The Competition Just Got Hotter For Nigerian Fintech Startups As PalmPay Launches And Raises $40M round led by China’s Transsion

China doesn’t just want to give up yet: Opay, fully backed by Chinese investors is already displacing fintechs in Nigeria. Lori Systems, in a newly sealed $30 million deal with Chinese investors is squaring up to Nigeria’s Kobo360. Another fintech startup PalmPay, backed by Chinese mobile-phone maker Transsion has not only been launched in Nigeria, but is starting its life on a platter of gold after raising a $40 million seed-round from Transsion.

Here Is All You Need To Know

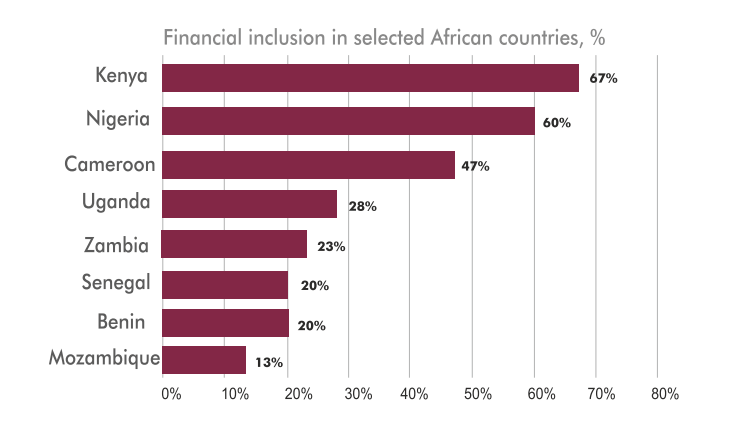

- Fighting the low rate of financial inclusion in Nigeria has got more interesting. Despite the crowded fintech ecosystem in Nigeria, China is joining the league fully through PalmPay.

- PalmPay’s $40 million (a huge sum when converted into the Nigerian naira (N14.4 Billion) ] investment came from Transsion’s Tecno subsidiary, with participation from China’s NetEase and Taiwanese wireless comms hardware firm Mediatek .

- Although PalmPay had piloted its mobile fintech offering in Nigeria since July, it officially announced its entry into the Nigerian market at a launch in Lagos on Wednesday, November 13.

- With this investment, the startup will be looking to become Africa’s largest financial services platform, according to a statement.

- In addition to Nigeria, PalmPay will use the $40 million seed funding to grow its financial services business in Ghana.

- The payments startup has plans to expand to additional countries in 2020, according to PalmPay CEO Greg Reeve.

- Nigeria has multiple new digital-payments entrants — see Chippercash — and several firmly rooted later stage fintech players, such as Paga and recently confirmed unicorn Interswitch.

PalmPlay Is Leveraging On All Chinese Mobile Phone Products In The Market As Its Starting Strategy

Now watch this: Transsion Holdings is the leading vendor of mobile phone products in Africa year-on year, with its brands ranging from Infinix to Tecno to Itel. With this investment, PalmPay enters a strategic partnership with Tecno, Infinix, and Itel that includes pre-installation of the startup’s app on 20 million phones in 2020. With over 150 million of these phones sold in Nigeria alone in 2018, PalmPay would obviously be the giant over other under-funded startups in Africa even before it starts.

On channel and access, we’re going to be pre-installed on all Tecno phones. Your’e gonna find us in the Tecno stores and outlets. So we get an immediate channel and leg up in any market we operate in,” said Reeve.

PalmPay has since received its approval from the Nigerian Central Bank as a licensed mobile money operator in July. During its pilot phase, the payments venture registered 100,000 users and processed 1 million transactions, according to a company spokesperson.

In addition to Transsion’s support and network, Reeves names PalmPay’s partnership with Visa .

“We signed a strategic alliance with Visa so now I can deliver Visa products on top of my wallet, link my wallet to Visa products and give access to someone who’s completely unbanked to the whole of the Visa network,” he said.

Another strategic advantage PalmPay may have as a newcomer in Africa’s fintech space is Reeve’s leadership experience. He comes to the CEO position after serving as Vodaphone’s global head of M-Pesa — one of the world’s most recognized mobile-money products. Reeve was also a GM for Millicom‘s fintech products across Africa and Latin America.

“I’ve had my fingers in mobile financial services for the last 10 years,” he said.

Reeve confirmed that PalmPay has local teams (and is hiring) in Nigeria and Ghana.

With the company’s launch and $40 million raise — which is potentially the largest seed-round for an Africa focused startup in 2019 — PalmPay’s bid to gain digital payment market share is on.

A Look At What PalmPay Does

The UK headquartered venture — that was also founded with Chinese seed investment — PalmPay offers a package of mobile based financial services, including no fee payment options, bill pay, rewards programs, and discounted airtime. In Nigeria, PalmPay will offer 10% cashback on airtime purchases and bank transfer rates as low as 10 Naira ($.02).

With its payments focus, the startup enters Africa’s most promising digital sector, but also one that has become notably competitive and crowded — particularly in the continent’s largest economy and most populous nation of Nigeria.

By a number of estimates, Africa’s 1.2 billion people represent the largest share of the world’s unbanked and underbanked population.

An improving smartphone and mobile-connectivity profile for Africa (see GSMA) turns this scenario into an opportunity for mobile-based financial products.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world