African fintech startup Chipper Cash has achieved unicorn status after raising $100 million in a C-Series funding round.

The round was headed by the investment division of the American Silicon Valley Bank — SVB Capital. Deciens Capital, Ribbit Capital, Bezos Expeditions, One Way Ventures, 500 Startups, Tribe Capital and Brue2 Ventures also took part in financing the startup.

The developers plan to use the funds to create new products. Part of the funding will also go towards hiring new employees.

| S/N | AFRICAN UNICORNS | SECTOR | YEAR FOUNDED | YEAR BECAME A UNICORN | COUNTRY (PRIMARY MARKET) | TEAM MEMBERS |

| 1 | Jumia | Ecommerce | 2012 | 2019 | Nigeria | Jeremy Hodara and Sacha Poignonnec, ex-McKinsey consultants |

| 2 | Interswitch | Financial services | 2002 | 2019 | Nigeria | Mitchell Elegbe |

| 3 | Fawry | Financial services | 2008 | 2020 | Egypt | Ashraf Sabry |

| 4 | Flutterwave | Financial services | 2016 | 2021 | Nigeria | Iyinoluwa Aboyeji, Olugbenga Agboola |

| 5 | OPay | Financial services | 2018 | 2021 | China | Opera |

| 6 | Chipper Cash | Financial services | 2018 | 2021 | Africa, with HQ in San Francisco, California, USA | Ugandan Ham Serunjogi and Ghanaian Maijid Moujaled |

A Look At What Chipper Cash Does

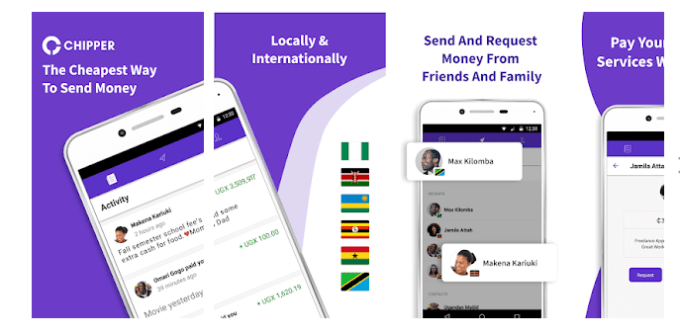

Founded in 2018 by Ugandan Ham Serunjogi and Ghanaian Maijid Moujaled, (two college students brought together by their academic adventures at Grinnell College, Iowa, USA) Chipper Cash provides free, interoperable payments in and between Ghana, Kenya, Uganda, Tanzania, South Africa, Rwanda, and Nigeria.

It accomplishes this by allowing customers to link their mobile money accounts (regardless of provider) to Chipper and make P2P transfers via its simple smartphone application.

After launching in October 2018, Chipper has averaged 40% month-on-month growth and already serves hundreds of thousands of users, attesting to its powerful value proposition and customer-focused design. The company has scaled to 3 million users on its platform and processes an average of 80,000 transactions daily. In June 2020, Chipper Cash reached a monthly payments value of $100 million, according to CEO Ham Serunjogi .

Read also:Fintech Startup, Chipper Cash Strengthens Presence In Rwanda

As of the end of May 2021, the startup is represented in a number of African countries, including Uganda, Nigeria and Tanzania. Chipper Cash also managed to expand to the UK. The country became the first market for the project outside of Africa.

Chipper Cash services are used by 4 million people. The startup noted that its user base grew by 33% over the coronavirus year 2020.

Parallel to its P2P app, the startup also runs Chipper Checkout: a merchant-focused, fee-based mobile payment product that generates the revenue to support Chipper Cash’s free mobile-money business.

On how the startup will compete in Africa’s crowded fintech ecosystem, Serunjogi pointed to Chipper Cash’s gratis-payment structure, among other factors.

“Money doesn’t buy product market fit. It doesn’t buy ultimate success in this space,” he said.

Read also:National Bank Of Egypt Adopts RippleNet Blockchain Technology

“By offering our product for free, we’re not in a pricing war or competing on a dollar-to-dollar basis. We’re in a pure utility war on who can provide the most value to our users. We’re quite comfortable with our position, and our long-term value proposition will speak for itself over time,” Serunjogi added.

Chipper Cash fintech Chipper Cash fintech

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer