom Capital is often strategic with its investments, going mostly for early comers with the huge potentials. It went for Nigeria’s Kobo360, a startup pioneering digital trucking in Nigeria through the Goldman Sachs-led $20 million investment. It also went for Andela, one of Africa’s well-funded startups. Hence, that Venture Capitalist TLCom Capital preferred to invest in tech companies in their early to growth stages, such as Twiga Foods, shows that the startup is, to a large extent, home to disrupt.

The same is also said of Goldman Sachs, America’s leading investment banker which is recently interested in Africa and international institutional firms and VCs looking to invest on the continent at a time when other international investment banks such as Credit Suisse and Barclays have cut down or exited their African operations altogether. Goldman Sachs’ investment in Twiga Foods marks its first major deal in a Kenyan firm.

In view of all these, we therefore discuss a few strategies gleaned from Twiga Foods’ quest to disrupt the Kenyan food market.

Prove A Point First But Know That Scaling Is Important

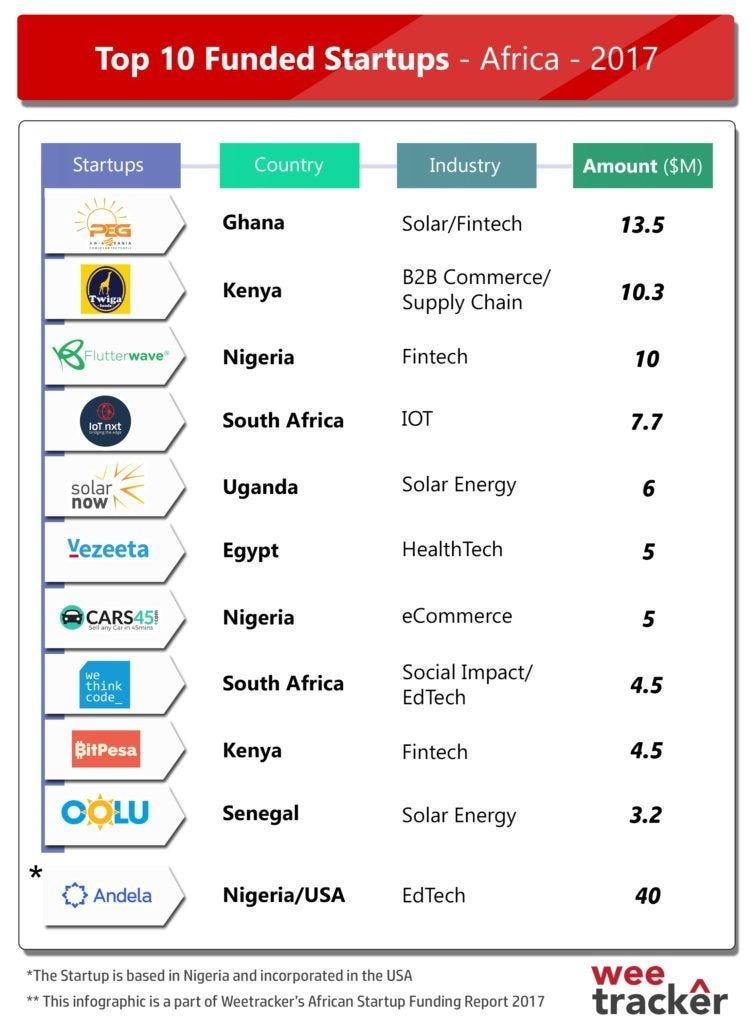

First CEO Grant Brooke simply had to find a way to scale Twiga Foods, a startup in the often neglected African startup ecosystem — agritech. Of the whole investment made into Africa’s startup ecosystem in 2018, agritech got a meagre $20.2 million, out of which Twiga Foods got $10.2 million. Compared to fintech’s $284.6 million, this is discouraging for new comers to the agritech sector.

From all indications, these figures are a representation of the fact that even though Africa has a yawning food sufficiency gap, startups who take the path of agri-businesses often face low investment appetite from investors. Nigeria’s agritech startup Farmcrowdy, one of Africa’s top-funded agritech startups for instance, has been able to raise slightly above $2 million in funding from VCs since its founding in 2016.

Of course, investors are not to blame: entering early stage startups in Africa’s agritech startup ecosystem appears foolhardy, with all the risk associated with crop yields, partly brought about by changes in climate and diseases.

So Twiga’s strategies were to first avoid the crop production stage, in preference of the post production stage when crops are ready to be harvested; and to eliminate the final consumers from its model. Consumers in the African food markets are highly dispersed, making it grossly difficult to aggregate them. They are also highly unpredictable. Pursuing them would increase cost per acquisition for any startup, at the same breath, creating unnecessary competition from dispersed local markets where they are used to buying and selling from.

