Here’s How The New Payment Service Bank License Given To Glo In Nigeria Will Work

Nigeria’s Glo-bacom has made the official announcement that it would be launching MoneyMaster PSB, its payment service bank business. MoneyMaster PSB is licenced by the Central Bank of Nigeria (CBN) to assist in the provision of financial services to millions of Nigerians who do not have bank accounts or who have underbanked accounts.

The digital solutions provider made these remarks in a press statement that was issued in Lagos “Our overarching goal as a company is to continue to have a positive impact on the lives of Nigerians by making a wide variety of possibilities available to them. MoneyMaster extends this goal by targeting the unbanked and under-banked with G-Kala, which is the company’s main product. This is done with the intention of increasing the level of financial inclusion in Nigeria.” Along with other Payment Service Providers (PSBs), MoneyMaster PSB will facilitate payment and remittance services within Nigeria, accept deposits from individuals and small businesses, issue debit and prepaid cards, operate electronic wallets, and carry out other services in accordance with CBN regulations.

Read also Afreximbank Raises $25M To Invest In African Startups

It is anticipated that MoneyMaster will make use of Globacom’s pan-Nigeria reach and substantial agent presence in both rural and urban regions in order to accomplish its goal of massive roll-out. This would give MoneyMaster a significant head start once it begins operations. Because MoneyMaster PSB is not network-specific, the only thing a client has to do to establish an account is dial *995# and then follow the directions from a Glo line or from any other telecommunications network. This may be done to open an account.

MoneyMaster PSB is in a position to redefine the landscape of payment service banks while driving financial inclusion in Nigeria, much like Globacom did for the telecommunications industry in 2003 when it began operations with cutting-edge technology and one-of-a-kind products. In the same way, Globacom revolutionised the telecommunications industry.

Read also Afreximbank Launches Trade Payment Services (AfPAY)

“The fact that the customer’s phone number will serve as the account number for the G-kala product offered by MoneyMaster is one of the product’s most notable features. We would like to express our gratitude to the CBN for providing us with the chance to broaden access to financial services in Nigeria by utilising our cutting-edge technology and extensive network “, came to the conclusion Globacom.

What Difference Will A Payment Service Bank License Make?

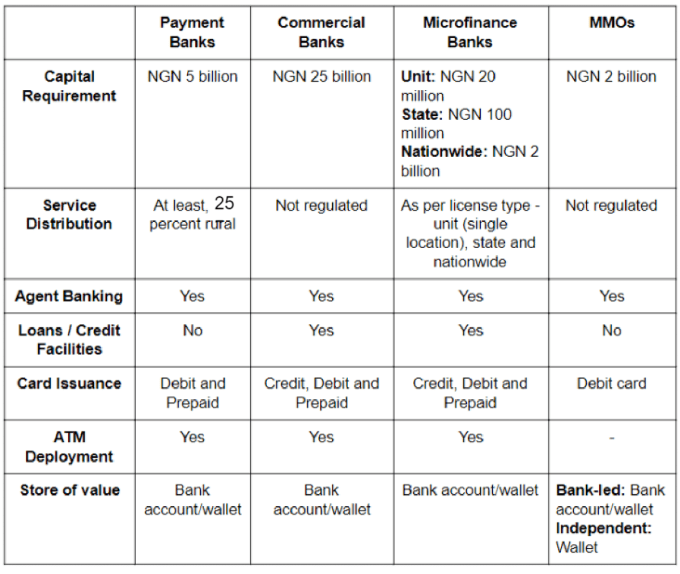

A Payment Service Bank (PSB) is a new category of bank with smaller scale operations and the absence of credit risk and foreign exchange operations. In addition to accounts (current and savings), PSBs can also offer payments and remittance services, issue debit and prepaid cards, deploy ATMs and other technology-enabled banking services. Think of them as basically stripped-down versions of traditional deposit money banks, with limited functionality and a focus on onboarding more of the excluded and marginalised population.

Under Nigerian central bank’s regulations, subsidiaries of mobile network operators (aka telcos), mobile money operators, retail chains (supermarkets) and banking agents are welcome to apply for the PSB license, provided they can meet certain requirements, including a 5 billion naira ($12million) capital base, and a combined 2.5 million naira ($6.4k) application and license fee (which are non-refundable).

Read also Binance Boosts its Global Law Enforcement Training Program to Meet Growing Demand

The new banking licenses for Nigeria’s leading telcos are coming after the CBN issued an updated and revised guideline for the licensing and regulation of Payment Service Banks in Nigeria on August 27, 2020.

Read also Nigerian Retail-Tech Startup Alerzo Acquires Payments Platform to Boost Growth

MTN has the largest chunk of the Nigerian telco market with over 74 million subscribers, followed by India’s Airtel with over 52 million users; locally owned Glo at 52 million; and then 9mobile with a meager 12 million users. Visaphone (which is merely an extension of MTN, having being acquired by the telecom giant in 2015 to boost its 4G capacity) comes last with just a little over 137, 000 users.

Glo bank Nigeria Glo bank Nigeria

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer, who has several years of experience working in Africa’s burgeoning tech startup industry. He has closed multi-million dollar deals bordering on venture capital, private equity, intellectual property (trademark, patent or design, etc.), mergers and acquisitions, in countries such as in the Delaware, New York, UK, Singapore, British Virgin Islands, South Africa, Nigeria etc. He’s also a corporate governance and cross-border data privacy and tax expert.

As an award-winning writer and researcher, he is passionate about telling the African startup story, and is one of the continent’s pioneers in this regard. You can book a session and speak with him using the link: https://insightsbyexperts.com/view_expert/charles-rapulu-udoh