Ethiopia has launched ‘Telebirr,’ a mobile money service that enables Ethio Telecom, the country’s telecom services provider’s customers to send, store, and receive money using only their phone number.

With the launch, the stage is now set for some fierce competition between Ethio Telecom, a telecom company owned by the country’s government, and M-Birr a mobile money company which has been active since 2009 with over 1.8 million users and a network of almost 33,000 points-of-presence covering branches, agents and other merchants. This competition stems from the fact that with this launch, Ethio Telecom’s Telebirr will now be available to its over 53 million customers.

Read also:African Telecoms Giants Battle Over Ethiopian Market

Through TeleBirr, customers will be able to email, receive, and store money using their mobile phones via the TeleBirr mobile money service.

They will also be able to pay for goods, utilities, and utility bills, as well as receive money from the diaspora, apply for loans, and connect their bank accounts to their TeleBirr wallet.

How to Register for Telebirr

Users may make self-registration for telebirr using their own mobile phone via App/USSD, or by visiting the nearest Ethio telecom’s shop, authorized retail agents or partner bank branches.

For more information on how to register, visit: https://www.ethiotelecom.et/telebirr/telebirr-registration/

Late To East Africa’s Booming Mobile Money Market?

Despite being the second most populous country in Africa with a population of more than 109 million, only about 33.86% of Ethiopian adults have formal accounts at financial institutions in Ethiopia, compared to the neighboring Kenya with over 82%.

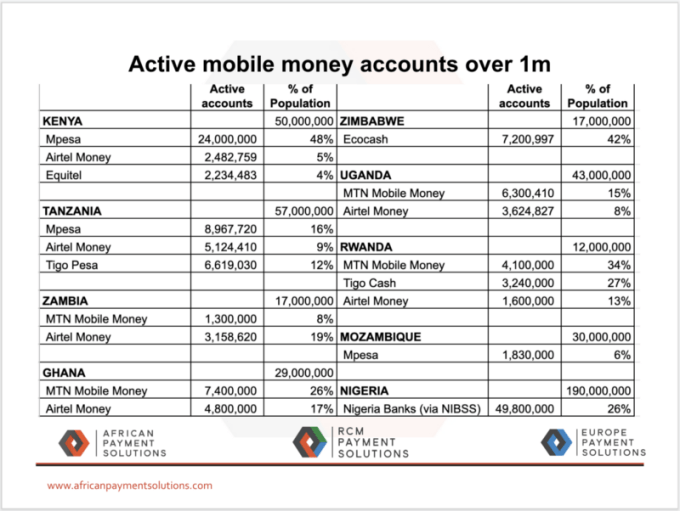

The country has also been largely left out of the booming mobile money market across the East African region. As of 2019, the total value of mobile money transactions reached $17 billion in Kenya, $12 billion in Tanzania and $5.9 billion in Uganda.

Even war-torn Somalia, with a meagre population of 15 million, about seven times smaller than Ethiopia’s, recorded approximately 155 million mobile money transactions, worth $2.7 billion, every month in 2018.

In 2019, the Global System for Mobile Communications (GSMA) declared East Africa number 1 in the world in terms of transaction volume and value of mobile money.

With more than 102 million active accounts, generating more than 17.1 billion transactions — an unmatched $293.4 billion in value and a 24% increase from 2018 — the region is the highest of any other sub-regions in the world. Sadly, none of these figures included Ethiopia.

It is therefore little wonder that a 2018 report by the GSMA described Nigeria, Ethiopia and Egypt, home to a combined adult population of over 242 million, as Africa’s mobile money sleeping giants.

Ethiopia’s low rate of mobile money usage could be attributed to the rigid regulatory walls that have ensured monopoly and lack of innovation. Telecommunication, aided by enabling legislations, has particularly driven the widespread adoption of the relatively new financial service type across Africa.

Read also:PayWay ET Secures 6-figure Grant As Fintech Landscape Takes Shape In Ethiopia

Safaricom’s M-Pesa, recently acquired by Vodacom, accounted for 655.95 million out of the 810.9 million mobile money transactions recorded in Kenya in the third quarter of 2019 alone. In Uganda, MTN enjoys over half the market share for mobile money.

“The reasons for this vary,” notes GSMA in its report about why Nigeria, Egypt and Ethiopia remain the continent’s sleeping giants when it comes to mobile money usage in Africa. “…In Ethiopia, a strictly regulated telco, restrictions on competition, lack of internet connectivity, and low levels of consumer trust and financial literacy have created barriers to uptake and market entry.”

Finally Loosening The Regulatory Barriers And Joining The League

In October 2020, after series of negotiations and deliberations, the National Bank of Ethiopia (NBE), finally granted a license to state-owned telecoms company, Ethio Telecom, to start mobile money service in the country.

This followed the issuance, in April 2020 by the bank, of a regulation called Licensing & Authorization of Payment Instrument Issuers.

For the first time in Ethiopia’s history, the regulation allowed mobile money transactions. However, there is a caveat: any company interested in the new financial service regime must set up a trust account with a deposit money bank in Ethiopia.

“As part of the application process,” the directive read, in parts, “the National Bank, may request for a preliminary meeting and demonstration of the intended payment instrument to be issued, its related services, products as well as operation. Based on requests made and written approval of the National Bank, a payment instrument issuer may be allowed to provide cash-in and cash-out; local money transfers including domestic remittances, load to card or bank account, transfer to card or bank account; domestic payments including purchase from physical merchants, bill payments; over-the-counter transactions; and inward international remittances services.”

The regulation has also opened up the country’s financial services sector to include that a licensed payment instrument issuer may, with the relevant agreement with regulated financial institutions and pension funds, be allowed to provide micro-saving products; micro-credit products; micro-insurance products; or pension products in the country.

Read also:MainOne’s Cloud Connect to Increase Business Connectivity in West Africa

The National Bank of Ethiopia also issued, that same year, a “Licensing and Authorisation of Payment System Operators Directive (ONPS/02/2020), allowing financial technology companies (fintechs) to start off payment processing and related services in Ethiopia.

Five licenses under the payment system operator directive include National Switch, Switch Operator, ATM Operator, POS Operator, and payment gateway license.

how to register TeleBirr how to register TeleBirr

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer