Sparkle Is Nigeria’s Latest One-Stop Shop For Retail Businesses Launched By Former Diamond Bank MD

This is an opportunity to invade Nigeria’s retail sector. Mr. Uzoma Dozie, former Group Managing Director of Nigeria’s Diamond Bank, which was recently acquired by Access Bank sees a big gap here. He is sure that launching Sparkle, a startup that hopes to reduce operational risks of small businesses in Nigeria, is the most timely thing around the corner. Whether it is registering your new company or registering for tax or getting forex or domain names for your businesses, you can do all that on Sparkle.

Here Is Why

- After seeing off Diamond Bank’s acquisition, Uzoma Dozie floats a new firm, Sparkle, to help reduce operational risks of small businesses in Nigeria.

- Sparkle’s target is to tackle how retailers achieve their daily objectives and scale their businesses.

- The startup will provide a range of innovative lifestyle services, in addition to typical current and savings accounts that exist in the market.

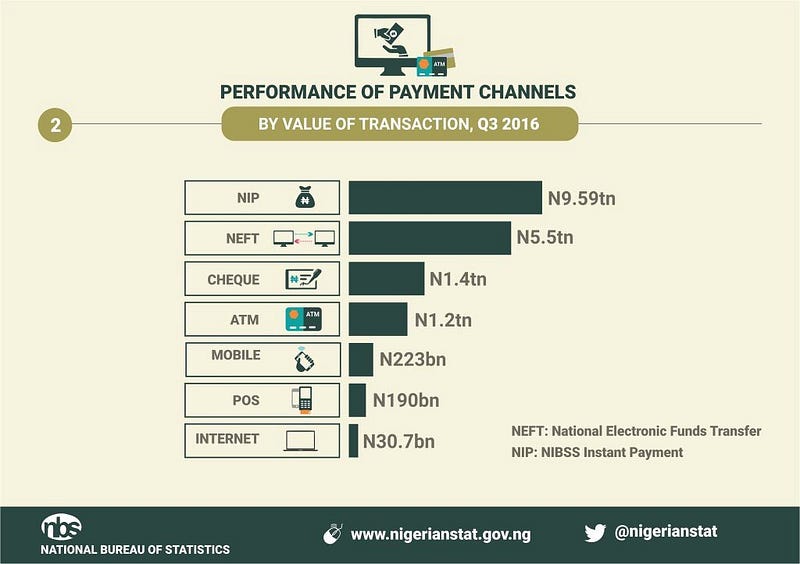

- In particular, Sparkle will deliver customer experience-led support services, ranging from inventory management and invoicing statements to foreign exchange services and a POS-via-mobile function.

- Set to launch in 2019, Sparkle will release plug-in APIs for the platform, to enhance convenience & service, whereby outside developers can contribute & build solutions.

- Powered by AI and Machine Learning, Sparkle is building a dynamic community around Nigeria’s retailers and consumers, influencing purchasing decisions based on user-generated behavioural purchase data.

- This will actively support retailers in navigating a better route to market by directing the right consumers their way.

This Will Be A Game Changer, A Major Disruptor For Many Leeching Onto The Retail Value Chain

Expect jobs to be taken away from Nigeria’s company registration agents, among many others currently reaping from Nigeria’s heavily dispersed retail ecosystem.

Sparkle team is also building a digital framework for retailers to register their companies, register for tax and register domains, as it looks to plug the gap in terms of business advisory and regulatory services for retail SMEs in the country.

“Retailers and consumers in Nigeria are currently disconnected; Sparkle is building the solution around its understanding of the challenges of small businesses, which will help reduce the operational risks small businesses are exposed to in their infancy. Sparkle is a product, a community, born out of necessity for Nigeria’s retail landscape. We will connect millions of retailers on a digital platform, providing a service they can trust, that is seamless, and that allows for frictionless transactions across all activities and business services”.

“Having spent more than 20 years building out the retail arm of Diamond Bank, it is clear that there is a significant gap in the market to incubate and roll out a new approach to services for retailers, and at scale; they need a financial & business services partner, not another finance platform.

This is where we stand out from all others. Sparkle is a collaboration between retailer and customer — a support system that will ensure far greater financial inclusion and much-improved access to market, built for many, built to scale,” says Uzoma Dozie, Founder and CEO, Sparkle.

Succeed? Support Is Already Guaranteed By Major Financial Players

For a man who was until recently Diamond Bank’s MD, the clout is still very much heavy.

Why Sparkle? Because you can. Because you want to do much more and businesses want to be much more. http://bit.ly/sparklinglife @NgSparkl, Mr Dozie wrote on his Twitter Handle

The startup has already entered into partnerships with Visa, Network International, as well as PricewaterhouseCoopers. They will also be working with Microsoft.

Retailers contribute 33% to total GDP and 45% of total employment in Nigeria and are a critical part of powering the Nigerian economy, however services available to small businesses have not been best suited.

Sparkle has identified lack of funding, poor access to market/network and lack of business training as the primary challenges for the sector, which is why the new platform will also provide access to mentorship and development.

“Technology adoption is the only way retail can scale in Nigeria.’’

“Technology adoption is the only way retail can scale in Nigeria. We are in a new, digital economy. Retailers, individuals, and businesses need the space and bandwidth to be creative and to build their business; we are building Sparkle as a wrap around for what they are already doing and we are leveling the playing field for all Nigerians, democratizing access and helping SMEs create their own luck. Sparkle is for the many, not for the few and as we continue to build out the platform,’’ Mr Dozie said.

During his tenure at Diamond Bank, Uzoma was responsible for ensuring technological innovation was central to the institution’s growth strategy. From 2014–2018, Diamond Bank’s mobile app adoption rates grew from 206,000 to 3.3 million, and he simultaneously focused on aggressively growing the bank’s retail arm to include 18 million MSME customers.

See Also: Lessons Startup Businesses Can Learn From Nigerian Diamond Bank Merger

Keen to pioneer diversity and financial inclusion, the Sparkle team has also identified women as a key demographic to collaborate with, as they play a key role in the new economy, with high adoption of tech to leverage on the flexibility of driving new businesses. Women are also essential in staying in touch and connecting with their millennial families.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world.