Tax War On Online Businesses: Nigerian and Kenyan E-commerce Businesses To Pay VAT

This is going to be deal breaker for online stores in these two countries. Possibly from 2020, all startups and businesses in Nigeria and Kenya that derive their revenue from the internet would have to pay 5% Value Added Tax on goods and services they sell online. Hard day also for online purchasers in both countries. Expect an extra deduction each time you purchase goods or services online, local or international.

Here Is Why

Kenya

The Kenyan Governments is seriously planning to tax online businesses through new regulations that will be introduced through the Finance Bill 2019. Should this happen online businesses in Kenya will be required to charge VAT once the bill becomes law.

Below are the relevant portions of the proposed law:

Section 3: Section 3 of the Income Tax Act is proposed to be amended by inserting the words:

(1). Subject to, and in accordance with this act, a tax to be known as income tax shall be charged each year of income upon all the income of a person, whether resident or non-resident, which accrued in or was derived from Kenya

(2). Subject to this Act, income upon which tax is chargeable under this Act is income in respect of

A. Gains or profits from:

Any business, for whatever period of time carried on;

Any employment or services rendered;

Any right granted to any other person for use or occupation of property;

B. Dividends or interest

C. a pension, charge or annuity; ii. Any withdrawals from, or payments out of, a registered pension fund or a registered provident fund or a registered individual retirement fund; and (iii) any withdrawals from a registered home ownership savings plan

D.income chargeable to tax includes income accruing through a digital marketplace

e. ‘Digital marketplace’ means a platform that enables the direct interaction between buyers and sellers of goods and services through electronic means

E. AN amount deemed to be the income of any person under this Act or by rules made under this Act;

F. Gains accruing in the circumstances prescribed in, and computed in accordance with, the Eight Schedule

G. Subject to section 15(5A), the net gain derived on the disposal of an interest in a person, if the interest derives twenty per cent or more of its value, directly or indirectly, from immovable property in Kenya; and

H. A natural resource income

Section 5 of the Value Added Tax Act, 2013 is proposed to be amended by inserting the words highlighted

1. A tax, to be known as the value added tax, shall be charged in accordance with the provisions of this Act on –

(a). A taxable supply made by a registered person in Kenya

b. The importation of taxable goods; and

c. The supply of taxable services

2. The rate of tax shall be:

A. in the case of zero-rated supply, 0% or In the case of goods listed in section B of the first schedule 8%

In any other case, 16% of the taxable value of the taxable supply, the value of imported taxable goods or the value of a supply of imported taxable services.

7. The provisions of subsection (1) shall be applicable to supplies made through a digital marketplace

8. For the purposes of this section, a ‘digital marketplace’ means a platform that enables the direct interaction between buyers and sellers of goods and services through electronic means

From the proposed law, it is not clear whether international online businesses that operate in Kenya such as Google, Facebook, Twitter and Instagram who have no physical presence in Kenya will be taxed. However, it is expected that special rules may be formulated detailing the operational mechanics of how taxation of the digital economy will be undertaken.

Nigeria

Nigeria has announced that it is considering a 5% Value Added Tax (VAT) specifically for online purchases. Babatunde Fowler, head of Nigeria’s federal tax agency, says the government may appoint banks as agents to deduct 5% VAT on all local online purchases with a bank card. The policy could be in place by early next year.

“Not that it is something new; it actually should be in existence.

“We will certainly follow up to make sure that every VAT that is due to becollected is collected. Soon, we will ask banks to impose VAT on online transactions for purchases of goods and services,”the Chairman of the agency, Mr Babatunde Fowler said.

‘’We Are Going After Everybody’’

The Nigerian agency has further explained that it is hustling hard to meet its N8 trillion revenue target for 2019. And it doesn’t stop with online purchasers.

The FIRS also seriously wants to increase Nigeria’s current tax population to 45 million. To do that, it would be relying on multiple information sources, Mr Fowler said. And that would include invading the country’s Bank Verification Number database and other related agencies with relevant information.

“We are going after everybody. I am sure you have heard that we have placed lien on some accounts of defaulters that have a billion naira turnover annually. So certainly, we are not leaving anyone out of the tax net,’’ he said.

FIRS targets to generate between N750 billion and N1 trillion from the clampdown, which includes closure of defaulters’ bank accounts. So, it is either you obey the amnesty or you close down your business.

See Also: 45 Million Nigerians Set To Be Taxed For Every Online Transaction

The Implication of This Proposed Taxation

“This will lead to a decline in use of cards online,” says Oluyomi Ojo, founder of Printivo, an online design and printing company. “Merchants will opt for bank transfers and customers will opt for other options. There’s no other way to look at the proposed policy than to see it as a card payment killer.,” he adds

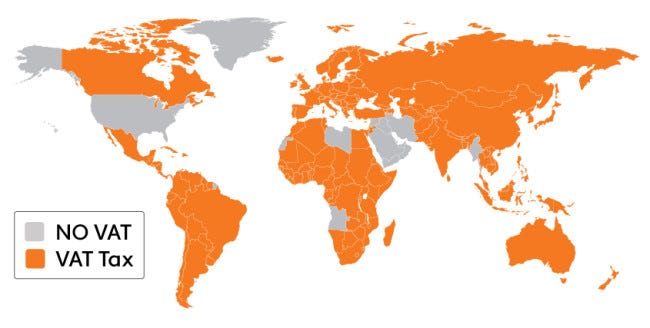

More than 160 countries charge VAT, including China, India, and most of Europe.