South Africa’s Telecoms Giant, Telkom Launches Digital Wallet

Leading South African teleco, Telkom has fully announced entrance into financial services with the introduction of a mobile payment solution called Telkom Pay Digital Wallet (or Telkom Pay). The platform which is expected to allow users to pay others and get paid themselves using their mobile phone through the WhatsApp messaging app; to anyone on their contacts list and also serves as a cashless Point of Sale (POS) payment option for businesses.

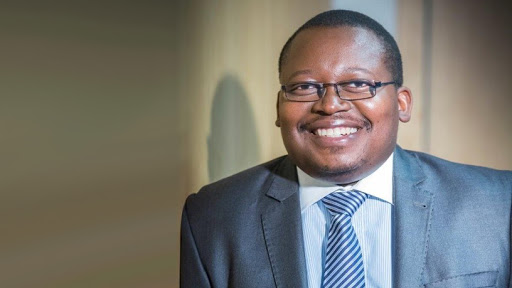

“We are launching financial services solutions that cater to everyone and that are easy to access through one’s phone 24/7 at an affordable price for consumers and businesses. Our device insurance has been in the market for a number of years,” says Sibusiso Ngwenya, Managing Executive for Telkom Financial Services.

Read also:New $311k Seed Funding For South African Car Tech Startup ServiceMyCar

“This year we have successfully launched funeral cover and our foray into payments further deepens our strategic intent to play a significant role in providing solutions that meet the needs of our customers and contribute to economic inclusion in South Africa.”

Users with WhatsApp can add Telkom Pay on the app, register and from then on, they can send and/or receive money by sharing a “Please pay me” with a contact or using a cell phone number to send them money, respectively. For those reluctant to carry cash on them all the time, the wallet allows for easy payments by simply scanning and paying for goods with QR codes at their favourite stores. Telkom Pay also allows customers to buy airtime, data and electricity.

Read also:Zimbabwean Businessman Adam Molai Just Launched A $1 Million VC Fund For African Startups

To continue transacting on Telkom Pay, users must top up their wallets via EFT, Nedbank ATMs or at any Pick ‘n Pay stores. One does not have to be a Telkom customer to access the platform. Transacting through the Telkom Pay Digital Wallet only requires registration and funds in the account and customers can link any bank card to the platform. Payments can be done anytime and will reflect immediately.

“The digital wallet is a convenient and safe platform for anyone who wants to send family and friends money; needs to buy airtime, data and electricity; and wants to shop and pay for goods or services using one platform,” concludes Ngwenya.

Kelechi Deca

Kelechi Deca has over two decades of media experience, he has traveled to over 77 countries reporting on multilateral development institutions, international business, trade, travels, culture, and diplomacy. He is also a petrol head with in-depth knowledge of automobiles and the auto industry