Paymob, an Egyptian digital payments provider, has landed a US$3.5 million funding round to grow its merchant network and accelerate regional expansion.

“In a world where consumers are currently adopting digital products in all aspects of their lives, now is the time to invest in Paymob products to empower the digital economy. These unprecedented times has proven the need for a robust digital payments infrastructure to serve the rising demand from all business types and sizes during the pandemic which resulted in a drastic increase of 450 per cent increase in merchant on-boarding rate since the beginning of Covid-19,” said Shawky, Paymob’s chief executive officer (CEO).

Here Is What You Need To Know

- Paymob’s latest funding round was led by Global Ventures and the Dutch Entrepreneurial Development Bank FMO with a follow-on investment by A15.

- The startup will use the proceeds to further expand its merchants’ network to rising demand, as well as product development and the establishment of a larger regional footprint. It plans to extend its products to more markets in Africa and the GCC.

Why The Investors Invested

Basil Moftah, general partner at Global Ventures, said his team was “incredibly excited” to partner with the Paymob team, as the need for financial inclusion is exacerbated by the current global pandemic.

“Led by a dynamic team, Paymob has a unique market position to offer integrated infrastructure solutions and payment services across a range of payment methods and channels. Paymob and Global Ventures share similar DNA — the ability to see problems in a different light, the creativity to rethink how things are done, and the courage to get it done,” he said.

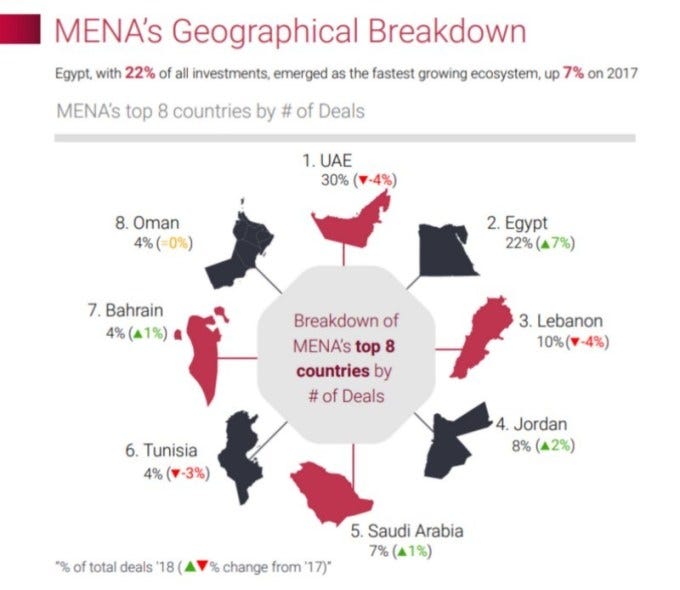

Read also: Here Are Reasons Egypt’s Startup Ecosystem Is Booming

A Look At What The Startup Does

Founded by Islam Shawky, Alain El Hajj and Mostafa El Menessy, Paymob is an infrastructure technology enabler providing payment solutions to empower digital financial service providers across Africa and the Middle East through mobile wallet technology.

The startup’s mobile wallet infrastructure processes more than 85 per cent of the market share of the transaction’s throughput in the Egyptian market, and serves merchants across five different markets, including Kenya, Pakistan and Palestine, and serving millions of customers on a monthly basis.

Chief operating officer El-Hajj said Paymob’s merchants and partners would benefit directly from the funding as Paymob will ramp up investments in its core payments offering to better serve its existing base and cater for the increasing demand.

“Empowering our merchants and partners networks in Egypt and Africa has and will always be at the heart and core of what we do at Paymob,” he said.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer