South Africa’s e-commerce startup SnapnSave raises capital from Vunani Capital

With Jumia’s controversial listing on the New York Stock Exchange, Konga’s recent acquisition by the Zinox Group, and barely a poor history at fund-raising this year, it does seem that confidence is gradually returning to Africa’s ecommerce sector (although this is still very much connected to fintech). South African startup SnapnSave, which has developed a cashback grocery coupon app, has raised an undisclosed amount of funding from Vunani Capital as it builds towards its Series A round.

Here Is The Deal

- The amount in this round of investment is undisclosed but investment came from VC firm Vunani Capital through its fintech-focused fund.

“We are delighted to be working closely with the team at Vunani. Their expertise in understanding corporate finance and their relationships in Africa will aid the company as we prepare for a Series A raise that will allow us to expand into new markets in 2020,” said SnapnSave co-founder Mark Bradshaw.

Why The Investor Invested

One thing is top on the list of why VC Vunani invested — SnapnSave belongs in the fintech space.

“This investment offers the Vunani group exposure to a new wave of fintech businesses that are using digital platforms to bring benefits to ordinary consumers,” Vunani executive director Mark Anderson said. “SnapnSave is our first fintech investment. We are expecting to enter into more transactions in the fintech space as we diversify our financial services offering.”

What The Startup Does

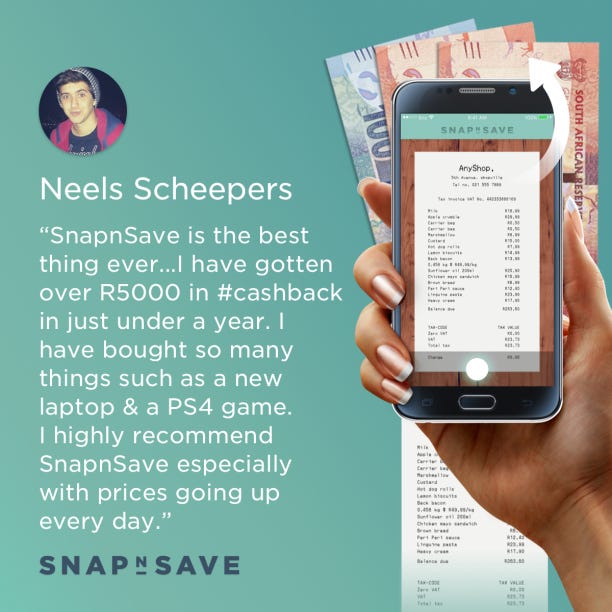

SnapnSave gives shoppers cash back on their favourite products, wherever they shop, just by snapping a photo of their till slip.

The startup secured ZAR14 million (US$980,000) in funding from Kalon and Smollan in 2017, taking in the second tranche of that investment last November.

The startup has seen significant growth since it was launched in 2015, and now has more than 350,000 users that have submitted over 1.5 million till slips and earned more than ZAR14 million (US$950,000) in rewards.

Its latest round of funding, which comes from VC firm Vunani Capital through its fintech-focused fund, will be used to further grow and scale the shopper and vendor base of SnapnSave as it builds towards a Series A round. Bradshaw’s fellow SnapnSave co-founder Tina Fisher said with over 200,000 grocery retail points in South Africa, it was clear that shoppers in the market do not just shop at one store for their favourite grocery items.

Read Also: Jumia: Lessons For E-Commerce Companies In Nigeria

“With promotions in retail traditionally being store-specific, more and more shoppers are signing up for SnapnSave to benefit from cash back savings available at any retailer. Leading brands like Coke, Pioneer Foods, Unilever, SC Johnson and more are working closely with SnapnSave to engage with these shoppers,” she said.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world