Shoprite Ventures Into The Online Pet Supplies Market

Africa’s leading retail chain, Shoprite Group is taking its pet food and supplies brand, Petshop Science, online as traditional bricks-and-mortar retailers in South Africa increasingly focus on omnichannel sales.

Insane valuations attached to US online pet supply stores, coupled with expensive advertising campaigns in the Super Bowl, signalled the peak of the dot-com bubble 22 years ago, but the market has shifted and expanded considerably since then. And Shoprite is clearly of the view that South Africans are ready to get their pet supplies on the Internet.

In a statement on Wednesday, Shoprite said the “pet economy” is growing strongly in South Africa – evidenced by the fact that it opened 22 physical Petshop Science stores around the country in the past 12 months. It said the pet sector in South Africa is worth more than R7-billion/year.

Read also With $3.8M Capital, Newly Founded Ethiopian Fintech Kacha Is Now Part Of EthSwitch

“Petshop Science Online offers a broad selection of more than 2 000 pet-related products. These include food, treats, toys and more from premium brands like Hills, Montego, Dog’s Life, Eukanuba, Ultra Dog, Royal Canin, Rogz and Nandoe,” Shoprite said.

Delivery is free for orders over R450. A R75 delivery fee applies to orders less than this. Orders placed by 4pm within a 60km radius of the Cape Town and Sandton CBDs get next-day delivery.

Petshop Science customers can create online profiles for their pets, including the pet’s name, birth date, type and breed. Customers can access these profiles in stores, allowing the retailer to “serve loyal shoppers with special offers tailored to their pets’ needs”.

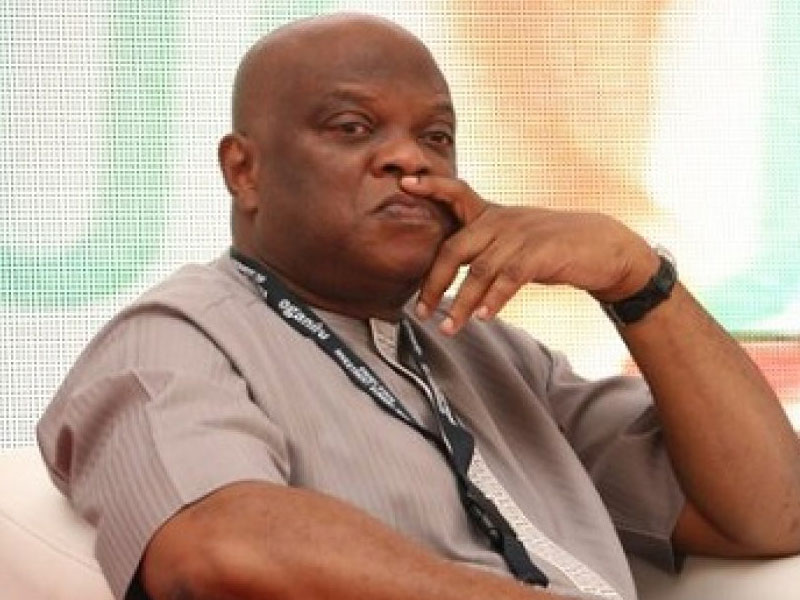

Kelechi Deca

Kelechi Deca has over two decades of media experience, he has traveled to over 77 countries reporting on multilateral development institutions, international business, trade, travels, culture, and diplomacy. He is also a petrol head with in-depth knowledge of automobiles and the auto industry