Why Japan’s Samurai Incubate Backed Releaf, Its Second African Agritech Investment

Samurai Incubate Africa, a venture capital firm led by a team of Japanese investors, isn’t famous for investing in African agritech startups. Apart from investment in Ghana’s Complete Farmer, almost all of its previous investments had gone to fintechs. But not any more, at least in the meantime. The venture capital firm has led a $2.7 million seed round in Nigerian agritech startup Releaf, four years after the startup was founded. Also leading the investment are Future Africa and Consonance Investment Managers, with the participation of individual investors Stephen Pagliuca, the chairman of Bain Capital and Justin Kan of Twitch.

“We think there’s a really great opportunity to bring both physical technology and financial services to these communities to make them more productive. And it’s kind of central to our thesis. We believe that our smart factories can serve as an economic pillar in these rural communities and make it easier for us to supply these communities with other services that they can find valuable like access to working capital, payment for education, and access to insurance services. So we see the food processing as like the first step it cements us in the value chain,” said Ikenna Nzewi, CEO of the startup.

The agritech business has also received $1.5 million in grants from The Challenge Fund for Youth Employment (CFYE) and USAID in addition to the seed round.

Read also:Egyptian Fintech Startup Kashat Raises $1.75m Bridge Funding Round

According to Nzewi, Releaf will utilize the seed money to develop technologies and distribute it to smallholder farmers. The $1.5 million in grants will next be used to provide working capital to these farms. He goes on to say that Releaf has already conducted finance trials this year that have raised smallholder incomes by three to five times.

Why The Investors Invested

There are several reasons why investors seemed to finally buy into the startup’s seed funding round, four years after it was founded.

First is that Releaf may have finally found its product market fit, after years of experimenting, even after the startup graduated from Y Combinator’s summer batch in 2017.

The founders’ decision to move back to Nigeria from the United States was also instrumental for the sudden turnaround of the startup company.

Read also:Notable For Backing Farmers’ Co-operatives, ABC Fund Invests $1m In Kenya’s Apollo Agriculture

“We took a much more broad approach to what the solution would be, but we really wanted to decide on a specific crop to work in. And we found that opportunity in the oil palm sector,” Nzewi said.

But perhaps the investors seemed to have gone for the startup largely because of its team.

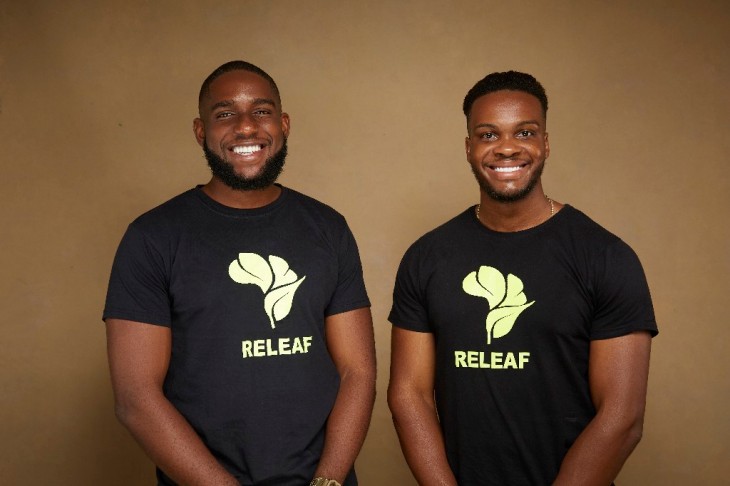

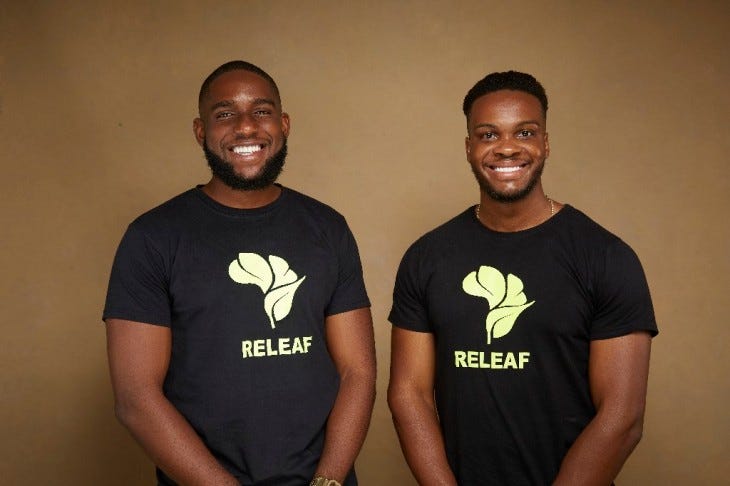

“We believe the firm’s thesis on decentralizing food processing would have a strong match with Africa’s economic development landscape for the next few decades. Ikenna and Uzo are the perfect founders to disrupt this market in Nigeria and beyond. We are thrilled to back them as they innovate in providing both agro-processing and financial services to rural communities and farmers,” said Rena Yoneyama, the managing partner at Samurai Incubate Africa.

Iyin Aboyeji, general partner at co-lead investor Future Africa also gave a hint about the quality of the startup’s team.

“…The team at Releaf is building the agro-allied industry of the future from the ground up, starting with palm oil which they have developed a novel technology to aggregate, deshell and process into critical ingredients like vegetable oil and glycerine. Future Africa is delighted to back Releaf to build the future of modern agriculture,” he said.

In terms of traction, the startup has made some considerable progress. Kraken (Releaf’s proprietary technology) already processes 500 tonnes of palm nuts, according to the company. Releaf’s software also connects to over 2,000 smallholder farmers who have supplied food manufacturers with over 10 million kg of high-quality palm kernel nuts.

A Look At What The Startup Does

Founded in 2017 by the duo of Ikenna Nzewi and Uzoma Ayogu, Releaf focuses on value chains, which are comprised of smaller factories located near smallholder farmers. Releaf buys nuts from farmers, then cracks them and crushes the kernels into vegetable oil with Kraken. The vegetable oil is then sold to FMCG processors and local manufacturers, primarily in Nigeria’s south-southern region.

Read also:Africa’s Transporters Adopt Cellulant’s Technology in Bid to Digitize the Sector

“Nigeria has about 60% more demand for vegetable oil than it does supply. And it can not be met due to supply shortfall with imports because the government banned the importation of vegetable oil. So there is a need to take these smallholders who are driving 80% of production and make them more efficient so that we can have a better balance of supply and demand for vegetable oil,” Nzewi said.

To distinguish itself from the highly competitive $3 billion vegetable oil market in Nigeria, Nzewi says that Releaf’s products quality standard is higher than that of the industry. Typically, a free fatty acid (FFA) meter is used to determine the purity of vegetable oil. While the industry standard is around 5% FFA, Releaf produces around 3.5 percent, according to the CEO.

Releaf investment Releaf investment Releaf investment Releaf investment

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer