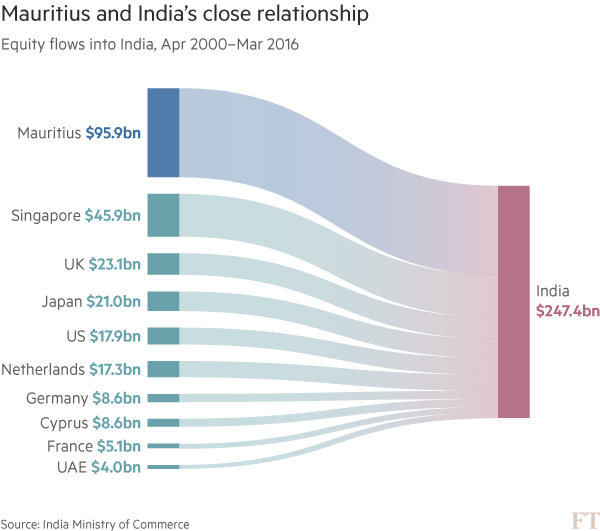

One major factor that will scare startup investors away from the tiny East African nation of Mauritius is most possibly its population of about 1.2 million people, largely about 167 times far off from the continent’s most populous country, Nigeria. But should investors be after high returns, less regulations and multiple taxation, Mauritius is the perfect destination for startup investors. Sharing the same maritime boundary with India’s 1.3 billion people, savvy investors may also benefit from tax treaties between the two countries. A protocol amending “India-Mauritius treaty”, announced on 10 May 2016, provides, among other things, an exemption from tax in India on capital gains earned by a tax resident of Mauritius. The implication of this is that such capital gains are subject to tax based on residency rules, thereby giving taxation right to Mauritius. In simple terms, a startup originally registered in Mauritius but doing business in India, may claim the tax exemptions stated above in India. With that said, the following are the reasons why regulation-wise, Mauritius supports its startups’ growth.

Tax Relief Provisions

- Zero tax on innovation startups: In sweeping reforms introduced in Mauritius in 2017, income generated by any company set up in Mauritius on or after 1 July 2017 which are involved in innovation-driven activities and where the IP assets are developed in Mauritius are exempt from tax. This exemption will apply for eight tax years, starting from the tax year in which the company starts its innovation-driven activities. For existing startups or companies, the eight-year tax holiday would be on income derived from intellectual property assets developed in Mauritius after June 10, 2019. In practical terms, all startups that are internet-driven in Mauritius will pay zero tax for eight years notwithstanding the size of their income.

- There is also tax incentive on research and development (R&D) to the effect that during a period from 1 July 2017 to 30 June 2022, if a person has incurred any qualifying expenditure on R&D that is directly related to one’s existing trade or business, one may, in the tax year in which the qualifying expenditure was incurred, deduct twice the amount of the expenditure, provided that the R&D is carried out in Mauritius and no annual allowances have been claimed on the same. The term ‘qualifying expenditure’ means any expenditure relating to R&D, including expenditure on innovation, improvement, or development of a process, product, or service as well as staff costs, consumable items, computer software directly used in R&D, and development and subcontracted R&D.

- There is also a five-year tax holiday for a startup or company setting up an e-commerce platform provided the company is incorporated in Mauritius before June 30, 2025. Also within the five-year bracket are peer-to-peer lending operators, provided the company starts its operation prior to December 31, 2020.

- Under the Mauritius Green Tax regime, tax exemption is granted for interest derived by individuals and companies from debentures or bonds issued by a company to finance renewable energy projects (the issue must be approved by the Director General of the MRA). This is a big incentive for startups in the renewable energy sector.

- For investment funds such as private equity companies and venture capital firms, effective January 1st, 2019 they would be taxed at the rate of 3% ( unlike regular business entities that attract a tax rate of 15%), provided the fund managers satisfy key conditions relating to their activities being carried out in Mauritius, and that they meet the minimum annual expenditure and minimum employment expected of their funds.

- Compared to other African countries, at 15% Mauritius has the lowest corporate tax rate in Africa. The consequence of that is that even after the expiration of all the tax holiday periods, the amount paid as tax for companies is still negligible. Moreover, effective Jaunary 1, 2019, there is the introduction of an 80% exemption regime on the following income: Foreign dividend, subject to amount not allowed as deduction in source country; Foreign-source interest income; Profit attributable to a PE of a resident company in a foreign country; Foreign-source income derived by a Collective Investment Scheme (CIS), Closed End Funds, CIS manager, CIS administrator, investment adviser or asset manager licensed or approved by the FSC; Interest income derived by a person from money lent through a peer-to-peer lending platform operated under a licence issued by the FSC after the five-year tax holiday.

- Another incentive to foreign startup investors could be found under the Mauritius Investment Promotion Act of 2000 which provides that where an investor is a company only individuals actively involved in the management of the company and holding occupation permits would be considered for permanent residence permit of the country, provided that the company is making an annual turnover exceeding 15 million rupees ($ 406,989). Also qualified for a permanent residence permit are self-employed non-citizens, holding occupation permits and having an annual income exceeding 3 million rupees ($ 81,397).

Government-backed Funds

Although year on year, the Mauritius startup ecosystem is not often in the news for much of the startup investment that comes to Africa, the country has a lot of funds for its business ecosystem. Among the notable government-backed funds are:

- SME Development Scheme: The SME Development Scheme is a private company wholly owned by the Government of Mauritius and was incorporated in July 2017. This institution has taken over the role and functions of the Small and Medium Enterprises Development Authority(SMEDA). The company encourages the development and expansion of small and medium enterprises. Under the SME Development scheme, eligible SMEs are granted a SME Development Certificate and are entitled to incentives and facilities, such as Income Tax holiday for the first 8 years and other tax concessions.

- National SME Incubator Scheme (NSIS): The National SME Incubator Scheme (NSIS) promotes the establishment and reinforcement of a sustainable entrepreneurial ecosystem in the Republic of Mauritius. Accredited Private Sector Incubators will provide all the infrastructural support, training and mentoring to the Projects accepted at Pre-Incubation, Incubation and Acceleration phases.

- Maubank Financing Scheme: Loans to Individuals under Maubank Financing Scheme Loans are granted for project up to a maximum Rs250,000 under Maubank Financing Scheme. Maximum Loan Amount: 90% of project value. Interest Rate is presently 3% per annum for the first 4 years, then interest rate at 6% per annum for the remaining years.

- The SME Equity Fund Ltd (SEF): invests in start-ups, expansion projects and new lines of business. It provides equity financing to SMEs established in Mauritius, and where the majority shareholder of the SME is a Mauritian national. The investment range starts at Rs 500,000 and can reach up to Rs 25m. The financing it provides to companies should not exceed 49% of the business’ equity capital — which means that the entrepreneur, must invest in at least 51% of the share capital.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer.

He could be contacted at udohrapulu@gmail.com