Nigeria laws startups

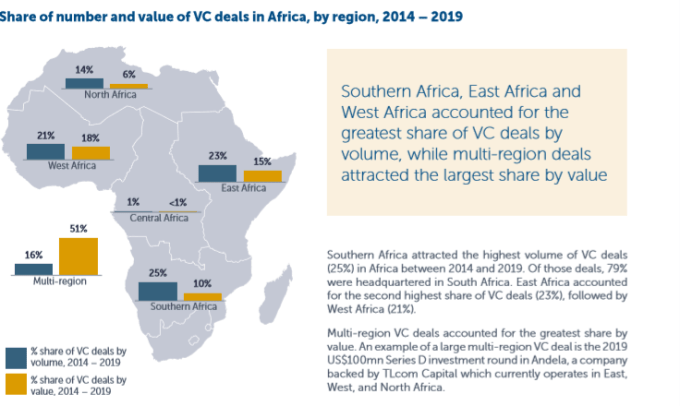

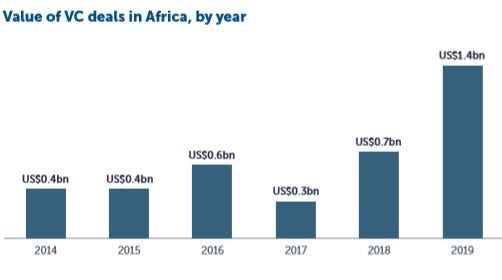

Nigeria has been at the forefront of the African startup ecosystem. According to the most recent report from the African Private Equity and Venture Capital Association, between 2014 and 2019, Nigeria accounted for 14% of all total VC funding deals done in Africa, just behind Kenya (at 18%) and South Africa (at 21%). However, even though the number of VC deals concluded on startups in Nigeria is much lower than that of South Africa or Kenya, VCs are pouring larger amounts of money into the West African country compared to South Africa or Kenya. For instance, according to the data firm, Partech Africa, in its 2019 venture capital report, Nigeria topped Africa’s VC funding landscape with US$747 Million in VC investment (37% of all funding). A similar feat was repeated by the country in 2016 and 2015, with South Africa and Kenya taking the lead, only recently in 2017 and 2018 respectively. Nigeria also houses Africa’s most valuable startup ecosystem — Lagos — which according to Startup Genome, in its Report, was worth $2 billion as of 2017. For one thing, Nigeria is Africa’s largest economy, behind South Africa with a Gross Domestic Product (GDP) of $400 billion (as at 2018) as well as the continent’s most populous country with a World Bank estimated population of 202 million people.

In view of these, it has become relevant to explore how Nigeria supports its startup ecosystem through its laws, regulations and policies.

Incentives — Tax Exemptions

A. For Venture Capital Firms

A long range of tax exemptions are given to investments made by venture capital companies in Nigeria under the country’s Venture Capital Incentives Act.

Consequently, under the Act, for every equity investment made by a venture capital company in a startup in Nigeria, there are deductions from the amounts to be paid as tax from the startup company’s income tax, each year until 5 years after each investment. For the first year, 30% will be deducted. For the second year, another 30% deduction will be made; 20% in the third year; 10% in the fourth year; while 10% deduction will be made in the fifth year.

Again, the withholding tax to be paid on dividends declared in a startup funded by a venture capital company in Nigeria is 5%, under the law, for the first five years of the investment.

Where the equity investment of the venture capital firm in a Nigerian startup company is sold or disposed of, the gains made by the venture capital firm on the equity investment is not liable to capital gains tax by the provisions of the Nigerian Capital Gains Tax.

However, to qualify to benefit from the incentives, investments by the venture capital company must make up at least 25% of the total funding required by the startup. The investment must also be specifically made in innovative companies; or for commercialization of research findings with high returns potential; or for the purposes of promoting SMEs. The venture capital company and the startup receiving the venture capital must, also, first be registered with Nigeria’s Federal Inland Revenue Service (FIRS), in charge of collection of taxes on behalf of Nigeria’s federal government, in order to benefit from the tax exemption.

Better Legal Framework For A VC Fund

Under Nigeria’s newly passed Companies and Allied Matters Act (‘The CAM Act’), it has also become easier to set up a legal structure for a VC fund. By the terms of the new law, venture capital firms in Nigeria may now be set up as limited liability partnership or limited partnership.

Previously, before the law came into being, it was normal practice to register VC firms as limited liability companies; general or limited partnerships, or as limited liability partnerships under the Partnership Law of Lagos State (Nigeria’s major economic city).

Even though under the old regime, general and limited partnerships could be registered and applied throughout Nigeria whereas limited liability partnerships only applied in Lagos, the new regime spells out definite governance framework for partnerships generally, as well as enlarges the operational scope of partnerships to cover the whole of Nigeria, and not just Lagos alone.

The essential difference between a limited liability partnership and a limited partnership under the new law is that while a limited liability partnership is a corporate body which has a legal personality different from the partnership as well as a perpetual succession, a limited partnership has no separate identity from those of the partners that make it up.

Indeed, a limited partnership under the new law captures the ideal form of most VC funds, which usually have one or more partners called general partners — responsible for the management of the funds under the partnership, and who are also liable for the debts and obligations of the partnership — as well as one or more persons known as limited partners — who contribute certain sums of money or property to the partnership and who shall not be liable to the debts and obligations of the partnership.

Apart from properly providing a clear legal framework for the operation of VC funds in Nigeria, the new partnership regime, under the CAM Act, also functions to provide some clarity about their taxation.

Under the Nigerian tax laws, dividends declared by a VC firm that is a partnership — from its investment in startups — are subject to a 5% withholding tax. Where the dividends are declared by the fund and are shared in a partnership, the amount each partner is entitled to is further taxed under Nigeria’s Personal Income Tax Act. However, where a partner who is part of the VC firm is a limited liability company, the company must pay company income tax of 30% on profits made from such earnings, including a further 2% education tax and 10% withholding tax.

Where, however, the VC firm is a limited liability company, under Nigerian laws, apart from paying a corporate income tax of 30%, they also pay 5% withholding tax and 10% capital gains tax (or zero capital gains tax where it is the equity (or shares) of the company that was disposed of).

Countries with top VC funding in Africa 2019. Source: African Private Equity and Venture Capital Association 2019 VC report.

Nigeria laws startups Nigeria laws startups Nigeria laws startups Nigeria laws startups Nigeria laws startups Nigeria laws startups Nigeria laws startups Nigeria laws startups Nigeria laws startups Nigeria laws startups Nigeria laws startups

B: For Startup Companies

Innovative startups in Nigeria have a range of incentives to encourage their early stage growth, even though in most instances, the process of applying for and securing the incentives are demanding, and in most instances unrealistic. The incentives include:

The Exemption Of Early Stage Startup Companies From Corporate Taxes

Under Nigeria‘s new Finance law:

- Small businesses with annual turnover of less than ₦25m ($64.5k) are now exempted from Companies Income Tax. However, to benefit from such incentive, such small businesses must first register for taxation in Nigeria and must continue to file tax returns during the period their profits are below the ₦25m threshold.

- A lower Corporate Income Tax rate of 20% ( as against 30%) will however apply to medium-sized companies with yearly turnover between ₦25m and ₦100m ($258k). To benefit from such incentive, the companies must first register for taxation in Nigeria and must continue to file tax returns during the period their profits are between the ₦25m and ₦100m thresholds.

- The law now, also, allows a minimum tax rate of 0.5% for every turnover and this provision will only apply to small companies (less than ₦25m turnover), thus allowing companies non-resident in Nigeria for tax purposes to pay minimum tax.

- Again, for companies or businesses that pay their tax dues early, a 2% deduction bonus on tax payable is given, in the case of medium-sized companies between ₦25m and ₦100m; and 1% deduction for large companies from ₦100m and above.

A Pioneer Status Tax (Free Tax) Incentive For Innovative Business Models

Although this is one of the most significant incentives available to early stage startups in Nigeria, there were only about 35 standing beneficiaries of pioneer status tax incentive in Nigeria as at March 2020, out of which only 1 is an ICT firm and 6 are agro-businesses; even though more than 125 applications were filed for the grant of the incentive during the period.

