In August 2020, Twiga Foods, the Kenyan agritech startup that is disrupting agricultural supply chain in East Africa, and which has, before now, raised a total of $55 million in debt and equity, backed by investors including Goldman Sachs and International Finance Corporation, announced it was seeking new funding to enable it expand its footprint in East Africa. Barely two months down the line, Twiga Foods and IFC’s Global SME Finance Facility are set to be part of an investment of up to Kshs 3.2 billion ($30 million) through unfunded risk sharing facilities (RSFs) with Tier 1 commercial banks with the first phase being led by Kenya Commercial Bank (KCB).

Here Is What You Need To Know

- IFC’s Global SME Finance Facility’s proposed investment would enable IFC and Twiga Foods to reach medium scale farmers, mainly SMEs and very small enterprises (VSEs) with limited banking, limited operating track records or lower levels of collateral.

- This initiative seeks to support over 300 irrigated medium-scale contract farmers to complement Twiga’s seasonal smallholder farmer supply base.

- This will stabilise year-round fresh fruit and vegetable volumes in line with Twiga Foods mission of supplying readily available safe, affordable, and high-quality food to Kenya’s urban markets.

- Peter Njonjo, Twiga’s CEO and co-founder mentioned that this initiative lines up strategically with the government of Kenya’s Agricultural Sector Transformation and Growth Strategy, which aims at boosting food security in the medium term through modernizing and scaling of commercial farming for the domestic market.

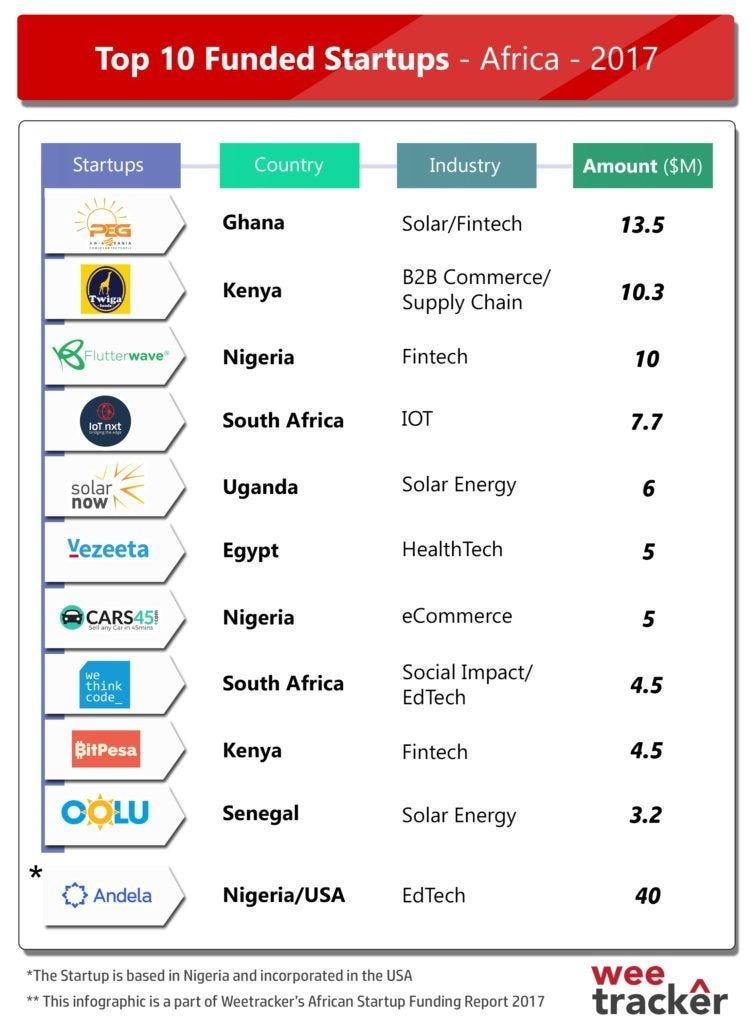

Of the whole investment made into Africa’s startup ecosystem in 2018, agritech got a meagre $20.2 million, out of which Twiga Foods got $10.2 million.

Twiga Foods IFC Twiga Foods IFC

Read also: Lessons Twiga Foods Has Taught Startups About Disrupting Africa’s Food Supply Chain

A Quick Reminder About What Twiga Foods Does

Co-founded in Nairobi in 2014 by Peter Njonjo and Grant Brooke, Twiga Foods’ simple business model is to aggregate all food retailers and dealers, from the banana vendors buying in bulk to the avocado retailers selling in stock, and then connecting them to Kenyan farmers producing quality farm produce. This is a classic example of a business-to-business (B2B) model, so that vendors looking to purchase agricultural produce don’t have to travel miles to meet local producers of the produce, thereby saving them the transportation and logistics cost, increasing the productivity and demand for the produce of the farmers, at the same time reducing food waste.

These metrics are what TLCom Capital looked out for when it invested in the startup in 2019.

“TLcom’s general investment thesis for Africa is that given the high penetration of mobile, there are very large markets where demand is already proven and technology can play a true role in offering a superior value proposition over existing solutions,” said Ido Sum, partner at TLCom Capital which syndicated Twiga Foods’ recent $30 million fund raising led by Goldman Sachs.

Quite noteworthy is the fact that TLCom Capital is often strategic with its investments, going mostly for early comers with huge potential. It went for Nigeria’s Kobo360, a startup pioneering digital trucking in Nigeria through the Goldman Sachs-led $20 million investment. It also went for Andela, one of Africa’s well-funded startups. Hence, that Venture Capitalist TLCom Capital preferred to invest in tech companies in their early to growth stages, such as Twiga Foods, shows that the startup is, to a large extent, home to disrupt.

The same is also said of Goldman Sachs, America’s leading investment banker which is recently interested in Africa and international institutional firms and VCs looking to invest on the continent at a time when other international investment banks such as Credit Suisse and Barclays have cut down or exited their African operations altogether. Goldman Sachs’ investment in Twiga Foods marks its first major deal in a Kenyan firm.

Currently, Twiga Foods serves around 3,000 outlets a day with produce via a network of 17,000 farmers and 8,000 vendors. It allows parties to carry out goods exchanges through mobile apps using M-Pesa mobile money for payment.

From an initial focus on agricultural goods and connecting the produce of farmers to marketplaces, the company has since created additional revenue streams by moving into the B2B supply chain for Fast Moving Consumer Goods and other consumer products.

What Is An Unfunded Risk sharing Facility?

A Risk Sharing Facility (RSF) allows the International Finance Corporation (IFC) Bank to share risk on loans in the Bank’s countries of operations.

Under the RSF, the IFC participates in the risk of loans given by local Partner Financial Institutions (PFIs) to local companies such as Twiga Foods, with the IFC’s risk participation possible on a funded basis similar to a syndicated loan or an unfunded basis similar to a guarantee — depending on the needs of the PFI.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer