The rush after sources of taxation is not yet over for the Nigerian government. Next on the line of taxation is online transactions. And Nigerian Federal Inland Revenue Service (FIRS), an agency of government responsible for the collection of taxes in Nigeria is not going to do so by deploring tax police after physical businesses. It is going to come by way of demanding Nigerian banks to put a Value-Added Tax (VAT) on every online transaction they are processing on behalf of their customers.

“Not that it is something new; it actually should be in existence.

“We will certainly follow up to make sure that every VAT that is due to be collected is collected. Soon, we will ask banks to impose VAT on online transactions for purchases of goods and services,”the Chairman of the agency, Mr Babatunde Fowler said.

‘’We Are Going After Everybody’’

Hard day for online purchasers in Nigeria. Expect an extra deduction each time you purchase goods or services online, local or international.

The Nigerian agency has further explained that it is hustling hard to meet its N8 trillion revenue target for 2019. And it doesn’t stop with online purchasers.

The FIRS also seriously wants to increase Nigeria’s current tax population to 45 million. To do that, it would be relying on multiple information sources, Mr Fowler said. And that would include invading the country’s Bank Verification Number database and other related agencies with relevant information.

“We are going after everybody. I am sure you have heard that we have placed lien on some accounts of defaulters that have a billion naira turnover annually. So certainly, we are not leaving anyone out of the tax net,’’ he said.

Voluntary Asset and Income Declaration Scheme (Nigeria’s Tax Amnesty Programme was launched in 2017) Is Going After Companies.

The programme gave tax defaulters in Nigeria a one-year period of grace to declare and settle their unpaid taxes. This appears to be a hard time ahead for most companies in Nigeria.

Most taxpayers are insisting that the scheme was just designed to eliminate them from business. Mr. Fowler said “administrative error” should take the blame arising from the huge number of accounts involved.

“Well, there is certainly one or two instances where we made administrative error, but when you are looking at over 50,000 accounts. There is a tendency that sometimes an error might be made. For those that we made errors on, I wrote them personally apologising and of course we lifted the lien on their accounts,” he said.

Also See: What NDIC New Insurance Cover Fund Would Mean For Bank Depositors

FIRS targets to generate between N750 billion and N1 trillion from the clampdown, which includes closure of defaulters’ bank accounts. So, it is either you obey the amnesty or you close down your business.

Key Insights Into Nigeria’s Debt Profile

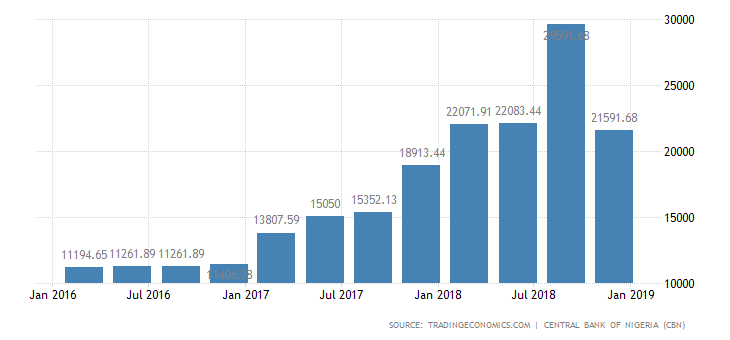

External Debt in Nigeria averaged 9263.57 USD Million from 2008 until 2018, reaching an all time high of 29591.68 USD Million in the third quarter of 2018 and a record low of 3627.50 USD Million in the first quarter of 2009.

Charles Rapulu Udoh

Charles Rapulu Udoh, a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organisations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution and data analytics both in Nigeria and across the world.