Nevertheless, by virtue of the provisions of Nigeria’s Industrial Development (Income Tax Relief) Act (“IDITRA”), the Pioneer Status is to be granted for an initial period of 3 years with a possibility of an extension for another 2-year period to companies in their first year of business or operations in Nigeria. The companies must, also, be among those on the list of pioneer industries in Nigeria. Consequently, companies or businesses older than a year would not benefit from the pioneer status incentive.

Again, businesses that have existed for several years in a particular sector may not enjoy the pioneer status, except such companies branch into new lines of business covered under a list of 27 or more new industries and products.

To qualify for the Pioneer Tax Incentive, the company must also have incurred capital expenditures of up to ₦100m ($258k). Companies granted Pioneer Status Incentives in Nigeria also enjoy tax relief on income earned during the tax holiday period and dividends paid from the profits earned during the tax holiday. The incentive also enables the company to set off tax losses incurred during the tax holiday against profits earned after the holiday, and to deduct capital expenditure in the same manner.

A Right For Startups To Partner With Large Corporates In Projects Above $1 Million

Under Nigeria’s Guidelines for Content Development in Information and Communications Technology, all indigenous or Nigerian Companies who have secured IT projects or contracts with any Nigerian Federal Public Institution or Government owned companies, of which the gross value of the project is Five Hundred Million Naira (N500,000, 000, 00)or above, shall engage on the project, a Nigerian startup or incubation team for the purpose of Research &Development on the project.

The Guidelines apply to all Federal Ministries, Departments and Agencies, Federal Government Owned Companies (either fully or partially owned) Federal Institutions and Public Corporation, Private Sector Institutions, Business Enterprises and Individuals carrying out business within the Information and Communications Technology sector in Nigeria.

An Alternative IPO Exit Route As Startups Can Now List On A Special Board On The Nigerian Stock Exchange

Nigeria also has developed a new mechanism that will allow high-growth startup companies to list on the Nigerian Stock Exchange. A fourth board on the exchange meant for small businesses and startups has now been launched, to that effect.

This has strengthened the exit alternatives available to startups in the country. That is, startups in Nigeria, apart from acquisition, may now consider IPOs (Initial Public Offerings) on the Nigerian Stock Exchange. The board, known as the Growth Board would offer them the opportunity to raise equities for their businesses.

However, it appears this is over-flogging a dead horse. A similar board, known as the Alternative Securities Market (ASeM) had previously been created by the exchange for emerging businesses — small and mid-sized companies with high growth potential. Findings show that only 9 companies (mostly in the oil and gas industry; none of which is a tech startup company), have been listed on the board.

One significant reason for this lack of interest by startup companies is the unappealing state of the Nigerian Stock Exchange, which at a market capitalisation of $ $36.91bn, is 22 times smaller than the Johannesburg Stock Exchange (at$825.66 Billion).

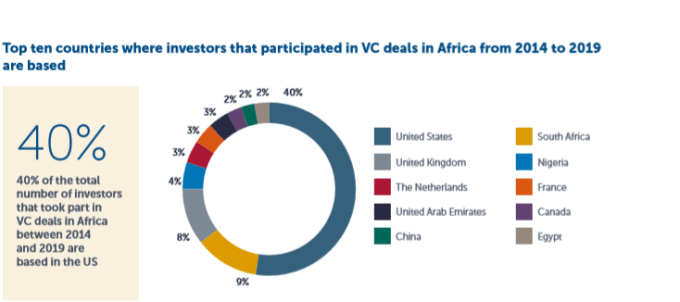

Where African startup VCs are based, 2019. Source: African Private Equity and Venture Capital Association 2019 VC report.

Government-backed Funds For Startups In Nigeria

There are a number of government-backed funds available in Nigeria, a majority of which are by way of loans and not equity. They are listed below:

Nigeria’s Central Bank Intervention Funds

The Central Bank of Nigeria, from time to time, launches series of intervention funds, aimed at startups and small and medium scale businesses.

For instance, owners of businesses in the Nigerian creative industry may now access loan facilities as high as ₦500,000,000 (about $1.4 million). The Creative Industry Financing Initiative is targeted at:

- Businesses in the fashion (including designing) industry

- Businesses in the Information Technology (including e-commerce, online payment solutions, software engineering etc.)

