Learning From TransferWise, The Most Valued Startup in Europe

Barely 8 years since its life began in 2011, TransferWise, the UK-based money transfer startup launched by Kristo Käärmann and Taavet Hinrikus with headquarters in London and offices in a number of cities including Tallinn, New York, and Singapore, recently reached a $3.5bn valuation and made 33 new millionaires of its workers. Here are a few lessons to learn from Europe’s most valuable startup and its recent valuations.

TransferWise Is Partnering With Its Employees To Grow Its Value

Indeed, this is unlike other businesses where employees are expected to show up at workplaces, work, go and get paid. Over 1,600 employees at Transferwise collectively own around 2 million vested options, according to last year’s company filings. The latest valuation means that all these employees are now worth $250,000 per employee on average. Collectively, TransferWise’s employees and its alumni (so-called “Wisers”) are now armed with more than $70m to start up their own ventures. In total, 33 new millionaires from its employees’ figures were made millionaires. This brought the total number of employees or investors with six-figure holdings in the payments company to more than 150.

Now the startup is not insisting that the employees must stay back or reinvest their new wealth in the business. is encouraging those employees to go and start up their own ventures.

TransferWise’s Head of Recruitment, Ben Craig, said the startup actively encourages employees to channel their “entrepreneurial mindset” into other projects, through initiatives like a six-week paid sabbatical after four years with the company, even though this can lead to “Wisers” leaving TransferWise to focus on starting their own businesses.

“Our old employees are totally advocates of our brand and we’re advocates of their companies as well,” he says, referencing formal partnerships between TransferWise and Plum, and another potential partnership with Dataminer.

“They’ve used our offices, we use their offices, we’re all in constant communication,” Craig adds. “We encourage employees who go out and start their own companies to lean on the skills of the two entrepreneurs who founded TransferWise, and to use the expertise of everyone who has worked with us over the last seven years to TransferWise to where it is today.”

The result of this is that the startup has now become the most valuable startup in the whole of Europe with its recent valuation at $3.5bn. Hundreds of its employees and early backers sold shares to new investors and existing stakeholders. Already more than a dozen former TransferWise employees have gone on to start their own businesses including Victor Troukoudes, chief executive of personal savings AI assistant Plum.

The wider diffusion of wealth to employees and investors is set to be a shot in the arm for the wider European ecosystem, as typically money from a successful startup is plowed back into other startups.

TransferWise Is Build On A Model So That It Not Only Allows Its Customers To Transfer Funds But Also To Buy Shares On Stock Exchanges

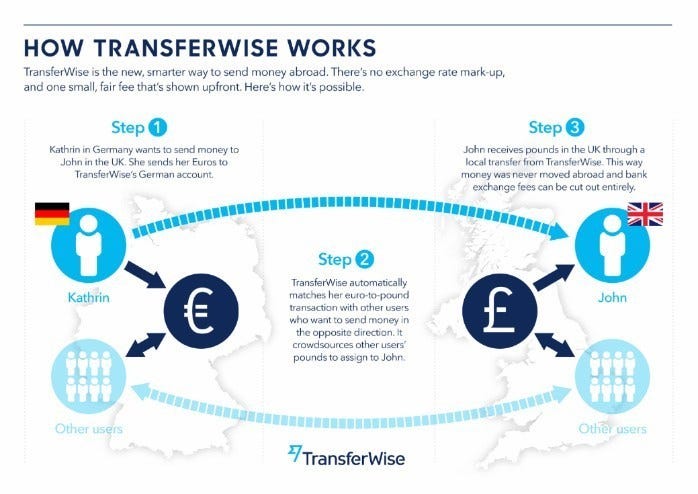

TransferWise allows its customers to open an online brokerage account and invest their savings in stocks of companies. Opening an online brokerage account is just as quick and easy as opening a digital bank account. The startup also allows its customers to find a cheap and reliable online broker via our broker recommendation tool.

For users of its online transfer services, there are 44 currencies they can use to exchange money between, within the app. They can also top up their Transferwise accounts in 18 currencies. The startup is also available in 144, almost all countries. At Transferwise, you can open an account for free and also maintain your account for free. There is no monthly cost to that.

Once your account has been opened, you can have your Transferwise ATM card delivered to your address for free. Unlike traditional banks, the startup does not charge any cost for the card. In fact, withdrawing money with Tranferwise from any ATM is free up to £200 / month and costs only 2% above this amount.

Also transferring money in the same currency as your Transferwise account has a flat fee. This will vary depending on your currency. The international transfer fee is €0.5–2.

Its only shortcomings are that it offers no interest on your savings; you cannot set up direct debits; overdrafts are not possible; joint accounts are also not available.

In short, TransferWise charges less than 1% on many currency transfers, compared to what the World Bank estimates is an industry average of more than 7%, thereby undercutting the fees charged by the big banks.

All these make TransferWise an uncommon success. Unlike many of its fintech peers, it has registered two straight years of profits, posting £6.2m in post-tax profits for its fiscal 2018 on £117m in revenue.

TransferWise Has Successfully Shown A New Way Startups Can Succeed Without The ‘Distraction’ of IPO

The founders of Transferwise, Taavet Hinrikus, and Kristo Kaarmann, said this week that they sold “much less than 20%” their own holdings, which are worth $1.3bn at the new valuation. Other big shareholders include Andreessen Horowitz with $65m worth and IA Ventures with $267m worth.

Hinrikus said the $292m sale would allow some of the company’s earliest backers to realize the substantial gains on their investments, without forcing it through the “distraction” of an initial public offering.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world.