Digital lending startups in Kenya are not heaving any sighs of relief any time soon. In its latest move, the Central Bank of Kenya has insisted that the proposed regulations to regulate digital lending are not only necessary but need to be approved faster than scheduled.

“We would like a focus bill on unregulated digital credit providers that will avoid conflict with already regulated digital financial services providers,” said Njoroge to parliament during the defence of the regulations.

Here Is What You Need To Know

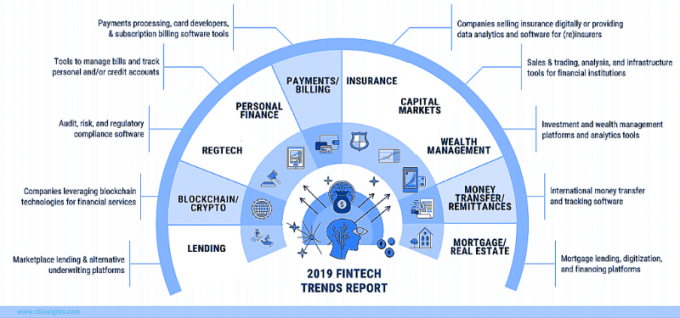

- The Central Bank of Kenya (Amendment) Bill, 2020, although purports to curb the steep digital lending rates that have plunged many borrowers into a debt trap as well as predatory lending, also extends its tentacles, by its operation, to all financial technology services in Kenya.

“At least shylocks hide. These platforms shout about themselves openly while impoverishing Kenyans,” Njoroge told a Parliamentary Committee meeting in August last year.

The Implications Of The Proposed Law On Digital Financial Services Startups In Kenya

Implied Lifting Of The Ban On Credit Lending Startups

Once the new law is passed into law, its first implication would be to terminate the ban on credit lending startups in Kenya as regards submitting credit information on their borrowers to Credit Reference Bureaus (CRBs). Thus, with a renewed power to report customers for blacklisting to the country’s central credit information sharing center, it is only safe to say that the risks associated with their business model have become, once again, more manageable.

Licensing of Digital Financial Services Companies/Startups

Another direct implication of the proposed new law on digital financial services startups in Kenya is that the Central Bank of Kenya will now possess recognized power under the law to issue operational licenses to startups desiring to provide services related to a digital financial product, financial product advice, market, administrative or management services or credit under a regulated credit contract in Kenya.

What this means is that startups that offer digital banking services will now also have to maintain a minimum authorized capital of five billion shillings ($46.4 million), which may be increased by such amount as shall be determined by CBK, unless the contrary is stated by the CBK.

In other words, all the rules regulating commercial banks and other financial institutions will now have to apply to startups offering digital financial services if the bill becomes law.

The Bill is coming amid complaints that digital lenders do not provide full information to borrowers on pricing, punishment for defaults and recovery of unpaid loans.

Digital lenders have also been accused of abusing personal information collected from defaulters’ mobile phone contacts list to bombard relatives and friends with messages regarding the default and asking third parties to enforce repayment.

Read also: Kenya Bans Digital Money Lenders, Extends Loan Repayment Period For Businesses

Regulation of Interest Rates Charged Users Of Digital Lending Services

Even though digital lenders in Kenya may still be allowed to lend, the law would however, if passed into law, see that they do not charge interests on their loans excessively. This is because the CBK could now determine the maximum rate of interest they charge their customers.

The latest move to control the activities of digital lenders follows the removal of legal cap on commercial lending rates by the Central Bank of Kenya in March 2020. The cap, established far back in 2016, which set interest rates chargeable by banks at 4%, was intended to address the issue of the affordability of credit for small enterprises and working people, as they had complained for years that high interest rates had locked them out of accessing credit.

Its removal in March this year has, however, resulted in the proliferation of digital lenders, who seek to take advantage of the business opportunities it offered. For instance, Tala, Branch, which are among top players in the mobile digital lending market in the country, offer interest rates of 152.4 percent and 132 percent per year respectively.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer