Lessons Startups Can Learn From the Shut Down of Zumi, a Kenyan E-commerce Site

Zumi, a Kenyan e-commerce site that sold non-food items, recently shut down after its funding ran out, adding to the increasing number of digital companies that have failed recently in Kenya.

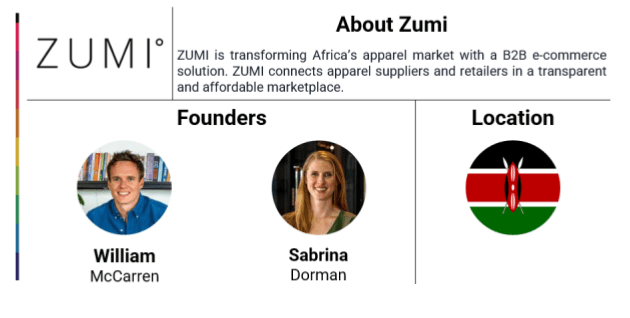

William McCarren, the co-founder and CEO of the company, said on LinkedIn that the move would result in at least 150 people being let go due to fundraising challenges that threatened viability.

“With a heavy heart, I share the news that Zumi will be closing its doors. The current macro environment has made fundraising extremely difficult, and unfortunately, our business was not able to achieve sustainability in time to survive,” wrote McCarren.

According to Crunchbase data, Zumi raised more than $920,000 (Sh120 million) in investment since its founding in 2016, and according to McCarren, the company had 5,000 clients and over $20 million (Sh2.6 billion) in revenue during that time.

read also Kenya’s TIBU Health Raises New Funding To Grow Customer Segment

Zumi, which began as a women’s-focused digital magazine, withdrew from the media business and switched to e-commerce after experiencing difficulty generating enough cash from digital advertisements.

The company’s decision to shut down is part of an ongoing pattern in which promising digital firms have been going out of business one after another, with the majority of them claiming challenging market circumstances and financial challenges.

As Kune Foods, Notify Logistics, WeFarm, BRCK, and Sky-Garden closed their doors in the past year, hundreds of jobs were lost, making the latest shut down the seventh tech start-up with headquarters in Kenya.

read also Nigerian Proptech HouseAfrica Raises $400K To Assist Land Owners Verify Land Titles

Sendy, for its part, shut down Sendy Supply, a platform for trading between retailers and suppliers, and reduced its personnel by 20% in October.

Here are a few lessons to be gleaned from Zumi’s shutdown

- Fundraising is critical: Zumi’s demise serves as a warning that startups must prioritise and must continuously work on its fundraising strategies in order to stay in business. Startups may struggle to exist without proper finance, especially during difficult economic times.

- Another takeaway from Zumi’s experience is the need of creating an effective business model that can create long-term profitability. After failing to earn money from digital adverts, Zumi pivoted from a lifestyle and fashion-focused media platform to an e-commerce site. Nevertheless, the shift was not effective, and the firm was finally shut down. Before beginning on any substantial pivot, startups should verify that they have a sound business model that can produce sustained revenue.

- Additionally, founders must have a thorough understanding of the industry-specific difficulties and the market they are competing in before setting out on the startup journey. It must be admitted that founder William McCarren struggled to identify more specific obstacles that Zumi experienced in the Kenyan market, as well as the strategies used to overcome those obstacles. The effect of Zumi’s transition from a media platform to an eCommerce platform (a 360-degree turn) on the company’s fortunes is also not extensively investigated.

- Additionally, startups must be adaptable and willing to pivot or modify their business models if initial strategies fail to provide positive results. Nonetheless, pivoting should be done with caution, taking into account the possible influence on the company’s operations and finances.

- Again, financial sustainability is important: Businesses must prioritise financial sustainability from the start, establishing a clear route to profitability. Failing to attain sustainability can result in closure, as was the case with Zumi. It is interesting to note that Zumi could not attain sustainability despite recording over $20 million in revenue.

- Tough market circumstances are a reality: Startups must prepare for the business landscape’s demanding market conditions. Startups need to have a robust business strategy that can endure market volatility and unpredictability.

- Learn from failure: Other business owners can benefit from Zumi and other Kenyan startups’ shutdown by taking note of their mistakes. When Zumi’s scenario is compared to that of other Kenyan startups, it is clear that they all face the same funding and market viability challenges. Yet, it is vital to remember that each of these firms had distinct obstacles that contributed to their death. Kune Foods, for example, had to struggle with high production costs and little market demand. BRCK, on the other hand, struggled with scalability because to the high cost of hardware fabrication. Understanding the causes of failure can assist avoid repeating the same missteps and improve the likelihood of success in the future.

lessons e-commerce Zumi lessons e-commerce Zumi lessons e-commerce Zumi

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer, who has several years of experience working in Africa’s burgeoning tech startup industry. He has closed multi-million dollar deals bordering on venture capital, private equity, intellectual property (trademark, patent or design, etc.), mergers and acquisitions, in countries such as in the Delaware, New York, UK, Singapore, British Virgin Islands, South Africa, Nigeria etc. He’s also a corporate governance and cross-border data privacy and tax expert.

As an award-winning writer and researcher, he is passionate about telling the African startup story, and is one of the continent’s pioneers in this regard