Rwanda-based Health-tech Viebeg Medical Poised for Growth with New Funding

In a significant development for the healthtech sector in East and Central Africa, Viebeg Medical, a leading medical supplies and equipment provider, has announced a substantial investment from J&J Impact Ventures and Sanofi Global Health Unit Impact Fund.

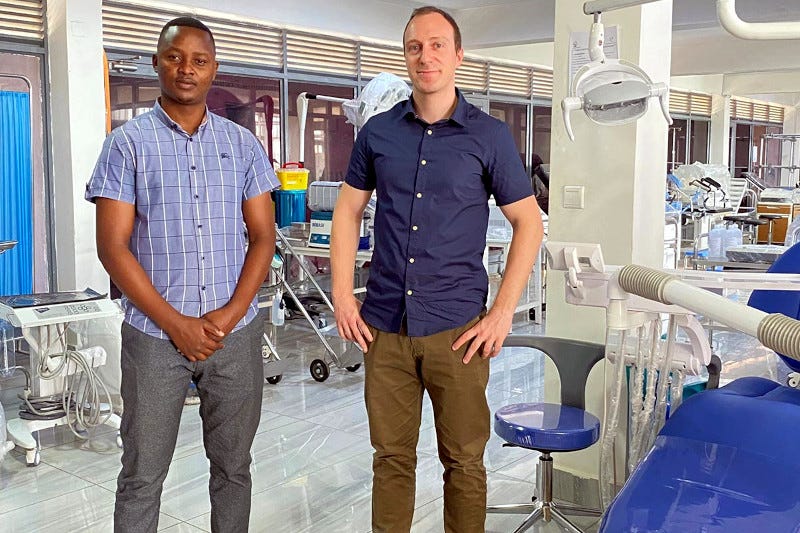

Viebeg Medical, founded in 2018 by CEO Tobias Reiter and Chief Commercial Officer Alex Musyoka, has successfully secured funding from prominent venture capital firms in the past, including Beyond Capital Ventures, Global Ventures, Angaza Capital, Founders Factory Africa, Norrsken, and others, amounting to over $2.5 million.

The latest investment from J&J Impact Ventures, an impact fund under the Johnson & Johnson Foundation, and Sanofi Global Health Unit Impact Fund is expected to propel Viebeg Medical to new heights in its mission to enhance healthcare accessibility in the region.

Serving over 1,000 hospitals, clinics, pharmacies, and healthcare providers in Rwanda, Kenya, and the Democratic Republic of the Congo, Viebeg stands out for its innovative data-driven procurement solution called VieProcure. This platform facilitates the efficient distribution of medical supplies, equipment, and pharmaceuticals, addressing critical supply chain challenges in the healthcare sector.

CEO Tobias Reiter expressed excitement about the company’s future endeavors, stating, “Through the past three years of operations at Viebeg, our team has identified large inefficiencies when it comes to the procurement decisions of healthcare providers across the East and Central African region.”

He further explained the company’s vision, saying, “Our HDSM model identifies the current healthcare demand, compares it to the supply of health services in the region, calculates the profitability of each unit of medical equipment, and then supports healthcare providers in making optimal procurement decisions, translating to better quality and more affordable patient outcomes.”

The investment comes at a pivotal time for Viebeg as it focuses on building a world-class health demand simulation model (HDSM), beginning in Rwanda where the company has the longest operational history.

Jon Fairest, Head of the Global Health Unit at Sanofi, expressed the organization’s enthusiasm for partnering with Viebeg, stating, “We are excited to play a role in Viebeg’s scale-up journey as an investor and partner through our impact fund. Viebeg has demonstrated the value of its model in disrupting supply chain challenges to improve accessibility and affordability of quality and essential medical equipment in resource-constrained health systems.”

He added, “Our global health unit is dedicated to improving access to sustainable healthcare for vulnerable populations with the highest unmet medical needs.”

As Viebeg Medical continues to expand its footprint and make strides in disrupting traditional healthcare supply chains, this investment is poised to make a significant impact on healthcare accessibility and affordability in the East and Central African region. Investors and industry experts will be closely watching as Viebeg enters its next phase of growth and innovation.

Charles Rapulu Udoh is a Lagos-based lawyer, who has several years of experience working in Africa’s burgeoning tech startup industry. He has closed multi-million dollar deals bordering on venture capital, private equity, intellectual property (trademark, patent or design, etc.), mergers and acquisitions, in countries such as in the Delaware, New York, UK, Singapore, British Virgin Islands, South Africa, Nigeria etc. He’s also a corporate governance and cross-border data privacy and tax expert. As an award-winning writer and researcher, he is passionate about telling the African startup story, and is one of the continent’s pioneers in this regard.