Africa needs the private sector to bridge the infrastructure gap – Zubairu

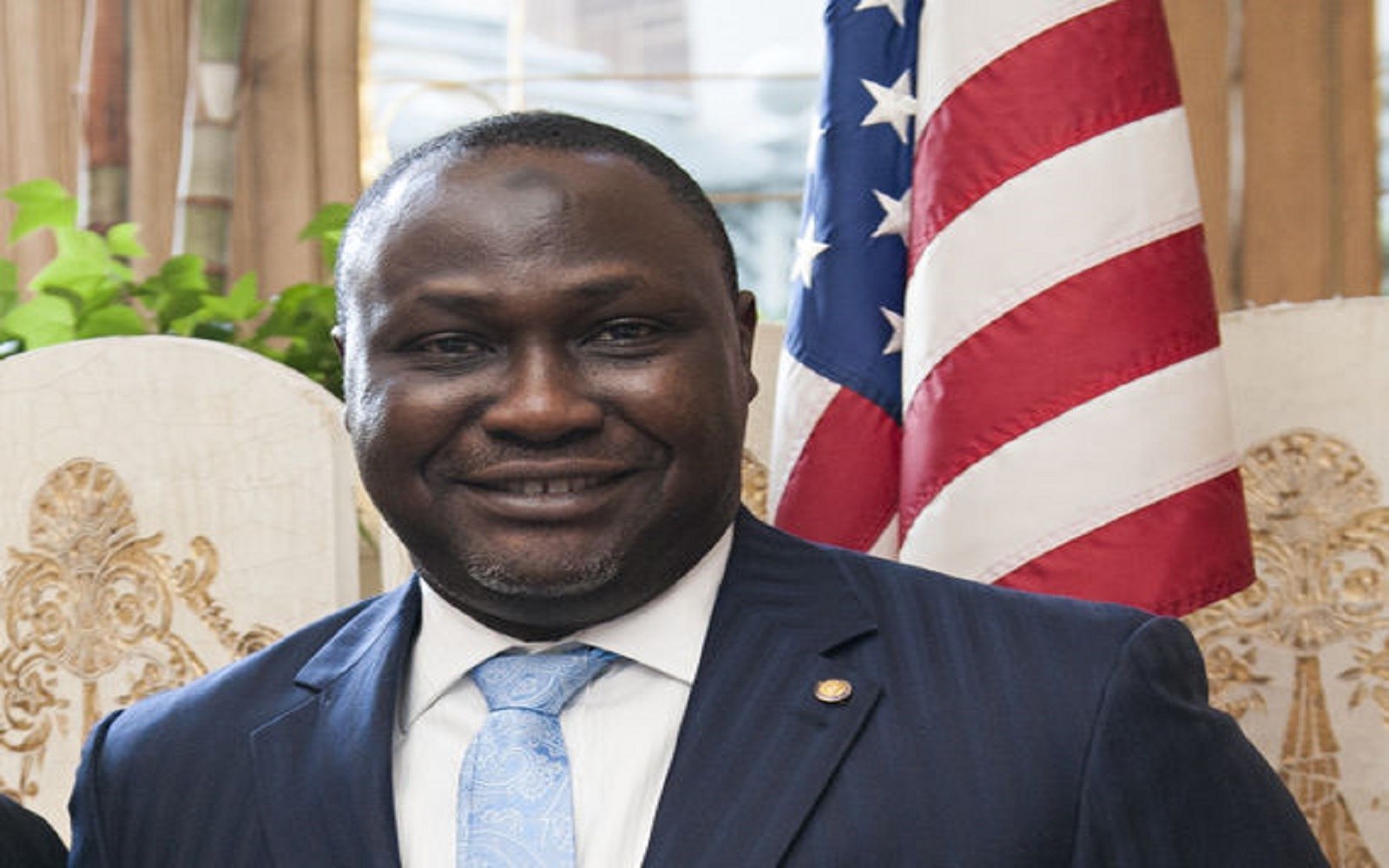

Samaila Zubairu is President, Africa Finance Corporation (AFC), a pan-African multilateral development finance institution focused on infrastructure development in Africa.

In this interview, he speaks on the need for Africa to bridge its yawning infrastructure gap and how the AFC is working towards providing the infrastructure base that will allow for regional trade to take place on the continent. Excerpts:

Despite efforts of development finance institutions to boost infrastructure outlay, Africa still has a huge infrastructure deficit. What needs to change to bridge the gap?

There are several ways of looking at Africa’s infrastructure gap. Let’s start at the macro level. Look at the investment required for infrastructure; it is about $170billion annually and most of that is for water and sanitation infrastructure which should take $67billion. Energy requires an investment of about $50billion, transport and logistics take $47billion while ICT takes $7billion.

However, Africa has been spending $77billion annually on infrastructure in the last seven years and that leaves a deficit of about $93billion. So, we should look at areas where the private sector can come in such as transport and logistics, based on a public-private -partnership basis.

Why is PPP not as forthcoming as you would like?

There are several points through which the private sector can come in. Water and sanitation is a bit of a challenge for private sector investment because they are viewed as social goods and so governments need to really concentrate on that. For energy, what is important is a pragmatic view of what is required. Governments fail to understand that they alone cannot make the investments that the continent needs, so they need private players. However, they need to de-risk the sector for private capital to come in.

So, the big challenge with infrastructure is that private capital is not flowing into that space. Capital is shy and you have to make it comfortable. So, African governments need to understand that they should make investors comfortable so they can come into the sector and once the sector receives these investments and the critical mass is built, they can withdraw the credit enhancement that is required to attract the investment.

Which countries have successfully deployed this model you described?

We have seen it in several economies. For example, in Turkey, they had bankable power purchase agreements (PPAs) to mobilize and encourage investors. However, when they achieved the requisite investment critical mass, they stopped providing the PPAs. So, there are no PPAs in Turkey today, as the power market has stabilized. Businesses produce the power and the government buys as it needs.

The AfCFTA has come into force and a common market will be launched in July. What role can the AFC play to ensure that it achieves its goal?

We have always believed that infrastructure deficit is a hindrance to regional trade. Africa has the lowest level of regional trade in the world. Some say it is at 10 percent while others say it is 18 percent.

However, the best estimate we have seen is 20 percent which is still very low when compared to Europe where it is 70 percent and Asia at 60 percent. A major bottleneck is an infrastructure. For example, a company in Nigeria finds it difficult to export to Cameroon or Benin Republic because of poor infrastructure. What we are trying to do at AFC is to provide that infrastructure base that will allow for regional trade to take place.

Kelechi Deca

Kelechi Deca has over two decades of media experience, he has traveled to over 77 countries reporting on multilateral development institutions, international business, trade, travels, culture, and diplomacy. He is also a petrol head with in-depth knowledge of automobiles and the auto industry.