- Businesses in the Nigerian movie industry (including movie producers, movie distributors)

- Businesses in the Nigerian music industry (whether as record labels, music artistes, etc.).

The businesses may get up to the following amount:

- A student of Software Engineering anywhere in Nigeria may get up to ₦3 million ($ 8,294) to boost his/her education.

- Movie Production businesses may get a maximum of ₦30 million ($82,943) to boost their businesses.

- Movie distribution businesses may get up to ₦500 million ( $1.4 million)

- Businesses in the Nigerian Fashion and Information Technology can also get funds to cover their rental/service fees (the exact amounts were not specified)

- Music Businesses may also get funds to cover their training fees, equipment fees, and rental/service fees.(The exact amount is however not specified. It also appears that the funds are not extended to businesses of production of music, and other related music roles).

To know more about this click here.

Other intervention funds by the central bank include the Micro, Small, Medium Enterprises Development Fund (MSMEDF); Commercial Agric Credit Scheme (CACS); Real Sector Support Facility (RSSF), etc.

To access any of the intervention funds, startups may need to go through financial institutions authorised by the central bank to disburse the funds. FCMB is an example of a Nigerian bank that participates in the scheme. Interested startups can check out its offers here.

Funds Under Nigeria’s Bank Of Industry

There are also series of funds operated by Nigeria’s Bank of Industry, the oldest and largest Development Finance Institution currently operating in Nigeria. BOI provides financial assistance for the establishment of large, medium and small projects as well as the expansion, diversification, rehabilitation of existing enterprises. Consequently, the Bank operates funds targeted at youths (Graduate Entrepreneurship Fund; Youth Entrepreneurship Support (Yes) Programms; Youth Ignite Programme); women; asset finance; as well as working capital.

To know more about the fund, click here.

To access any of the intervention funds, it may be easier to go through financial institutions authorised by the bank to disburse the funds.

FCMB is an example of a Nigerian bank that participates in the scheme. Interested startups may also check out its offers here.

Development Bank of Nigeria (DBN)

Development Bank of Nigeria exists to alleviate financing constraints faced by Micro, Small and Medium Scale Enterprises (MSMEs) in Nigeria. The DBN loan repayment duration is flexible (up to 10 years with a moratorium period of up to 18 months).

To access any of the intervention funds, it may be easier to go through financial institutions authorised by the bank to disburse the funds.

FCMB is an example of a Nigerian bank that participates in the scheme.

Interested startups may also check out its offers here.

Future Generations Fund Under Nigeria’s Sovereign Investment Authority

The purpose of the Future Generations Fund is to preserve and grow the value of assets transferred into it, thereby enabling future generations of Nigerians to benefit from the country’s finite oil reserves.

The fund is mostly available to venture capital or private equity firms, and not directly to startups.

To know more about the fund, click here.

Crowdfunding

Although Nigeria has not expressly permitted equity or loan crowdfunding, there is a proposed regulation to that effect.

Under the proposed regulation, only MSMEs (Micro, small and medium enterprises) registered as companies in Nigeria with a minimum of two-years operating track records shall be eligible to raise funds through a Crowdfunding Portal registered by Nigeria ’s Securities And Exchange Commission.

VC deals value for African startups, 2019. Source: African Private Equity and Venture Capital Association 2019 VC report.

The Bottom Line And Recommendations

Even though there have been efforts to enact good legislation to support Nigeria’s nascent startup ecosystem, these efforts are still struggled.

Compared to other African countries like Mauritius, Egypt, South Africa, Tunisia and Senegal, Nigeria still has a lot to do to support its startups.

The following recommendations are, therefore, important and if properly harnessed, have the potential to unlock the continent’s largest economy:

Startup Act:

Nigeria is long over-due for a Startup Act, which has since been adopted by other African countries such as Tunisia and Senegal.

One thing a Startup Act does is to aggregate all efforts geared towards promoting and uplifting all startups in countries where the Act exists. For instance, having a Startup Act will help to tailor incentives to startups more precisely, unlike what obtains presently in Nigeria where established corporates and well-funded companies end up benefiting most from the existing tax incentives, such as the Pioneer Status Incentives.

