Crypto and blockchain companies in South Africa are on the verge of receiving formal regulatory certainty from the country’s authorities. This follows the granting of South Africa’s first regulatory sandbox approval to the initiative by Mercury Foreign Exchange, VALR, and Ripple to test the regulatory treatment of their products— which include cross-border payments using the Ripple cryptocurrency, XRP .

“The Intergovernmental Fintech Working Group received a total of 52 applications during the application window for the Regulatory Sandbox which closed on 15 May 2020. The 52 applications received represented a broad range of financial services activities of which 34 were related to payments, 7 savings and deposits, 5 lending, 3 investments, and the remaining 3 identified as “other,” reads a statement from Intergovernmental Fintech Working Group (IFWG), an organisation that is made up of South Africa’s major financial regulators and government agencies.

Here Is What You Need To Know

- The IFWG’s members include the National Treasury, the South African Reserve Bank, the South African Revenue Service, the National Credit Regulator, the Financial Sector Conduct Authority, the Financial Intelligence Centre, and the Competition Commission.

- VALR is a cryptocurrency exchange focused on the South African market that offers rand trading platform for bitcoin, ether, and ripple, while Ripple is a blockchain-based payment protocol and digital asset (XRP) that is supported on cryptocurrency exchanges all over the world. VALR also has a partnership with Bittrex, which enables it to buy and sell over 50 different cryptocurrencies.

- Luno and AltCoinTrader, VALR’s competitors in South Africa, also endorse the Ripple cryptocurrency.

- Ripple has recently been sued by the US Securities and Exchange Commission for allegedly executing an unregistered securities offering when it launched the XRP digital asset.

What Is Regulatory Sandbox And Why Is It Important For Crypto Startups In South Africa?

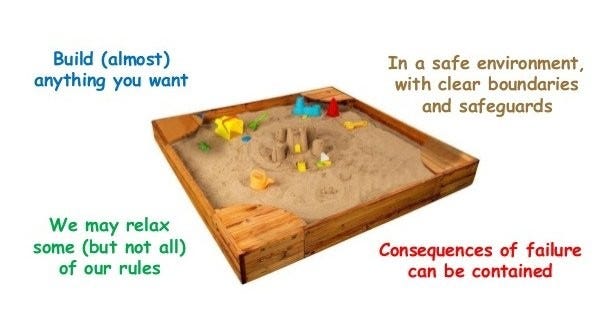

The aim of South Africa’s IFWG’s regulatory sandbox, according to the group, is to provide a secure environment for testing approved products or services.

“Accepted participants test their product or service within parameters established by the IFWG and are expected to report on testing progress at regular intervals,” IFWG said.

The IFWG, on the other hand, claimed that joining the sandbox does not change a startup’s licencing status or imply explicit or implied acceptance of the product or service under consideration.

“It does, however, offer both the regulators and the innovators an opportunity to consider the regulatory fit of emerging innovation. At the conclusion of testing, the insights gained should provide clarity on how such innovation could be treated from a regulatory perspective in future, thereby promoting regulatory certainty,” it said.

Lessons gained from the test, according to the IFWG, will assist South African regulators in deciding whether and how policies and regulations can improve to encourage responsible innovation in the industry.

Read also:Akon To Launch Cryptocurrency In Africa Before The End Of 2021

“In most cases testing is expected to last 6 months and the innovators have worked with the various regulators to determine appropriate testing parameters, consumer protection measures and continued compliance with all regulatory requirements during the testing period. Dates for the next intake’s application window will be communicated closer to the end of cohort,” the group said.

| S/N | Innovator | Innovator’s core business | What is in the sandbox? |

|---|---|---|---|

| 1 | The People’s Fund | Crowd-investing platform that facilitates raising capital for Small and Medium-sized Enterprises (SMEs) with consumers willing to invest. The investments are used to fund SMEs’ purchase orders, products or assets. | The sandbox seeks to clarify the treatment and appropriate framework for the intermediation of crowd-investing platforms. |

| 2 | The Standard Bank of South Africa Limited | Standard Bank is a financial institution that offers banking and financial services to individuals, businesses, institutions and corporations in Africa and abroad. | The scope of testing is limited to the reporting of cross-border foreign exchange transactions submitted to the Financial Surveillance Department of the South African Bank utilising a blockchain platform, and verifying that the reporting is timely and in compliance with all relevant reporting rules, as prescribed in the Business and Technical Specifications. The reporting tested will happen in parallel to existing reporting process and clients would not be impacted. |

| 3 | Investec Bank Limited (Investec) | Investec provides Specialist Banking and Wealth and Investment services to individuals, businesses and intermediaries. | Investec is testing a safe custody service for crypto assets through its innovative Digital Asset Vault offering. This is a secure mechanism for Investec clients to store and transfer crypto assets, reducing reliance on cold storage i.e. complex hardware wallets and/or crypto asset exchanges. The objective of testing the Digital Asset Vault in the Sandbox is primarily to test Investec’s regulatory compliance, regulatory reporting processes, and related risk management frameworks in collaboration with the IFWG. |

| 4 | Xago Technologies (Xago) | Cross-border remittances | Testing the regulatory treatment of crypto assets (specifically Ripple (XRP)) in terms of the South African Exchange Control Regulations 1961, promulgated in terms of section 9 of the Currency and Exchanges Act, 1933 (Act No. 9 of 1933), used for effecting cross-border transactions between South Africa and the United Kingdom, and the United Kingdom and South Africa, subject to certain limits prescribed by the relevant authorities, and reporting on such transaction to the relevant authorities. |

| 5 | Mercury FX (Mercury) | International payments | Mercury is testing the regulatory treatment, and associated regulatory reporting implications and obligations, of crypto assets (specifically XRP) being used for effecting low-value cross-border remittances between South Africa and the United Kingdom and vice versa, subject to certain limits prescribed by the relevant authorities. Testing will in the main be done in terms of the South African Exchange Control Regulations 1961, promulgated in terms of section 9 of the Currency and Exchanges Act, 1933 (Act No. 9 of 1933). |

| 6 | Centbee | Innovating digital payments | Centbee is testing the regulatory treatment of crypto assets (specifically Bitcoin (BTC) and Bitcoin Satoshi Vision (BSV)) for low-value cross-border remittances between South Africa and Ghana and vice versa |

South Africa crypto approval sandbox South Africa crypto approval sandbox

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer