Africa Finance Corporation Expands Footprint in Benin, Botswana, Democratic Republic of Congo (DRC) and Somalia

Africa Finance Corporation, the continent’s leading infrastructure solutions provider, continues to expand and diversify its membership and shareholder base, recently welcoming Benin, Botswana, the Democratic Republic of Congo, and Somalia.

Accession to membership by Botswana and Somalia advances AFC’s mandate by conferring privileges and diplomatic immunities in line with the Corporation’s multilateral status and provides support for meaningful engagement in these key African economies. Furthermore, it enables AFC to mobilise global capital to work alongside domestic finance for sustainable and viable infrastructure and industrial development in member states. AFC now enjoys member support from three-quarters of African countries, with a total of 40 sovereign members.

Botswana’s Minister of Finance & Economic Development, Peggy Serame, said: “We are pleased to invest in AFC, as the Corporation has demonstrated its commitment as an African entity dedicated to infrastructure growth. We are proud to be a part of this pan-African triumph and looking forward to developing more critical infrastructure in the future.”

Dr. Elmi M. Nur, Somalia’s Minister of Finance, commented: “As Somalia continues to rebuild and grow, our membership in the Africa Finance Corporation will play a crucial role in securing the financial support needed to drive our nation’s development forward. We look forward to this exciting partnership.”

read also First Circle Capital Invests in Nigerian Credit Fintech Pennee

Additionally, the equity investments in AFC by existing members Benin and DRC enhance the Corporation’s pan-African spread of shareholders, which include governments, development finance institutions, and institutional investors.

A stellar record of consistent financial performance combined with a strong risk management framework and a growing and diversified shareholder base are behind AFC’s A3 investment-grade credit rating, which the Corporation leverages optimally to fulfill its mandate to close Africa’s infrastructure and industrial financing gap.

Romuald Wadagni, Benin’s Minister of Economy and Finance, said: “Our investment in the Africa Finance Corporation reaffirms our commitment to addressing Benin’s infrastructure and socio-economic challenges with endogenous financing solutions. We are optimistic that this new synergy will catalyze growth and development for our people.”

Nicolas Kazadi, Minister of Finance of the DRC, commented: “We are looking forward to leveraging our relationship with the AFC to sustainably build critical supporting infrastructure that will maximise our resources.”

AFC’s investments in Benin, Botswana and DRC span the natural resources, transportation & logistics and industrial sectors, with a combined portfolio size of US$53 million in the three countries. The Corporation is working with the government of Somalia to fund infrastructure and economic development that will optimise the country’s key resources.

read also How Technology could Enhance PPP Projects

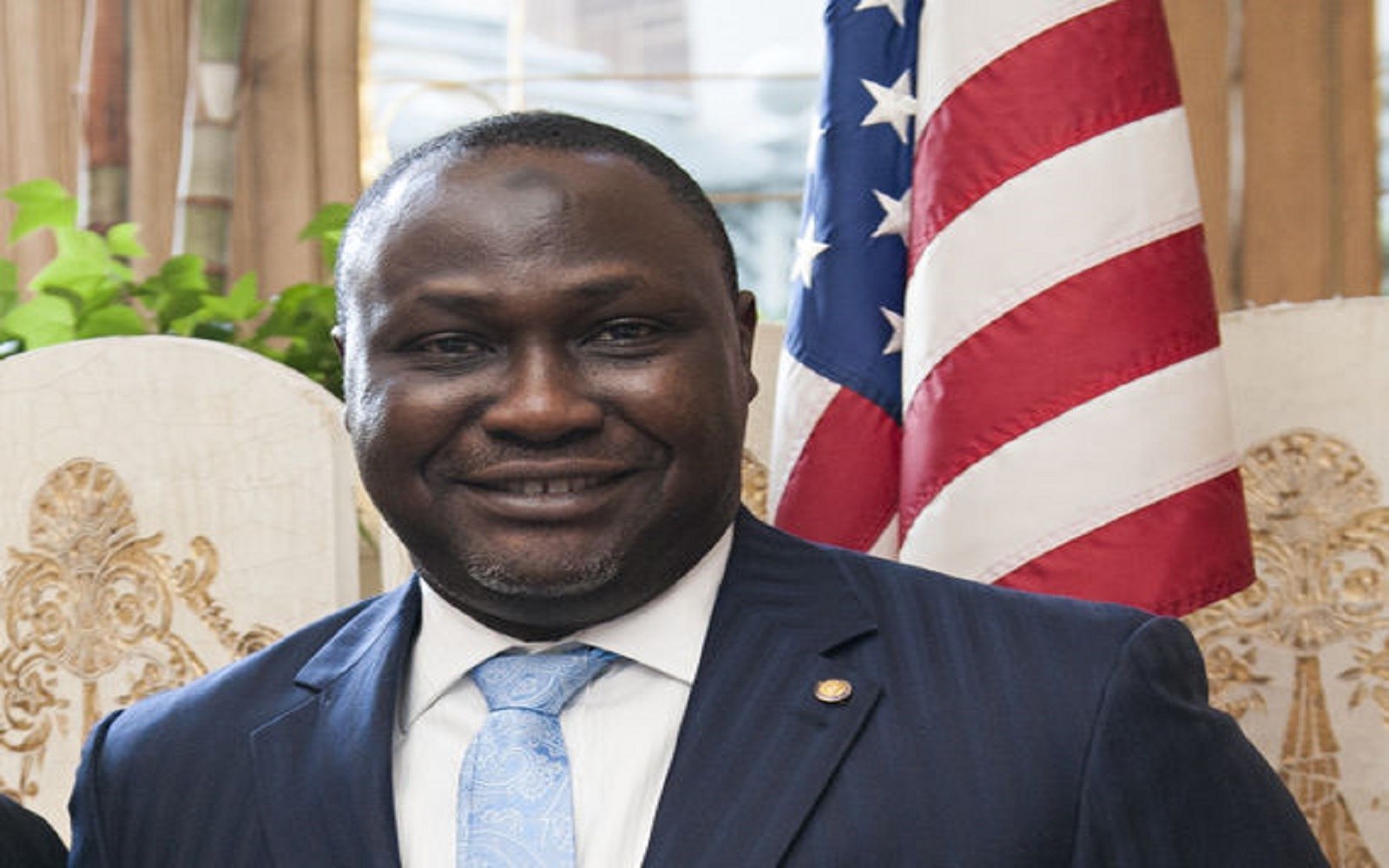

“We are always pleased to welcome new African countries as Member States and Shareholders of AFC as it reinforces our growing appeal as the resilient and reliable bridge to a prosperous African future of enhanced value capture and retention ” said President & CEO of AFC, Samaila Zubairu. “We remain committed to working alongside our member countries to accelerate sustainable development impact in their respective countries by developing and financing infrastructure, natural resources and industrial assets that will enhance productivity and economic growth.”

Kelechi Deca

Kelechi Deca has over two decades of media experience, he has traveled to over 77 countries reporting on multilateral development institutions, international business, trade, travels, culture, and diplomacy. He is also a petrol head with in-depth knowledge of automobiles and the auto industry