For instance, the existence of a Startup Act has encouraged the Senegalese government to target startups and newly created companies more precisely with a three year tax exemption.

The Senegalese Startup Act, among other things, grants special status (known as a label) to a labelled innovative and disruptive private or public company, which has been legally registered for a period of not more than 8 years; and whose strong growth potential is built on a disruptive economic model. The law also applies to any startup created by any Senegalese living abroad who owns at least 50% of the startup. This will, undoubtedly, attract more investments back home from Senegalese citizens living in foreign countries.

Enactment Of The Equivalent Of South Africa’s Section 12J

Another policy change capable of facilitating the growth of startups in Nigeria is the introduction of an equivalent Section 12J of South Africa’s Income Tax Act of 2009.

The incentive allows investors who make investments in approved Venture Capital Companies (VCC) — that then invest in qualifying small companies — a tax deduction.

Thus, by investing in a Section 12J venture capital company, the investor not only qualifies for a full deduction of the total investment amount from their taxable income in the relevant tax year, but they are also indirectly supporting the South African economy and the growth of local SMEs.

By operation, Section 12J works like this:

- A tax-paying entity (corporate or individual) approaches a VCC with its investment.

- The VCC accepts the investment for investments in its portfolio companies and issues the investor with a certificate for the amount invested.

- With this certificate, the investor approaches the South African Revenue Service (SARS) and presents the certificate. The certificate empowers the investor to deduct the full value of the investment from their taxable income in that tax year.

- Section 12J is so attractive to investors that when the investment reaches maturity and the investor withdraws from the VCC portfolio, the capital gains tax on the investment will be zero as a result of the initial benefit of the 100% tax deductibility.

This explains why there are, today, many VC firms in South Africa and why South Africa has collected more than 21% of all VC funding deals in Africa between 2014 and 2019, whereas Nigeria only received 14% of the deals, even though Nigeria is the continent’s largest economy and has more than 3 times South Africa’s population.

Although Nigeria has a venture capital legislation, there is a big difference between enticing individual and corporate investors to invest in venture funds and enticing venture funds to invest in startups. Nigeria is simply doing the latter; and because of the risk aversiveness of investors in emerging markets, the country may not get the results it desires for its local startup ecosystem any time soon.

Establishment of Equity Funds For Startups

What Nigeria currently has are credit facilities for startups. There should be government-backed equity funds that take up shares in startup companies instead of credit facilities that usually come with strong terms such as interests, modes of repayment of principal sums, etc.

Equity participation in early stage startups function to assist them to go through the difficult periods of their early years until they are mature enough to take in any type of financing.

Indeed, while Nigeria maintains little or no presence in early stage investing by way of equity funds, countries like Egypt and South Africa do not.

Top South African companies in 2016, for instance, launched the $84 million SA SME Fund, a VC fund to co-invest alongside various investors (not solely VC investors). SA SME Fund CEO Ketso Gordhan said the fund would invest about 75% of the sum in black-owned small and medium-sized enterprises, including tech startups.

SA SME Fund and the government’s Technology Innovation Agency (TIA) have, also, further announced a public-private partnership to co-invest R350 million across three venture capital funds. The partnership sees over R350 (over $23 million) invested in the three venture capital funds. South Africa’s SME Fund’s mandate to the three fund managers includes a requirement that they invest at least 50 percent of the fund into businesses owned by black entrepreneurs.

In Egypt, there is Bedaya, a government-backed incubator, established by Egypt’s General Authority for Investment and Free Zones (GAFI) in 2009. The incubator offers up to LE 150,000 (US$9,047) in funds as well as business development services, networking opportunities and manufacturing spaces to startups in Egypt. 60 percent of Bedaya’s fund is allocated to supporting startups from governorates outside of the capital, Cairo.

In Morocco, government-owned financial institution “Caisse Centrale de Garantie-CCG” also partners with the Maroc Numeric Fund to facilitate access to financing for very small and medium-sized businesses and, more recently, for innovative project developers and startups.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer