Onlookers might have assumed that by the time Egyptian transport firm Swvl made it to Nasdaq via SPAC purchase, it would have become one of the African startup ecosystem’s few success stories. However, it appears that this is no longer the case. Swvl’s hopes of relying on the Nasdaq adventure are dwindling by the day: the company’s share price has plummeted from $9.33 to $1.64 in the four months after it announced its Nasdaq listing. As per its latest statement, Swvl has also cancelled one of the largest purchases by an African startup in recent years, the acquisition of UK-based competitor Zeelo for about $100 million. Swvl indicated in the statement to its stakeholders that all prerequisites for finalising the Zeelo sale had been completed, but the transaction could not proceed due to the present financial market turbulence.

Swvl’s Recent Notable Timelines

- August, 2021: Swvl acquired Spain’s Shotl, and consequently entered Europe. Shotl was present (at the time of the acquisition) in 22 cities across 10 countries, including Brazil, Japan, and had a pan-European footprint, with over 350,000 bookings.

- August, 2021: Swvl received $35.5m in PIPE (Private Investment In Public Equity) funding including from investors Agility and Chimera Abu Dhabi. Swvl’s proposed business merger with Queens Gambit Growth Capital (the SPAC acquisition) was the reason for the investment. The PIPE investment was made using Swvl’s exchangeable notes. Each note was exchanged for shares of the combined company at an exchange price of $8.50 per share.

- November, 2021: Swvl announced its second acquisition, gobbling up ViaPool, a mass transit company in Latin America (Argentina). The deal was reportedly worth about $10 million.

- February, 2022: Swvl received extra $21.5 million in PIPE funding. Again, each note was exchanged for shares of the combined company at an exchange price of $9.1 per share. Swvl pegged $8.50 per share for notes issued in 2021 and $9.1 per share for notes issued in 2022.

- March, 2022: Swvl announced its third acquisition, of door2door, a German-based high-growth mobility platform that partners with municipalities, public transit operators, corporations, and automotive companies, providing software for on-demand mobility, multimodal routing and mobility analytics. door2door has 24% market share in Germany, which is Europe’s largest mass transit market. The value of the deal was not disclosed.

- March 31, 2022: Swvl went public (through a SPAC merger with Queen’s Gambit Growth Capital). As a result of this, Swvl Holdings Corp. Class A common stock and warrants of Swvl Holdings Corp. began trading on NASDAQ under the ticker codes “GMBT” and “GMBTW.” Shares were sold at $9.33 per share on the first day. An aggregate of 35% of Swvl’s total ownership became public tradable.

- April, 2022: Swvl announced the acquisition of Volt Lines, a Turkey-based B2B and mobility-as-a-service company. The acquisition was made one month after Swvl’s public listing. Swvl stock was down 12% in pre-market trading at this time. The value of the deal was not disclosed.

- April, 2022: Swvl announced the purchase of Zeelo, the UK’s largest smart bus platform and technology scale-up by bookings, for US$100 million. The transaction was scheduled to close in May 2022.

- May, 2022: Swvl announced it has laid off 32% of its entire workforce. The lay offs affected staff in the startup’s engineering, product, and support divisions. Swvl it expected to be cash-flow positive in 2023 as a result of the downsizing.

- June, 2022: Swvl the suspension of its daily and city-to-city services in Kenya and its daily services in Pakistan. In a statement, Swvl noted that the suspension was “in light of the worldwide economic slump.”

- July, 2022: Swvl announced the acquisition of its Mexico-based Urbvan Mobility Ltd (“Urbvan”), a shared mobility platform that provides tech-enabled transportation services to Latin America’s second biggest country by population. Formed in 2016, Urbvan is present in 18 cities around Mexico. The value of the deal was not disclosed. According to Swvl, the deal will be completed in Q3 2022.

- July, 2022: Swvl terminated their previously-announced $100m transaction whereby Swvl would acquire Zeelo. Swvl previously funded a $5M convertible promissory note to Zeelo. Following the termination of the acquisition transaction, Swvl and Zeelo mutually agreed to terminate the convertible promissory note and Swvl forgave the $5M balance under the transaction.

