400 million. According to the UN, this is how many people are predicted to live in Nigeria by the end of 2050. This is almost double the current population, about 60% of which are unbanked and, if they are banking with one of the established incumbents, are increasingly unhappy with the overall customer experience and the exorbitant fees.

A better banking experience compared to services offered by traditional banks is a huge driver for the success of challenger banks across the globe. In Kuda’s case, this has translated into serving almost 300k customers and transacting over US$700m transactions per month, one year after launching in August 2019.

What is Kuda and what makes it so special?

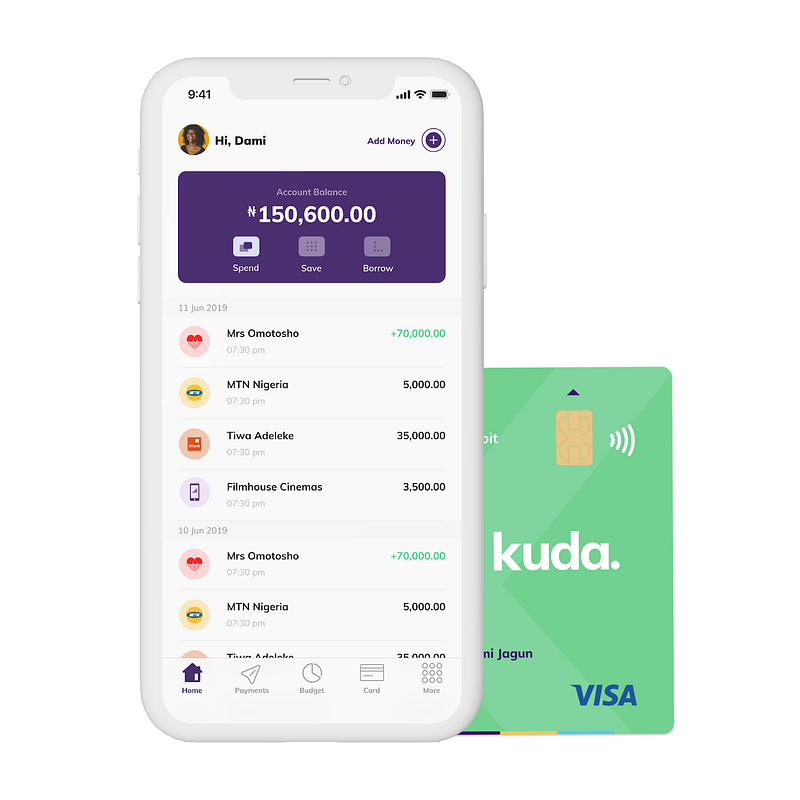

Kuda’s mission is to revolutionise the African banking sector and to give regular African banking customers access to free banking services. Available on iOS and Android, Kuda is effectively a zero fee, full service, digital bank and a pioneer in Africa. It also benefits from a first mover advantage as the first digital challenger bank with it’s own microfinance banking license in Nigeria.

Kuda App (www.kudabank.com)

While Kuda makes no profit on it’s core offering — it doesn’t charge card or account maintenance fees — it still earns money via interchange and it’s newly launched lending product. The latter is offered via overdrafts, which makes it a lot less risky than other more traditional lending products. In addition Kuda is planning on launching a remittance vertical soon to serve the Nigerian diaspora.

Read also:Fintech Startup, SeamPay launches mobile wallet for faster digital payments in Nigeria

The potential for Kuda is huge, not just in Nigeria but also to become the leading pan-African digital challenger bank. Of course, in the end, it’s not just the market size and its characteristics, but also the quality of the team that matters. When we first met Babs and his co-founder Musty we were immediately impressed by their comprehensive local market knowledge which they gained working many years in the Nigerian financial service industry.

Read also: Egyptian Startups Have A New $3m Micro Fund From VC Cairo Angels

After all, our investment in Kuda is exactly the kind of deal we like at Target Global: Backing ambitious and execution-focused visionaries building large transformational companies in sectors that we know well. In this regard we really feel that Kuda ticks all the right boxes and we are therefore extremely excited to announces the successful closing of a US$10 million fund raise — the largest ever African Fintech seed round ever — with participation from our friends at Entrée Capital (who are also co-investors @ some of our other successful Fintech deals, Rapyd and Finom) and a wide range of successful Fintech founders and angels such as Raffael Johnen (founder of Auxmoney), Johan Lorenzen (founder of Holvi), Brandon Krieg/Ed Robinson (founders of US-based, Stash), and Oliver and Lish Jung (angel investors in Nubank, Revolut, Chime).

Read also:Cape Verdean Fintech Startup Makeba Raises $2.8m Through Crowdfunding

Kuda will be using the investment to continue accelerating its growth plans and to keep up with customer demand. It is also in the process of opening a London office to attract top tier talent outside Nigeria.

We at Target are delighted that the team has chosen to work with us and we are excited about their path forward.

Dr. Ricardo Schäfer is a Partner Target Global Early Stage Fund II

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer