Chipper Cash Becomes Africa’s Newest Unicorn

Trailing the pathway set by others in recent times one of Africa’s leading cross-border payment startup Chipper Cash, has secured $100 million in a Series C funding round. Led by SVB Capital, the investment arm of Silicon Valley Bank, the round saw participation from other investors including Deciens Capital, One Way Ventures, Ribbit Capital, 500 Startups, Bezos Expeditions, Tribe Capital, and Brue2 Ventures.

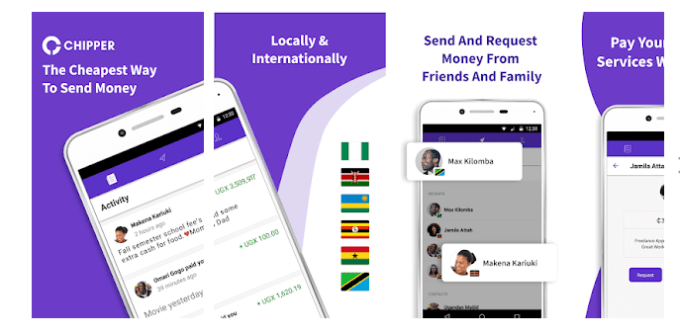

Founded in 2018 by Ham Serunjogi and Maijid Moujaled, Chipper Cash is a provider of mobile-based, no fee, peer-to-peer (P2P) payment services across seven African countries: Ghana, Uganda, Nigeria, Tanzania, Rwanda, South Africa, and Kenya.

In the last two years, Chipper Cash has been on a successful roll following a $8.4 million seed funding in 2019, and in 2020 alone, it closed a $13.8 million funding in June and a $30 million Series B round led by Ribbit Capital with Jeff Bezos’s personal VC fund – Bezos Expeditions- in November. With this latest investment of $100 million, the company has so far raised a total amount of $152.2 million.

Read also:Ethiopia Becomes Africa’s Latest Hot Market For Fintechs As Mukuru And Flutterwave Take Stands

Chipper Cash plans to deploy the latest cash injection to expand its offerings, and its workforce by adding hiring up to 100 employees. Its new products will include US stock offerings for users in Nigeria and Uganda.

Expanding beyond Africa, the company has entered into the United Kingdom, according to CEO, Ham Serunjogi. “We’ve launched cards products in Nigeria and we’ve also launched our crypto product. We’re also launching our US stocks product in Uganda, Nigeria, and a few other countries soon”, he said. Currently, Chipper Cash claims to serve about 4 million users across the African continent.

Read also:Nigeria’s Central Bank Raises Capital Requirements for Payment Solutions Service Providers $609,000

Up until recently, Africa had only five private unicorn startups, including Jumia, Flutterwave, and Interswitch. Serunjogi disclosed that Chipper Cash is probably the most valuable private startup in Africa today after this round. Though subtle, it can be inferred from his statement that the company has indeed become Africa’s sixth unicorn.

Kelechi Deca

Kelechi Deca has over two decades of media experience, he has traveled to over 77 countries reporting on multilateral development institutions, international business, trade, travels, culture, and diplomacy. He is also a petrol head with in-depth knowledge of automobiles and the auto industry