For a long time now, authorities in Egypt have been concerned about assisting startups within its territory to thrive. They have never been more convinced than they are now. After the major successes of ride-sharing startup SWVL (which recently announced that it was going public on Nasdaq through a SPAC arrangement) and the mounting intensity of funding flowing from across the world into local startups, the government of the North African country, leaning on the usual Vision 2030 mantra, has finally put the final seal on the rules for operation of Special Purpose Acquisition Company, (SPAC).

A SPAC, also known as a blank-cheque company, is formed to raise cash through an initial public offering (IPO) in order to buy and take public an existing firm, usually a smaller one. Swvl is the second Middle Eastern company to use the SPAC method to go public. Anghami, an Abu Dhabi-based music streaming platform, announced earlier this year that it would merge with Vistas Media Acquisition Company, a SPAC, in order to go public.

Read also Endeavor Raises $8m To Fund Startups In South Africa

The new SPAC rules in place in Egypt are far-reaching in their effects, pulling down previously luguburious standards preventing smaller companies from selling their shares to the public. According to Dr. Mohamed Omran, Chairman of the Financial Supervisory Authority, the new rules known as Resolutions No. (171)of 2021, include rules governing the operations of SPAC, as well as Resolutions No. (172) of 2021, which amended the rules for listing and writing off securities on the Egyptian Stock Exchange.

Who Can Form A SPAC Under The Rules?

Under the new rules, companies for the purpose of acquisition (SPAC) must be formed only as a venture capital company in accordance with Article (27) of Egypt’s Capital Market Law No. (95) of 1992 and its amendments.

As a result, in order to be registrable as a venture capital company, the SPAC must have at least ten million Egyptian pounds ($636k) in issued and paid-up capital, which will be paid by the founders or promoters.

The SPAC must likewise be owned in this manner:

- At least 50% of the SPAC company must be owned by legal persons (natural or artificial).

- At all times, the percentage of ownership of the SPAC by financial institutions and/or qualified investors shall not be less than 25%.

- As for the founders and promoters, they shall contribute up to 5% of the SPAC’s capital for the SPAC. Their contribution must, however, not be less than ten million pounds ($636k) at the formation of the company.

What Are The Rules Governing The Operations Of A SPAC?

Under the new rules, registration as a SPAC comes with some heavy obligations, which include that:

- The SPAC must commit to raising capital within a month of its registration with the Egyptian Authority through public subscription and/or private offering based on the investment plan to buy the target companies.

- Following the SPAC’s capital raise, the board of directors must be reconstituted in accordance with a resolution passed by the SPAC’s General Assembly.

- The SPAC’s managing director must also be chosen from among the founders (promoters). Such a person must also fulfil the requisite experience requirements contained in guidelines (regarding direct investment companies) issued by the Authority.

- Under Resolution No. (171) of 2021, the SPAC’s articles of association must also include a provision authorizing the SPAC to deposit its entire issued capital, including the proceeds of the subscription (raised through public subscription or private placement), in a special account with one of the Central Bank of Egypt’s licensed banks.

- Again, if the SPAC raises at least 100 million Egyptian pounds ($6.3 million) under the SPAC arrangement, the money must be put in low-risk financial products that can be converted into cash on demand.

- Again, if the SPAC fails to achieve the minimum voting percentage required under the law for the approval of the target acquisition, the SPAC’s shares will be compulsorily written off, in accordance with the guidelines issued by the Authority’s Board of Directors. However, this can only happen under the rules if the Egyptian Stock Exchange, has in place, the Financial Supervisory Authority-approved executive procedures enabling that.

- Unless two years have gone after the procedures for raising the company’s capital were completed — or the SPAC company meets the minimum capital required to carry out its operation following the capital increase, which is 100 million pounds — the SPAC company must also put in place liquidation proceedings.

- Where any of the promoters or founders bears all the expenses — except for the establishment expenses, the auditor’s fees and the management fees — the founder or promoter can only obtain incentives or tax credits only after completing the acquisition of the target company (or companies), as disclosed in the prospectus.

- According to the guidelines, the draft acquisition proposal (containing full information of the targeted company’s activities) must be presented to the company’s extraordinary general assembly. The assembly must be set up in such a way that the founders or promoters, as well as anyone linked with them, are barred from voting on the acquisition proposal.

- If any shareholder objects to the acquisition proposal before the General Assembly, such shareholder must leave the company within thirty days following the General Assembly’s approval of the acquisition resolution. The exit can take one of three forms: i) the SPAC company selling objecting shareholders’ shares on the stock exchange; (ii) the SPAC company buying back their shares (treasury shares); or (iii) or the SPAC company by acquiring additional financiers for their shares.

- SPACs have a single goal under the new rules: to acquire ownership percentages in entities or companies within two years of completing the capital raise. The acquisition can be accomplished in one of three ways: i) 100% capital or voting rights acquisition, followed by a merger with the target company; or ii) acquisition of a controlling majority of the target company’s capital or voting rights in such a way that the percentage required to make a merger decision is exceeded by such acquisition; or iii) acquisition of an absolute majority of the target company’s capital or voting rights.

- By Resolution No. (172) of 2021, the new rules also altered the previous rules for the listing and delisting of securities on the Egyptian Stock Exchange. In place of the previous provisions, the rules have added an item authorizing the registration of SPAC shares. They also exempt SPACs from producing financial statements for the two fiscal years prior to their application for SPAC registration.

- At the time of the application for registration, the primary shareholders of the SPACs must, however, own at least 51 percent of the shares in the capital of the SPAC.

- The rules also provide that the net profit percentage in the previous fiscal year prior to the SPAC’s application for registration should not be less than 5% of the capital of the SPAC.

- The SPAC must also maintain its treasury shares for three months after filing the application.

- The proceeds realised from the capital increase by the SPAC must be deposited in an Egyptian bank account — designated as a special account — operated by a bank licensed by the Central Bank of Egypt. The proceeds to the deposited in the account cover proceeds raised through public subscription and/or private placement, but excludes expenses necessary for the establishment and licensing of the company, the auditor’s fees and the management fees.

- The SPAC must also appoint an independent financial advisor who is registered with the Authority to evaluate the target company.

What Are Required Of Target Companies Subject To SPAC Acquisitions?

The new guidelines state that companies subject to acquisition (such as tech startups) must follow the rules for stock market listing. The target company is, however, exempt from the provisions of items (5, 7, 8) of Article (7) of the rules for listing and delisting securities on the Egyptian stock exchange if it is one of the developing or promising companies working in the fields of technology, innovations, and digital technologies.

Read also IATF2021 Ends With Great Expectations for African Businesses

The rules define a company with the sole purpose of acquisition (SPECIAL PURPOSE ACQUISITION COMPANY «SPAC») as a company that is established and licensed as a venture capital company, with the sole purpose of acquiring one or more companies as target companies, and providing them with the necessary financing.

The Space For Tech Companies Is Still Small On The Egyptian Exchange

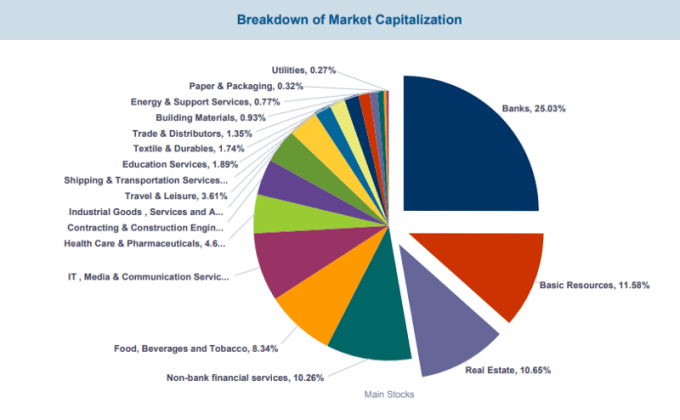

Compared to other sectors, there are currently only about six companies classified as tech on the Egyptian Exchange, out of over 220 companies listed on the exchange. And out of the six, only Egypt’s leading fintech firm, Fawry, may rightly be classified as a digital company in the true sense of the word.

However, even though there are only a few tech companies listed on the platform, they have outperformed other sectors in terms of trading volume.

For instance, the total trading value of the shares of tech companies listed on the exchange amounted to 3.7 billion Egyptian pounds in the first quarter of 2021, compared to 5.6 billion Egyptian pounds which accrued to listed banks, even though there are 14 banks currently listed on the exchange.

International Investors Are Interested In Egypt’s IPOs

The greatest insights, and the key to understanding the future of startup exits through IPOs on The Egyptian Exchange lie in the investors’ demographics.

Of the investors who participated in Fawry’s public listing, Egyptians represented 80.3% of the IPO and 50% of the private placement; while Arabs and Foreigners represented 19.7% of the IPO and 49.3 of the private.

This was expected; while the private placement was done by a foreign firm -Netherland Holding BV — the IPO was local and closer to Egyptians via the exchange.

But what is even more intriguing is the demographics of the participants in all the four IPOs that held on The Egyptian Exchange in 2019.

Read also Atlantica Ventures, Again, Leads $3.5m Seed Round In Nigerian Fintech API Startup OnePipe

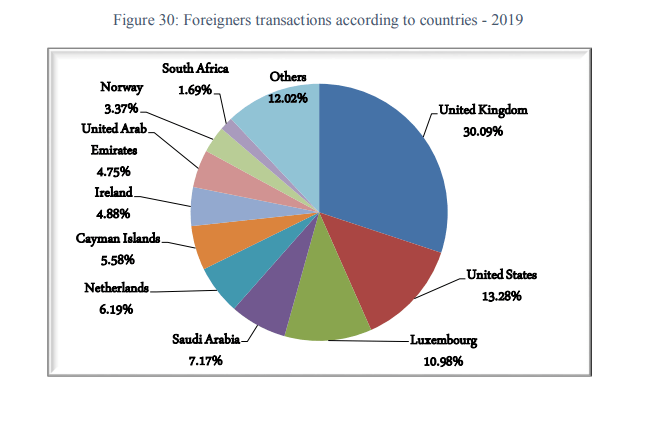

Valued at EGP 5.14 billion (compared to EGP 5.2 billion in 2018), the four IPOs saw 67.36% participation of foreigners, and only 32.64% of Egyptians, although Egyptians dominated total annual transaction deals (67.06% to 32.94%).

Overall, while investors from the United Kingdom accounted for 30.09 percent of total foreigner transactions in 2019, the United States of America, Luxembourg, and the Kingdom of Saudi Arabia, each had a share of 13.28 percent, 10.98 percent, and 7.17 percent, respectively.

New SPAC Rules Egypt New SPAC Rules Egypt New SPAC Rules Egypt New SPAC Rules Egypt New SPAC Rules Egypt

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer who has advised startups across Africa on issues such as startup funding (Venture Capital, Debt financing, private equity, angel investing etc), taxation, strategies, etc. He also has special focus on the protection of business or brands’ intellectual property rights ( such as trademark, patent or design) across Africa and other foreign jurisdictions.

He is well versed on issues of ESG (sustainability), media and entertainment law, corporate finance and governance.

He is also an award-winning writer