Eight Tech Trends to Watch in 2021

Technology will first make some buzz before becoming the norm. Here are some of the trends we will likely see in 2021. 2020 was anything but a lull. The COVID-19 pandemic exposed vulnerabilities in our society and formed many pockets of crises that called for rapid digitalization to deploy quick fixes. With vaccines on the horizon, the world is poised to restart and climb back up, and we rely on technology more than ever to deliver more permanent solutions.

As such, technology will first make their buzz before becoming the norm. Here are some of the technology trends we will likely see in 2021.

“Yes, we can hear you.”

With telecommuting becoming a default in 2020, we saw a rise in demand for seamless experiences in virtual meeting rooms. Many employees will find value in great gear such as high quality headsets and microphones. When you’re wearing pajamas to work, visual presence is not as important. But audio quality must be in top shape as communicability is the anchor of any work-from-home setup.

Podcast-quality mics will be one of the most popular cart items this coming year.

It’s now or never for 5G

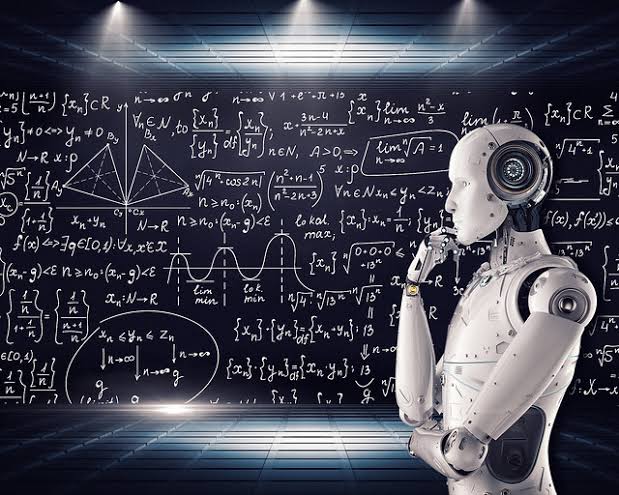

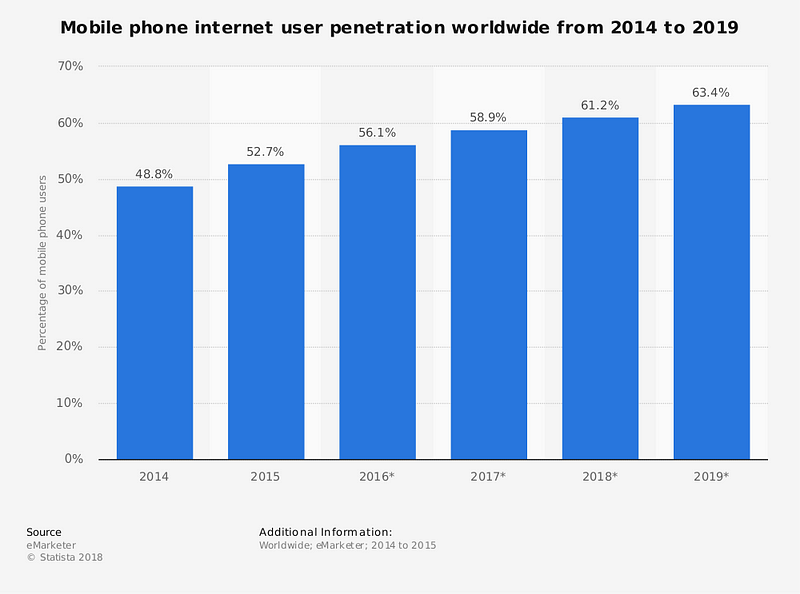

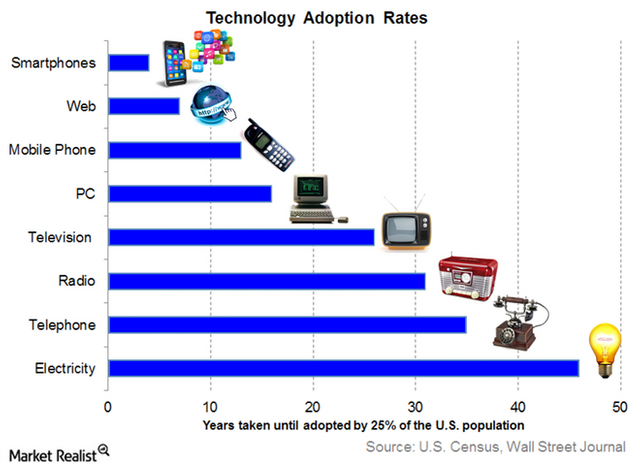

Aside from socio-economic inequalities, COVID-19 exposed the oft-ignored fact that Internet connectivity in the Philippines can still be expensive and sometimes disappointing. We’ve relied on the Internet as an aid in educating the children and keeping both public and private sectors from completely shutting down.

Designing a greener future

With this dramatic shift to digital, there will be further push to expand 5G coverage, as well as other modes of connection to more remote places.

Boost in efforts for infodemic management

We’ve been in an infodemic long before COVID-19 and it only turned for the worse in 2020. There is a lot of fear to feed on and the lack of a full picture of the virus only enabled speculation to get blurred in with facts.

Read also:How Technology could Enhance PPP Projects

Unlike COVID-19, there is no vaccine for fake news, but 2021 is a prime year to introduce more creative efforts to eliminate not only its dissemination, but perhaps its creation and publication.

Improved customer experiences in digital banking

With the accelerated migration to digital finance, we can expect banking systems to opt for more robust security provisions. With open banking shaping up in the Philippines, there is just no room to let fraud and data losses and breaches run with the rise.

Digital banking shows no signs of slowing down. Though many may have found themselves forced into it, there’s no reason to halt its momentum. We’ve yet to meet a person who says they miss queueing or looking at printed passbooks. Moreover, this enabled anyone to venture into e-commerce and small businesses when they needed to.

It’s also important to note that digitization can make banking more accessible to people with disabilities, as well as financially empower people living in rural areas with no banking solutions. Expect financial institutions to roll out more optimized and personalized experiences for their customers.

New wearable in personal air purifiers

Environmentalists have rallied about it for decades but no one predicted that 2020 was the year that humans collectively clamored for clean air. COVID-19 had elicited fear that the very air we breathe in will make us sick.

Read also:Taaply, Cameroonian startup To Digitise Business Cards

Personal air purifier necklaces are like magical amulets that clean the air within a certain radius of you. While there’s no proof that these are able to fully remove particles such as coronaviruses, there’s some comfort in knowing that you’re not breathing in dust and other vague pollutants that may be out there. A must-have, at least, for allergy sufferers.

Wireless charging and other simplifications

The smartphones of 2021, aside from having even better cameras, will push to make wired charging a thing of the past. Flip and foldable phones were received well this year, and based on the lineup of new phones for next year, smartphone companies will still be riding this wave.

Sanitizing for sanity

We may be on our way back to being a mobile and outgoing society, but at least now we have all seen Contagion. Our newfound knowledge on fomites compels even the most carefree of us to shine a UV light over high-touch surfaces. Portable UV wands have been popular among parents and immunocompromised people with a need to keep germs to a minimum. And now, many people have adopted this technology in their homes to sanitize incoming objects and we won’t be surprised if it extends to a handbag staple.

Kelechi Deca

Kelechi Deca has over two decades of media experience, he has traveled to over 77 countries reporting on multilateral development institutions, international business, trade, travels, culture, and diplomacy. He is also a petrol head with in-depth knowledge of automobiles and the auto industry