Therefore, by targeting the middleman between the farmer and consumers, Twiga found an easily large market to scale. The startup already has more than 17, 000 producers for direct delivery to more than 8,500 vendors.

Africa’s Agritech Startups Who Solve The Inefficiency Problem In The Agric Supply Chain May Win

Twiga’s other strategy is simple: find an efficient way to deliver to final consumers at lower costs. Inefficiencies in the supply chain have been blamed for high food prices in African cities, where close to 90 percent of the supply comes from informal retail outlets. Kenyans spend 45 percent of their disposable incomes on food, compared to 14 percent for South Africans and 10 percent for citizens of most European countries. To solve this problem, Twiga followed a simple pattern:

- Get a farmer to sign up to join Twiga.

- Twiga visits and assesses the farm, then adds farmer onto system.

- Twiga issues a purchase order to book the produce and indicate date of harvest.

- Twiga harvests and weighs farmers produce and issues you with a receipt.

- Farmers receive payment within 24 hours.

- All produce is gathered at over 30 Collection Centres across Kenya from the farms.

- Produce goes to the Packhouse for processing, grading and dispatch to over 60 sales routes.

- A vendor signs up to join Twiga.

- Twiga sales representative visits vendor and registers them onto system.

- Vendor places order with sales representative.

- Twiga delivers produce directly to vendors shops.

Through this, the farmer benefits from: guaranteed market; transparent pricing as seen on price boards; farming advice;resources and access to credit from Twiga’s partners. On the part of vendors, the benefits include quality produce; free delivery; assured food safety through easy tracking; access to credit from Twiga’s partners; and fair prices for produce.

The end implication of this simple process is that Kenyans would spend less to purchase food produce. This would in turn encourage them to budget more on food.

Can Using Corporate Expertise Like Twiga Foods Assist Startups To Grow Faster?

To beat the glut in investment in Africa’s agritech startup ecosystem, Twiga quickly appointed Peter Njonjo to take over from founder Grant Brooke. Although the startup has previously raised $10.3m from investors and secured $2 million in grant funding from organizations such as USAID and the GSMA in 2017, followed by a 2018 $10m investment from the International Finance Corporation (IFC), TLcom, and the Global Agriculture and Food Security Programme, bringing Njonjo onboard the startup may seem more or less a strategic move to capture more market and scale quickly.

“Starting new ventures is really my skill-set and passion, while proficiently running institutions is Peter’s skill-set and passion. Twiga has an aggressive growth plan and this transition leverages on our respective expertise, ” Brooke said.

Njonjo was the most senior Kenyan at Coca Cola Company where he worked for 21 years, leading the multinational’s West and Central Africa business unit as President.

Peter Njonjo’s appointment, noted Mr Brooke, presents a first; with a senior executive in a Fortune 500 Company joining an African startup, a “clear testament of the increasing capacity of venture capital in funding and solving significant problems and harnessing opportunities on the continent.”

“If my leadership was the period in which Twiga was proving a point that there’s a better way to build food safe and secure markets, Peter’s leadership will be about institutionalizing this way of doing business and scaling it. Peter’s experience in building efficient supply chains and last-mile distribution in over 33 African countries makes him uniquely suited to lead us,” said the outgone Twiga Foods CEO Grant Brooke.

Currently, the startup has reached more $50 million in total funding since 2014 when it was founded, over $35 million achieved under Njonjo’s leadership.

Critically speaking, Twiga’s success could largely be attributed to Grant Brooke, who has built a career researching Kenya’s informal retail market, an experience dating back to his home city, Texas, in the United States. Njonjo’s appointment could be analysed as finally giving Twiga Foods an African outlook. Therefore, it is safe to say that Twiga Foods still has a long way to go in qualifying as a contemporary agritech startup founded and run by an African. Mr. Njonjo’s Africa’s first ever corporate touch at Twiga and its eventual success may however still be a lesson in strategy for African startups.

Twiga Foods: Bottom Line

To put Africa’s food needs into perspective, Kenyans have more certainty of having food than Ugandans, Rwandans, Togolese or Nigerians. This is a dire situation for the population of these countries combined, and a huge opportunity for many more African agritech startups to come onboard.

Twiga Foods has obviously found a large market for its business model. Africa’s farmers are still obscure, and remotely isolated from the large market. Twiga has started a show of allowing them to play a significant part with some force. It does this by collecting them together with technology and helping them to deliver their products to final consumers, in a safe, cost-effective and efficient way.

These are the lessons Twiga Foods has taught us in Africa’s complicated food supply chain, and why Twiga Foods may be Africa’s next unicorn (and indeed the first agritech startup to achieve such feat) in ten years to come, if it gets its processes and team right.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world