Bit Sika has had a field day helping persons in Nigeria and Ghana send digital money across boundaries. Barely four months since its launch, the Ghana-based crypto remittance startup, backed by Twitter CEO Jack Dorsey startup is reporting a $1 million in transactions

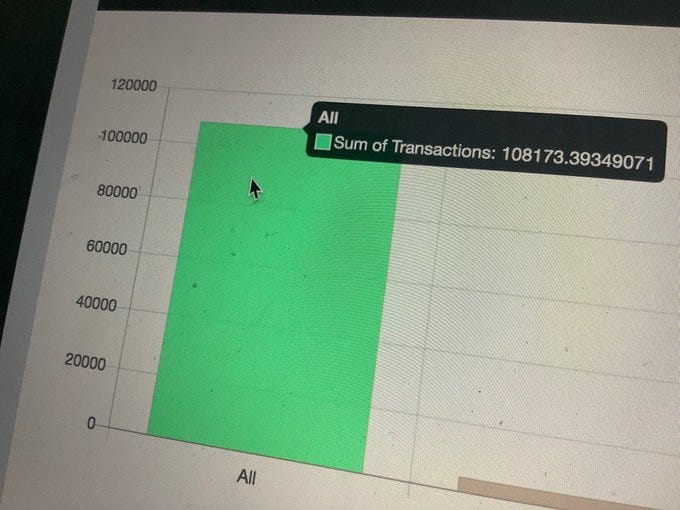

‘‘We hit a $1 million in transactions today.

We appreciate it,’’ Founder Atsu Davoh noted in a tweet.

Here Is All You Need To Know

- Bit Sika has only been around for about four months now, so reaching a milestone of $1 million in transactions so soon appears a major achievement.

- Twitter CEO, Jack Dorsey on its recent trip to Africa, showed some support for the startup.

- In December 2019, Bit Sika also received some funding from Microtraction, making the startup Microtraction’s first non-Nigerian investment.

- Microtaction was majorly drawn to Bit Sika because the startup was making cross-border payments across countries fast, auditable and cost-effective.

- Microtraction stated that Bit Sika, by so doing could help millions of Africans, including individuals and businesses alike.

‘‘Atsu’s relentless effort to spread the adoption of crypto — first with a USSD wallet, then with a crypto-focused charity platform and now with an app focused on cross border payment — is second to none. The team’s ability to push out products quickly with a laser-focused customer-centric approach is admirable,’’ Microtraction added.

- Apart from gaining support from Microtraction, Bit Sika has previously participated in Binance’s incubation program

- Buoyed by this recording $1 million in transaction volume, Bit Sika is planning to scale the business to other African countries, including a foray into the francophone African market.

- The Bit Sika app has already been launched in Ivory Coast, Mauritius, Mali, Senega, Gabon, and Cameroon, in addition to the countries where it is already active.

‘‘Happy to say that @BitSikaAfrica has expanded to money transfer between Cameroon, Gabon, Senegal, Ivory Coast, Mali and Mauritius (alongside Ghana and Nigeria). These countries will be available on the app in a few days, later this month. Have to improve my french now,’’ Founder $atsu@atsudavoh further tweeted.

Read also: More Loans From Banks May Be Available To Nigerian Businesses In 2020

A Look At What The Startup Does

- Founded in late 2019, the Bit Sika app allows its users to send crypto and fiat currencies alike, and move money from phone to phone, between Nigeria and Ghana.

‘‘Bit Sika has created a platform that uses digital currencies to move money across borders at negligible/no fees. Users can deposit and remit money across multiple currencies using the app. For instance, Dofi, a Ghanaian lady who works and earns her salary in Nigeria wants to send money to her mother in Ghana; She can deposit Naira in the app, make a transfer and the Cedis equivalent is received by her mother instantly. The magic of crypto, which helps move the money around, happens in the background, making this an easy to use platform for the mass population.

All monies deposited in Bit Sika are stored in USD credits/stable-coin. This means that, once your Bit Sika balance is not used, the USD value of your balance never changes. This serves as a better store-of-value against African local currencies. No other app in the market offers this to its users,’’ Microtraction noted in its recent Bit Sika investment statement.

- According to founder Atsu Davoh, on average, the value of each transaction on the platform is nearly $200.

- Atsu and his team actually pivoted the Bit Sika platform from being a donation crowdfunding platform, which allowed people living in other countries to send donations to African nationals in need of the funds, to its present cross-border crypto remittance model.

- As part of its long-term strategy, Bit Sika is planning on launching its own, Binance-based stablecoin — African Stablecoin (ABCD), which it announced in late 2019. The African Stablecoin is expected to see its launch in January 2020.

The Founder Behind Bit Sika

Bit Sika CEO and Founder Atsu Davoh dropped out of college (Carleton College) in the United States and moved back to Ghana to help innovate on Africa’s financial infrastructure. He initially built a USSD platform that allowed Africans with the most basic feature phones to acquire and send Bitcoin between phone numbers without the internet.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award winning writer.

He could be contacted at udohrapulu@gmail.com