For one thing, 2019 has seen a deluge of investment in African startups. German-headquartered KfW Development Bank has just joined the train. Partnering with Allianz Global Investors, KfW Development Bank has set up a EUR170 million (US$188 million) “fund of funds”, called AfricaGrow, which aims to help Africa’s private equity and venture capital funds make investments in startups and SMEs on the continent.

‘‘The design and structure of the new AfricaGrow Fund is a milestone in support for the African economy. It is intended to help small and medium-sized enterprises, primarily in reform-oriented African countries, close the existing financing gap and build a solid equity base. In Africa’s economy it is mainly the small, local companies that create the most jobs and thus contribute significantly to securing people’s incomes,” said Dr Joachim Nagel, member of KfW Group’s executive board.

Here Is All You Need To Know

- Launched on behalf of the German Federal Ministry for Economic Cooperation and Development (BMZ), the KfW fund, called AfricaGrow which will be managed by Allianz, and will finance 150 innovative businesses through local funds by 2030 in order to promote sustainable economic and social development.

- The fund volume stems from cooperation between public and private partners and is initially EUR170 million.

- Half of that — EUR 85 million (US$94 million) — comes from the Federal Ministry for Economic Cooperation and Development (BMZ), plus another EUR 30 million (US$33 million) from KfW subsidiary DEG and EUR55 million (US$61 million) to EUR70 million (US$78 million) from Allianz companies.

- The AfricaGrow Fund is designed as a fund of funds for promoting small and medium-sized enterprises (SMEs) and start-ups primarily in countries associated with the G20 Compact with Africa (CwA). The AfricaGrow Fund aims to have a catalytic effect on the emerging and dynamic SME and start-up e cosystem and thus promote jobs and income across the CwA countries. The objective is to help these countries attract private investment along with technical and fnancial assistance, in return for reforms that improve the business climate, e.g. fghting corruption or improving good governance.

- Acting as a strong and reliable anchor investor, the Fund will allow partnering venture capital (VC) or private equity (PE) funds to raise private capital more easily. To this end, the AfricaGrow Fund will be set up as a structured fund. KfW, on behalf of the German Ministry for Economic Cooperation and Development (BMZ), will provide a frst-loss tranche on the fund-of-fund level. It is expected that this will leverage additional funding by DEG — Deutsche Investitions- und Entwicklungsgesellschaft mbH as anchor investor and other investors for the emerging African VC and PE fnancing sector.

- The German Federal Government is providing an additional budget in the tens of millions for accompanying support measures.

Who Will Benefit From The Fund?

The fund is designed to address the fnancing needs of SMEs across multiple industrial sectors and technology-based start-ups (e.g. FinTech, off-grid, AgTech, EdTech, HealthTech, mobility, e-commerce), especially those that pursue innovative business models (e.g. pay as you go) and have strong growth potential and a clear focus on exports, including cluster-based growth models. It will also provide funding for technical support in building managerial capacities.

The AfricaGrow Fund Will Work With Local Fund Managers and VCs To Invest In African Startups

The AfricaGrow Fund will work with Pan-African regional and country-specific funds with proven track records and capacities, primarily in CwA countries. These are: Benin, Burkina Faso, Côte d’Ivoire, Egypt, Ethiopia, Ghana, Guinea, Morocco, Rwanda, Senegal, Togo and Tunisia. Generally, the AfricaGrow Fund will invest in market-oriented funds with a strong private-sector approach.

Comments:

From the look of things, the fund is accessible to all African startups, but special attention would be given to CwA countries — Benin, Burkina Faso, Côte d’Ivoire, Egypt, Ethiopia, Ghana, Guinea, Morocco, Rwanda, Senegal, Togo and Tunisia.

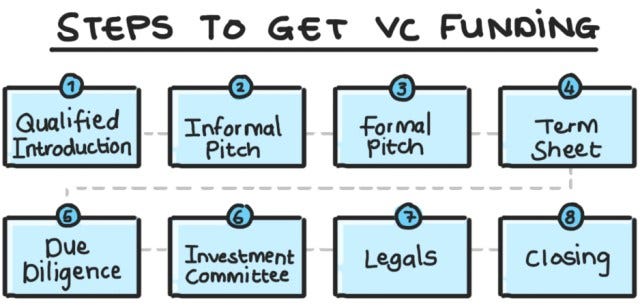

For startups interested in accessing the fund, enquiries may be made at Allianz Global Investors, who would be the lead manager of the fund and who would determine which venture capital firm or private equity company in your country that is qualified to be part of the funding scheme. In other words, you may only get the funding through VCs in your country appointed by Allianz Global Investors.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world