Nigeria Based Mobile Solutions GONA Raises Multi-million Dollar Fund For Expansion

More Africa-focused startups are raising funds to either expand or grow their businesses this year. Apart from Opay’s recent funding round, GONA, the Chinese startup that offers cashless bus services and payment solutions with a focus on the Nigerian market is the latest to join the bandwagon.

This is remarkable because it shows that the African startup ecosystem is gradually fusing into the global startup ecosystem.

Here Is The Deal

- News website, c.m.163.com says the Chinese-led investment came from Crystal Stream Capital, UnityVC and Shaka VC.

- According to Liu Xiaojun, the founder and CEO of GONA the round of financing will be used for team building and product technology upgrades.

- This new investment will further allow GONA to employ more locals to help develop the product and expand its popularity.

“We will try to employ the best people to help the most Lagosians have a better daily commuting experience,” says co-founder, Noah Gu.

- Larry, a partner at ShakaVC, notes that the minibus scene provides more efficient and convenient travel services for hundreds of millions of Africans, and the market potential is huge.

- As the first Chinese fund to focus on early African investment in Africa, ShakaVC will support the development of GONA in local resources, experience, and capital.

- GONA boasts of thousands of active users and nearly 10,000 transactions every day.

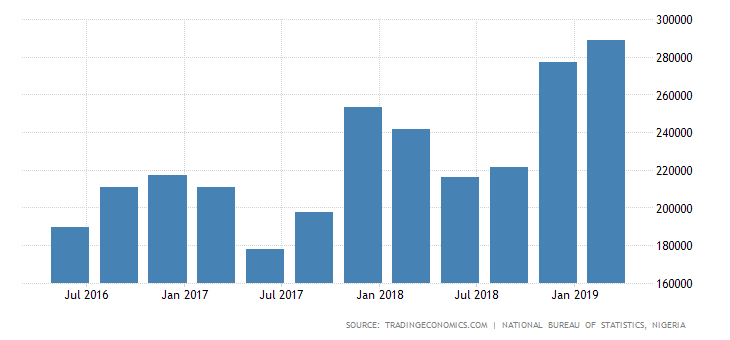

GDP From Transport in Nigeria increased to 288637 NGN Millions in the first quarter of 2019 from 277338.67 NGN Millions in the fourth quarter of 2018. GDP From Transport in Nigeria averaged 198649.70 NGN Millions from 2010 until 2019, reaching an all-time high of 288637 NGN Millions in the first quarter of 2019 and a record low of 144848.60 NGN Millions in the first quarter of 2010.

GDP From Transport in Nigeria increased to 288637 NGN Millions in the first quarter of 2019 from 277338.67 NGN Millions in the fourth quarter of 2018. GDP From Transport in Nigeria averaged 198649.70 NGN Millions from 2010 until 2019, reaching an all-time high of 288637 NGN Millions in the first quarter of 2019 and a record low of 144848.60 NGN Millions in the first quarter of 2010.What GONA Does

- GONA is a mobile payments platform with primary operations in Lagos.

- GONA is enabling cashless payments on ‘informal transit’ public buses in Lagos and is also working to solve the pains of inconvenience in the local travel market. This it is doing by using technical means to improve operational efficiency.

‘‘The Rains Are Here, You deserve a less stressful bus ride to work. Pick up your smartphone and purchase a ticket on GONA, monitor the closest buses to you and hop onto one. Pay for your ride in style, avoid the chaos of “No Change”, Gona tweeted.

- The startup recently announced the completion of a multi-million dollar Pre-A round of financing.

- Even though GONA is headquartered in China, Lagos remains its primary focus. In Lagos, GONA has fully completed localization, with roll-out in certain routes within Lagos, one of which is Yaba to the University of Lagos (UNILAG) campus.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world.