2019 proved a year for Nigerian startups. Of all the venture capital funding that came to Africa within the year, about 50% went to Africa’s largest economy — Nigeria. Latest report, Decoding Venture Investments In Africa Report of 2019 released by WeeTracker showed that Nigerian startups scooped a whopping $663.24 million out of the overall $1.34 billion raised in funding in Africa in 2019.

“Nigeria and Kenya accounted for a whopping 81.49% of the total VC money raised in Africa,” the report states.

Here Is All You Need To Know

- The funding, which came in the form of equity, grants/prizes and debt financing, represents 50.5 percent of the total funds raised in the continent.

- Foremost among the Nigerian-focused startups are Interswitch, OPay, Andela and Palmpay which accounted for most of the top venture deals on the continent last year.

- Speaking on the performance of tech startups in Africa, Andrew Fassnidge, Founder of the Africa Tech Summit, said that the year 2019 saw Interswitch, a leading payment platform in Nigeria secure $200 million led by Visa, ahead of the company’s 2020 planned IPO.

- Next in line was PalmPay, a relatively new mobile money transfer platform, which secured $40 million led by China’s Transsion Holdings Company (formerly known as Techno). The same week, OPay, the FinTech platform from Opera, secured $120 million Series B investment from Chinese investors.

- The WeeTracker report classified 2019 as a “robust” year for Africa, driving a total annual venture capitalist funding to $1.340 billion, the highest score to date. Kenya came second with a 283.6 percent growth from its 2018 funding.

- They are followed by South Africa in third place. These top three countries accounted for over 80 percent of the entire deals on the continent.

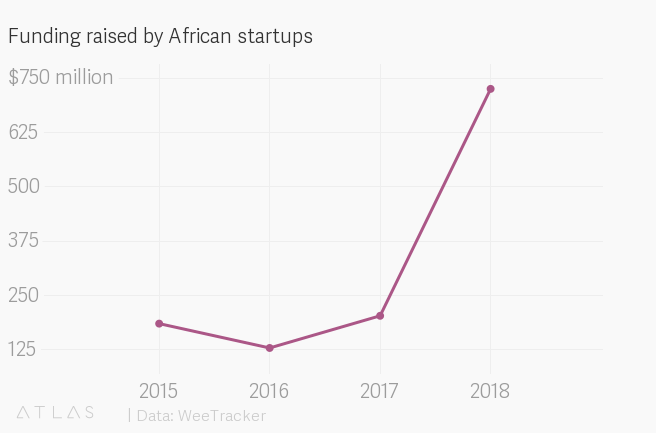

- This massive funding is said to have been raised from 427 deals, representing a 79.2 percent Year over Year (YoY) increase from the $725.6 million collected from across 458 deals in 2018. Only 6 percent of these sampled deals accounted for the majority of the investments.

- The Annual Venture Investments In Africa Report 2019 by WeeTracker is an analysis that offers a comprehensive overview of emerging trends and opportunities in the African Startup and VC industry along with in-depth analysis backed by data.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award winning writer.

He could be contacted at udohrapulu@gmail.com