Apparently, Estonian investors may have well understood the African mobility market. The game now may be not to go after the public transport sector or to launch another ride-hailing startup. Arising from the $109 million investment secured by their fellow national company, Bolt (formerly Taxify) to invade the African market, South Africa-based Estonian startup Planet42, which in June this year, raised over $2.4 million to conquer the South African mobility market, has again secured US$10 million debt funding round to move into new markets.

“Our ambition is to make mobility accessible to everyone who can afford it, including the people that banks deem “blacklisted”, which comprise more than 90 per cent of our clientele. We’ve already signed up over 300 car dealerships across South Africa, but there are still several thousand to go. And that’s just the first market we have tackled. This round will open more doors in South Africa and beyond for us,” said Eerik Oja, the chief executive officer (CEO) and co-founder of Planet42.

Here Is What You Need To Know

- The US$10 million debt financing came from the US-based Lendable Inc, an institutional debt investor.

- This means that the total amount now raised by the startup is now US$20 million. The startup also has plans to raise a Series A round in 2021.

- With the financing, the company plans to expand into other emerging markets.

- The debt facility reduces the relative cost base of Planet42, enabling the company to pass savings onto its customers and make the product accessible to even more people.

- Because Planet42 owns the vehicles and generates predictable revenues from its fleet, it is in a position to raise significant debt financing.

Why The Investor Invested

“Planet42 has proved its ability to grow even through the current pandemic. We fully share their mission of improving people’s lives through access to mobility, and are thrilled to provide backing to expand Planet42’s impact in South Africa,” said Hani Ibrahim, chief investment officer at Lendable.

The co-founders have previously long been working in investment firms, hence the relative ease and deep connection in the industry. One of the co-founders, Marten Orgna also has a long history of the South African mobility space, hence the investors’ trust in the capacity of the team to execute.

Planet42 debt funding Planet42 debt funding

Read also: After Bolt, Another Estonian Startup Planet42 Raises $2.4m To Allow South Africans Own Cars

A Look At What Planet42 Does

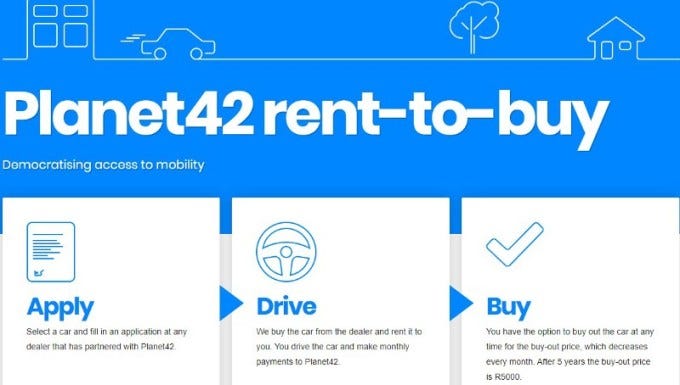

Planet42 originally launched as CarGet in 2017 to service South Africa, a market well-known to co-founder and CFO Marten Orgna, who ran African Investments for Trigon Capital. The startup partners with dealerships across South Africa to offer access to cars for personal use to its largely underbanked clientele (9 out of 10 of customers).

Planet42 uses an automated scoring algorithm to process client applications based on credit bureau, affordability, and alternative data.

If the application is approved, Planet42 analyses the customer’s validation documents, such as IDs, payslips and bank statements before purchasing the car from the dealership and renting it to the customer.

The asset is secured with tracking technology, as well as comprehensive and mechanical insurance. So far Planet42 has bought and delivered over 2,000 second-hand cars in South Africa, and it now plans to purchase 100,000 cars by 2024.

“We grew eight-fold in 2019 and we had our strongest month to date in April, despite the ongoing crisis. We see a huge need for people to improve their standards of living with better mobility, but a lack of options in the market to service them. More than 24 million people are credit impaired or have no access to finance in South Africa — that’s well over half of the adult population,” explains co-founder and CEO Oja, who gained experience in the alternative vehicle financing space as Country Manager for Mogo Finance in Estonia.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer