Like many of you, we’ve had to reorient our fundraising strategies as the current crisis has unfolded. Many of my portfolio companies have also asked for advice because they’ve never seen a crisis like this before. Over the years, I’ve found that the fastest way to get answers is to talk to people who’ve navigated similar circumstances to understand what to expect and get easy-to-take-action tips to inform our new strategy.

I spoke with dozens of my most trusted advisors, people who survived and thrived — or crashed and burned — during 2001 and 2008 and have stories to tell. This article contains some of the best tips from those conversations.

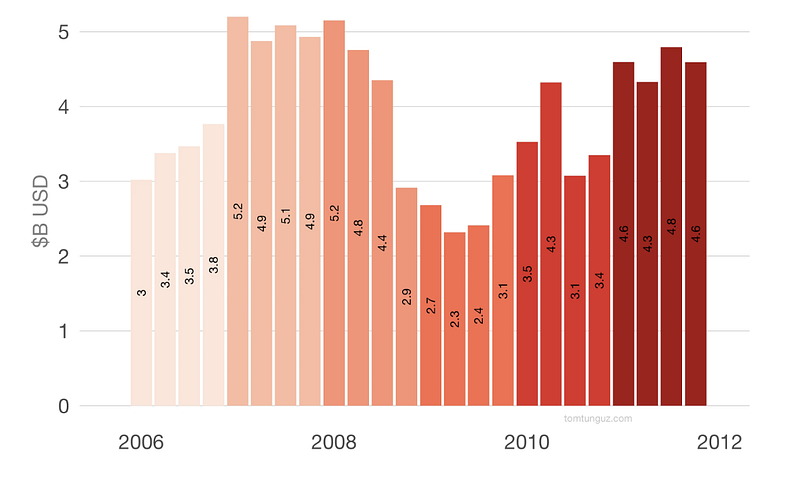

Before we get into that, you are probably asking yourself, how long and deep will this “slump” be? There is no easy or accurate answer. The best piece I found is from Tomasz Tunguz. Here is a graph from his piece showing the total amount invested per quarter during the last recession.

What he saw was investment dollars drop by 40% from $4.8 billion to $2.9 billion in two quarters; that amount then steadied and began to recover two years later. That said, the deal count “was business as usual across the early fundraising rounds,” Tunguz writes. “Aside from Q3 2008, which saw a dip, VCs were still investing in as many rounds. Valuations and round sizes were the main contributing factor to the decline in VC dollars invested.”

Mark Suster wrote an excellent piece about this as well and is advising companies to weather an initial slump where VCs are focused on triage of existing portfolio companies for three to 18 months. Knowing that deals don’t disappear completely even when it slows down is key. So here are some tips for shifting your fundraising strategy

Tip 1: “Try to fundraise from your customers first.” — Justin Kan, serial entrepreneur, investor, and founder of Justin.tv

We survived 2008 with Justin.tv when every other independent video site died. The trick was that every month, we sat down as a team and thought of all the ways we could increase revenue and all the ways we could cut costs and implemented everything. We were able to cut our burn substantially, and two years later, became cash-flow positive.

Tip 2: “Focus on getting deals done.” — an anonymous founder who is closing a round and does not want to jeopardize their positioning

The 2001 and 2008 crashes were absolutely wild and caught a lot of founders off guard. They had been used to living in a world where money was plentiful and diligence was light. They were in the driver’s seat on price and terms and could pick investors when it came to putting a round together. Suddenly the environment looked different as investors were the term and price setters. Diligence got intense, and ideas needed to make sense. A lot of founders couldn’t cope; others went into wartime footing and thrived by doing more with less.

Tip 3: “Target high-quality investors with long track records.” — Jenny Fielding, founder of The Fund and managing director of Techstars NYC

Many funds are sitting on piles of cash that need to be deployed over a certain time period, so keep that in mind if you’re fundraising now. While the public markets may be shaky, venture investing is relatively isolated from public markets as VCs have long-term — 10-year — time horizons. In fact, some of the best VC vintage funds were a product of the last downturn. Quality investors know this history and will be leaning in to write checks during these uncertain times.

Tip 4: “Only do deals with long-term partners.” — Sridhar Iyengar, founder of AgaMatrix and Misfit Wearables

In 2001, we saw some epically bad behavior from everyone. Everyone’s true colors really came out. There were some investors that tried to exploit the situation and impose valuations, terms, and control provisions that would hamper long-term growth and partnership. For a lot of founders, their first instinct was to get a deal done. Investors who want to set the company up to fail are not worth it. At the end of the day, successful startup outcomes come from partnership, and you need someone whose true colors really shine. We were very lucky to be able to turn down investors during that time, but a lot of other companies didn’t do that and ended up struggling for years with the baggage.

Tip 5: “Investors will want companies that can weather the storm.” — Ari Newman, founder of Filtrbox and JustOn

I was raising our Series A in late ’08/early ’09, and it was very difficult to get anyone off the fence. I later described the process as about as much fun as rubbing your arm with sandpaper and then pouring alcohol on it. We were only a few months from cash flow break even at a decent run rate and growing 10% month over month, but in that market, what series A investors were looking for was the de-risked opportunity. They wanted to own a good chunk of a company (25% or higher) that could weather the storm and not burn much cash at all. It’s a lot like what I see developing today. At the time we traded growth for stability and tried to run the company as close to break-even as possible. Be prepared for this expectation in terms of operating plan and pricing expectations.

At this point, you probably expect me to rattle off the same advice you hear from everyone that “the best companies are built during downturns,” as if that is a consolation for the severity of your roller coaster. The periods around 2001 and 2008 were both brutal for startups, investors, and founders, and there is reason to believe this period will resemble those periods in some ways. As I tell new founders, even in good times, it’s not how far you fall but how high you bounce that counts. Focus on what you can learn from what’s happening, adapt, keep moving forward, adapt again, and survive.

Joel Wish is a Founder @getSimpleHealth and a Board member @Parsley_Health.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer.

He could be contacted at udohrapulu@gmail.com