AgriPitch Competition Winners at the African Youth Agripreneurs Forum Emerge

A veteran exporter of Kenyan fresh fruits and vegetables and a young South African farmer specializing in the design, provision, and management of indoor and outdoor hydroponic systems, were the winners of this year’s youth AgriPitch competition, organized by African Development Bank in partnership with the Western Cape Government in South Africa.

The event which is the 2019 youth AgriPitch Competition themed “Climate Smart Agriculture: Business and Employment Opportunities for Africa’s Youth” took place in Cape Town, South Africa from 24th to 28th July.

Kenyan Alex Muli, CEO, and Co-Founder of Goshen Farm won $25,000 for best agribusiness in the mature start-up category, while Paul Sheppard, from South Africa, Co-Founder of Future Farms, took the $10,000 prize for the early start-up category.

“It was a great event. I met many pioneers in the various agri-tech spaces with many potential and exciting projects, with the renewed hope of access to finance models coming to the fore. The prize money will help our company to upscale to the size we want to grow to, as well as meeting potential investors and learning more about the industry,” said Sheppard.

Muli, who co-founded Goshen farms with his mother in 2011, said it was exciting to be shortlisted as agripreneur in the Mature Startups category. “The boot camp was a great learning experience for me and helped me to know how to better tell the story about my business. I was humbled to meet fellow agripeneurs from other African countries who are doing great stuff out there hence rewriting our continent’s story, a story of hope, transformation, and sustainability by young Africans for Africa,“ he said.

Over 400 agribusiness proposals from across the continent participated in the AYAF competition, which culminated in an award gala dinner, where six winners from the two categories received a total of U$ 74,000.

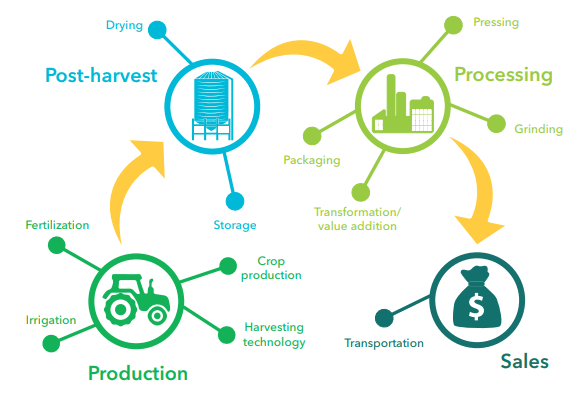

This AgriPitch Competition was part of a larger forum, the African Youth Agripreneurs Forum (AYAF) an annual forum of the African Development Bank’s flagship, Enable Youth Program, which focuses on youth employment and food insecurity.

“At the African Development Bank, we believe that the future of the continent’s youth lies in more rapid and inclusive economic growth which creates quality jobs. This is why the Bank has developed a number of key programs, such as Enable Youth and the Jobs for Youth in Africa Strategy. To date, the Bank has committed over $350 million to Enable Youth investments in 12 countries on the continent, “said Dr. Edward Mabaya, Manager, Agribusiness Development Division at the African Development Bank.

The forum provided a platform for youth agripreneurs and key stakeholders to brainstorm with experts, business leaders, investors and policymakers on issues that affect youth employment and key solutions to addressing these.

It also served as a call to action to support innovative agriculture growth through intense engagement and mentorship for small and medium enterprises and emphasized that with greater support and opportunities to set up their agribusiness enterprise, youth can become the driving force of Africa’s agriculture transformation.

Sponsors of the 2019 AgriPitch Competition and African Youth Agripreneurs Forum include the Bank’s Youth Entrepreneurship and Innovation Multi-Donor Trust Fund (funded by The Netherlands, Demark, Italy, Sweden, and Norway); the Western Cape Government’s Department of Agriculture; The Korea-Africa Economic Cooperation Trust Fund; and The Africa Climate Change Fund.

“We strive to disrupt the African Agricultural ecosystem the way we do best by creating resilient markets for our agricultural produce. We will be there soon,” Muli said.

Kelechi Deca

Kelechi Deca has over two decades of media experience, he has traveled to over 77 countries reporting on multilateral development institutions, international business, trade, travels, culture, and diplomacy. He is also a petrol head with in-depth knowledge of automobiles and the auto industry.