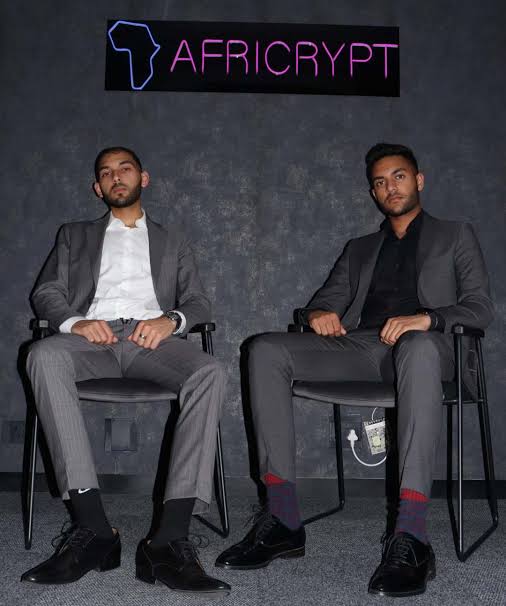

Africrypt Investors Push for Charges Against Cajee Brothers

A group of out-of-pocket bitcoin investors is pushing for criminal charges against a pair of South African brothers who ran a suspected fraudulent cryptocurrency platform, even after a mystery benefactor emerged to repay some of the lost cash.

Read also FedaPay Lands New Funding From Benin Business Angel Network, Expands To Niger

A warrant for the arrest of Raees and Ameer Cajee, age 21 and 18, could be issued soon if authorities decide to go ahead with plans to prosecute, according to Sean Peirce, of Durban-based Coast to Coast Special Investigations, which is representing some of those who lost out from the Africrypt scandal. Private prosecution could also be pursued, he said.

“We are pushing for the brothers to be charged for fraud, theft and possibly money laundering,” said Peirce in an interview. “They can get 10-15 years for a first-time offence.”

We are pushing for the brothers to be charged for fraud, theft and possibly money laundering.

The brothers allegedly disappeared in April along with about US$3.6-billion of bitcoin, although a former lawyer to the brothers later disputed that sum. They had earlier informed clients that the company was the victim of a hack, while urging them not to report the incident to authorities.

Read also Funding: How Nigerian Crypto Startups Fared In 2021 Despite CBN Ban

“They stated that they were hacked and we have proof that they were not,” said Peirce, who represents about 35 traders. “Their intent was to defraud and to steal.”

Africrypt’s lawyer, however, said a prosecution may run into headwinds because several of the investors signed agreements to transfer their claims to a Dubai-based firm identified as Pennython Project Management, which offered some payouts to those who were burned. They no longer hold the right to any interest and therefore can’t push for civil or criminal proceedings, Rashaad Moosa said.

The Hawks, a special investigative police unit that’s looking into the matter.

While the whereabouts of the Cajees are still unknown, Pennython came forward to offer about 70% to the rand to the burned investors. It said it’s interested in the proprietary software belonging to Africrypt, though the full motivation remains murky.

A number of “investors that I represent got paid out some money”, said Peirce. “However, we are still pushing forward with the criminal case as there is still money lost.”

Read also Revolutionalising Legal Practice With Technology

The Africrypt fallout has shone a light on the lack of scrutiny over the country’s burgeoning crypto industry, which has boomed in popularity since the surge in the bitcoin price a year ago. Another South African crypto company, Mirror Trading International, collapsed in 2020, with losses totalling about $1.2-billion.

South Africa’s financial regulator is planning to unveil a framework covering cryptocurrencies early this year to help protect vulnerable members of the society, it said last month.

Peirce was brought in by one of his friends who also put money in the venture to help investigate Africrypt and build a criminal case. Other investors in the Durban area joined the plan to try and get the brothers jailed.

Read also Leading Cybersecurity Firm, Softline, Pours More Investments Into Egyptian Market

There has been cooperation between the investigators and South African authorities, including the Hawks and the National Prosecuting Authority, said Peirce. The mystery investor has previously asked that any criminal complaints be dropped if an agreement was reached during a liquidation process, though Peirce said that’s not an option.

Kelechi Deca

Kelechi Deca has over two decades of media experience, he has traveled to over 77 countries reporting on multilateral development institutions, international business, trade, travels, culture, and diplomacy. He is also a petrol head with in-depth knowledge of automobiles and the auto industry