- August, 2022: Swvl announces first major partnership outside of acquisition with the Kuwait-based City Group, a premier transport operator and provider of warehouse services in Kuwait, under which City Group will use Swvl’s Software as a Service (“SaaS”) products.

A Woeful SPAC Outing

According to Swvl’s Form 424B3 filed on July 7, 2022, it is clear that the five-year-old startup is not only dealing with the current volatility in the financial markets, but it also appears to be dealing with the uncertain confidence of its SPAC investors, who appear to be willing to hang on even longer without redeeming their shares in the company. According to lock-up extension agreements signed between Swvl and the concerned investors, who own 84 percent of the shares currently trading on Nasdaq, they would be required to hold on for extra periods ranging from one year to eighteen months after the prior lock-up periods expired.

Read also Kenya’s Sendy Joins Swvl, Vezeeta and Wave, Lays Off 10% Of Its Workforce

The lock-up agreements, together with other alternative financing agreements, provide a mechanism to avoid the existing high redemption rates among SPAC investors. SPAC redemptions were on the upswing for 2021. From January through July, the average monthly SPAC redemption rate ranged from 7% to 43%, according to SPAC Research/SPAC Alpha. From July to November, however, this range expanded to 43 percent -67 percent, with the average SPAC having a redemption rate of 60 percent across these four months.

The purpose of redemption rights under a conventional SPAC arrangement is to assist motivate investors by giving them a sort of “money-back guarantee” that entitles them to return their shares for the initial IPO price, which is normally a modest $10 per share. However, if a considerable proportion of shareholders choose to exercise their right to redemption, as has recently happened with several SPACs, the combined SPAC business’s capital available for future operations may be significantly reduced. This will almost certainly expose the SPAC to the risk of failure if it occurs. A common scenario that triggers this right of redemption is when the share trades below its listing price. Swvl’s stock price has since fallen from $9.33 to $1.64. The table below depicts these difficulties among recently-listed SPAC companies.

| S/N | NAME OF SPAC COMPANY | INDUSTRY | SPAC MERGER COMPLETION DATE | STOCK MARKET | PRICE PER SHARE ON FIRST DAY OF PUBLIC TRADING (IN USD ) | CURRENT PRICE PER SHARE AS AT AUGUST 3, 2022 (IN USD) |

|---|---|---|---|---|---|---|

| 1 | Anghami, Inc. | Music Streaming | February 4, 2022 | Nasdaq | 8.88 | 3.13 |

| 2 | Swvl Holdings Corp | Digital Transport | March 31, 2022 | Nasdaq | 9.33 | 1.64 |

| 3 | Forge Global Holdings, Inc | Software Application | March 21, 2022 | NYSE | 10.11 | 4.55 |

| 4 | Cepton, Inc. | Software Application | February 14, 2022 | Nasdaq | 9.2 | 1.76 |

| 5 | GreenLight Biosciences Holdings, PBC | Biotechnology | February 2, 2022 | Nasdaq | 8.82 | 3.26 |

| 6 | Dave Inc. | Fintech | January 05, 2022 | Nasdaq | 8.02 | 0.73 |

| 7 | Cvent Holding Corp | Cloud-based enterprise | December 17, 2021 | Nasdaq | 8.19 | 6.08 |

| 8 | Boxed, Inc | Ecommerce Retailing | August 12, 2021 | Nasdaq | 9.98 | 1.90 |

| 9 | Vacasa, Inc. | Rental Management Platform | December 06, 2021 | Nasdaq | 9.97 | 2.88 |

| 10 | BigBear.ai Holdings, Inc. | Artificial Intelligence | December 07, 2021 | Nasdaq | 10.03 | 2.40 |

| 11 | BuzzFeed, Inc. | Digital Media | December 3, 2021 | Nasdaq | 9.62 | 1.89 |

| 12 | Lottery.com | Gambling | November 19, 2021 | Nasdaq | 8.23 | 0.47 |

| 13 | DocGo Inc. | Mobile Health Platform | November 17, 2021 | Nasdaq | 9.57 | 8.30 |

| 14 | Embark Technology, Inc. | Self-driving software solutions | November 10, 2021 | Nasdaq | 8.80 | 0.51 |

| 15 | Nerdy Inc. | Live online learning platform | September 20, 2021 | Nasdaq | 11.20 | 2.98 |

| 16 | Offerpad Solutions Inc. | Real Estate Platform | September 01, 2021 | Nasdaq | 8.80 | 2.09 |

| 17 | SmartRent, Inc. | Enterprise software- Smart home operating system | August 24, 2021 | Nasdaq | 12 | 5.73 |

| 18 | Matterport, Inc. | Data | July 22, 2021 | Nasdaq | 15.00 | 4.79 |

| 19 | Sunlight Financial Holdings, Inc. | B2B2C POS Fintech | July 09, 2021 | Nasdaq | 7.97 | 3.99 |

| 20 | Playstudios Inc. | Gaming | June 21, 2021 | Nasdaq | 5.8 | 3.8 |

Lessons African Startups Can Draw From Swvl’s SPAC Outing

Speedy Execution Is Key But Regulations Remain King

Swvl’s co-founders’ ability to execute quickly has never been questioned. Indeed, one of its early backers, Vostok New Ventures (now VNV Global), stated succinctly in 2019 that “The entrepreneur in this case is of exceptional calibre. Mostafa Kandil, previously of Rocket and Careem, has established a team that executes well and quickly. Indeed, Mostafa could be the first Arab tech entrepreneur to build a global product.” This quick execution skill ensured that the founders were able to expand the startup globally and take it public within a record period of just 5 years.

Read also South African Fintech SME Funder Retail Capital Acquired By TymeBank

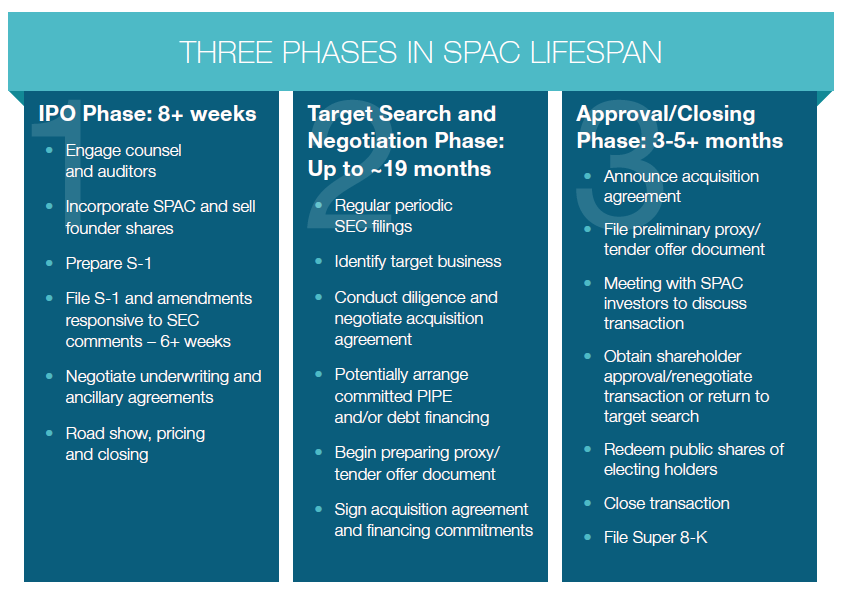

However, swift execution frequently entails dangers, notable among them being those related to regulation. SPAC was formerly only weakly regulated by the Securities and Exchange Commission (SEC), which is in charge of overseeing securities and investments in the US. SPAC financial statements were fairly brief and could be created in a matter of weeks in the IPO registration statement (compared to months for an operating business). There were no past financial results or assets to reveal, and the company risk indicators were modest. The IPO registration statement was basically standard language with director and officer biographies thrown in for good measure.

But all that has changed since the SEC approved the issuance of proposed rules regarding special purpose acquisition companies (“SPACs”) on March 30, 2022.

