This Report Lists Reasons The Manufacturing Industry In Kenya Is Backward

Startups, whether new or existing going into the manufacturing industry in Kenya have new lessons to learn before embarking on the journey. Besides the fact the manufacturing industry contributed only 8.4% to the GDP in 2017, the manufacturing industry contribution to Kenya’s GDP has never gone beyond 10%. Now, a new report is helping to show the reasons for that bad performance and what can be done to boost Kenya’s manufacturing capacity and enhance industrialization.

Conducted by SYSPRO, a global provider of industry-built Enterprise Resource Planning (ERP) software for manufacturers and distributors in collaboration with Strathmore University, the study on manufacturing in Kenya saw close to 100 companies drawn from 12 sectors of the production and manufacturing industry in Kenya interviewed.

The study explored the productivity and competitiveness of the manufacturing sector in Kenya, the role of new technologies in improving the sector and the state of adoption and use of these new technologies.

The study revealed among other things five factors that affect the manufacturing industry in the country and these include:

Spare Parts

The study found that most of the companies interviewed were still using outdated production units because of the high cost involved in buying newer machines. This is even made worse because there is the scarcity of locally manufactured spare parts. In most cases, manufacturers could not say which products or parts were of great quality and which were fake spare parts until they used them.

This usually leads them to incur higher costs should the spare parts turn out to be fake and there is a need for replacement. This incidence of counterfeits has seen many manufacturers go for the importation of parts instead of buying them locally. Most of the times, this leads to longer periods of non-performance for machines as they await the delivery of the spare parts from overseas.

High software and hardware costs

Kenyan manufacturers also suffered high software and hardware costs. This hindered them from adopting newer technologies that could help improve the efficiency and productivity of the manufacturers. Manufacturers not having access to these simply resort to using outdated technology which they can afford. The end result of this is higher production costs and the inability to compete with those who are able to acquire the latest technology. Many of the manufacturers interviewed proposed tax incentives from the government so that they can acquire these technologies.

Nevertheless, the SYSPRO report showed that manufacturing managers have been able to keep the costs of their solutions down by having their Enterprise resource planning (ERP)solution (a software which integrates all facets of an operation, including product planning, development, manufacturing processes, sales, and marketing)divided in modules unlike their competitors.

Doing so offers its clients choice and flexibility. At the simplest level, a company only needs just 1 or 2 modules of an ERP Solution to begin automating its business which SYSPRO provides. This has proved quite popular with SME manufacturers in Kenya.

Lack of skilled labour

The study found a jarring dearth a dearth of skilled labour in Kenya who can operate such machines needed in manufacturing processes. The study recommended that there should industry-wide support for an apprenticeship, graduate internships and technical courses in universities so that the Kenyan local manufacturing sector would become an attractive business experience.

The implication of the paucity of this skilled workers is that over 50% of the respondents now felt that Kenya’s manufacturing sector would have difficulty competing with counterparts in other developed countries that have advanced education and training systems.

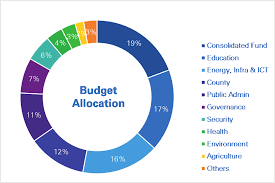

Government Support

The study indicated that the Kenyan government is not doing enough to support the manufacturing sector. A majority of the manufacturers interviewed felt that the government need to do more to support the sector so as to make it competitive and attractive to potential investors. The manufacturers particularly pointed out that support in the areas of development of infrastructure, provision of exemptions, grants, and subsidies as well as purchasing guarantee from the government would have a lasting impact on the sector.

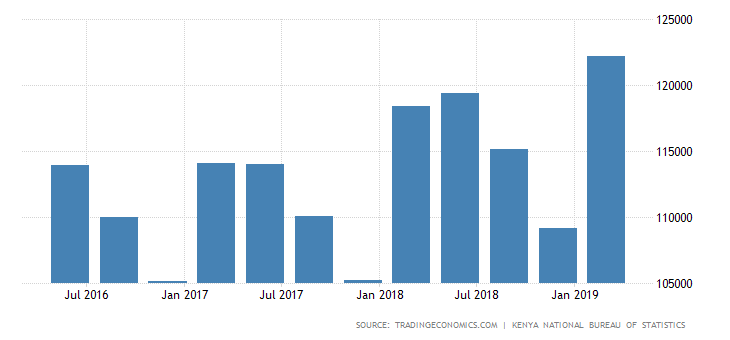

High energy costs

This simply means that the cost of access to electricity for the manufacturing industry in Kenya is just so high. In fact, the cost of electricity was reported as the main external factor that adversely affected business operations in the last 2–3 years. This is despite the government’s efforts to reduce electricity costs for the manufacturers.

Other factors which were noted as having an effect on the manufacturing sector were:

- The high cost of capital financing

- Political climate

- Cheap imports and exchange rates.

Right Now, Manufacturing Companies In Kenya Are Focusing On This Area For Improvement

From the companies interviewed, it appears they are prioritizing product development, advertisement, and marketing, computer systems, hardware and software as potential investment areas to improve business operations in the next financial year.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world.