The following primary modifications for SPACs would now be required by the proposed rules: a) in certain SEC filings by SPACs, new disclosure and financial statement requirements, especially in relation to financial projections and fairness evaluations in de-SPAC transactions; b) the removal of the safe harbour for forward-looking statements under the Private Securities Litigation Reform Act of 1995 (the “PSLRA”) for disclosure in those registration statements; c) new registration requirements under the Securities Act of 1933, as amended (the “Securities Act”), for de-SPAC transactions; Securities Act liability for “underwriters” in de-SPAC transactions; and a 20-calendar-day minimum dissemination period for disclosure documents in a de-SPAC.

Perhaps the SEC’s most significant disclosure rule is the one which provides that SPAC sponsors must now inform SPAC shareholders that their incentives are to close any deal, and that shareholders who continue to hold SPAC shares through the deSPAC will have their holdings diluted by at least 20%, and frequently substantially more.

Read also African Mobility Fintech Moove Closes $20M New Funding From South Africa’s Absa

Due to this increased attention from regulatory organisations like such as the SEC and the Financial Industry Regulatory Authority (FINRA) in recent months, SPAC acquisitions are now intrinsically riskier. Numerous high-profile SPACs have recently been the subject of federal investigations, which has probably put many ordinary investors on the defensive.

Therefore, startup owners should push for speedy execution while simultaneously keeping an eye out for any regulatory ambushes and preparing a response in advance. There is no point in denying that the string of SEC regulations that were enacted after Swvl’s SPAC went public undoubtedly caught the company off guard. This is clearly evident in its recent operational decisions.

Increasing A Startup’s Burn Rate Due To High Compliance Costs May Be Costlier In The Long Run, Especially For Startups Without Any Future Funding Clarity

In any case, every startup’s ultimate goal is to exit as soon as possible, but doing so need not be costlier, especially if the startup is not yet mature enough to handle certain costly operations.

Swvl had raised $122 million in total funding as of February 2022. It then paid more than $10 million in fees for its SPAC IPO. While acknowledging that it may incur significant expenses and devote significant management effort to ensuring compliance with the requirements of Section 404 of the Sarbanes-Oxley Act, which will increase further when it is no longer an “emerging growth company” as defined under the US Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), Swvl suggests that it may have to delist from Nasdaq in the future if it becomes increasingly unprofitable to continue to list.

The higher compliance costs, as well as the company’s dismal performance on Nasdaq, explain why it has recently had to curtail its operations. It is still unclear whether the company would avoid more downsizing in the future.

Startup’s Management Should Implement Standard Corporate Governance Practices And Undergo Relevant Training Early Enough

One important takeaway from Swvl’s SPAC adventure is the importance of early exposure to sound corporate governance principles. This will get the startup’s management ready for the challenges of following and putting into practise the accepted corporate governance standards.

Swvl acknowledged that its management team has limited expertise to handle a publicly traded firm, deal with investors in public companies, and adhere to the ever-more-complex legislation governing public corporations.

“Swvl’s management team may not successfully or efficiently manage their new roles and responsibilities or the transition to being a public company subject to significant regulatory oversight and reporting obligations under U.S. federal securities laws and the continuous scrutiny of analysts and investors. These new obligations and constituents will require significant attention from Swvl’s senior management and could divert their attention from the day-to-day management of Swvl’s business, which could adversely affect Swvl’s business, financial condition and operating results,” the recent disclosure from the company reads.

Startups should therefore prepare themselves from the beginning for the challenges of building a global company as well as the regulatory and corporate governance practices they will face during the growth stage of their business.

swvl SPAC lessons swvl SPAC lessons swvl SPAC lessons swvl SPAC lessons swvl SPAC lessons swvl SPAC lessons swvl SPAC lessons

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer, who has several years of experience working in Africa’s burgeoning tech startup industry. He has closed multi-million dollar deals bordering on venture capital, private equity, intellectual property (trademark, patent or design, etc.), mergers and acquisitions, in countries such as in the Delaware, New York, UK, Singapore, British Virgin Islands, South Africa, Nigeria etc. He’s also a corporate governance and cross-border data privacy and tax expert.

As an award-winning writer and researcher, he is passionate about telling the African startup story, and is one of the continent’s pioneers in this regard. You can book a session and speak with him using the link: https://insightsbyexperts.com/view_expert/charles-rapulu-udoh