We Are Improving Revenue Generation Outside Natural Resources — Samuel Jibao

Dr Samuel S. Jibao, Commissioner-General of the National Revenue Authority (NRA) is an accomplished economist cum researcher whose area of interest is Public Economics with special focus on Taxation. As the helmsman of the NRA in the past one year, he has brought unprecedented transformation to the Authority. In this interview, Jibao speaks on the ongoing reforms in the NRA and their impact on trade and economic growth in Sierra Leone. Excerpts:

HOW would you describe the contributions of NRA to the economy of Sierra Leone?

Any decisive government has to envision financing its public expenditure primarily from domestic revenue rather than depending on the unpredictable and conditional donor funding. While donor funds still has a strong presence in the Sierra Leonean budget, domestic revenue contribution has been on the increase since the inception of the present administration in 2018. In that year, total receipts (domestic revenue and grants) rose to73% of the government budget from 62% the previous year; of which domestic revenue was 64% of total government budgeted expenditures (compared to 52% in 2017).

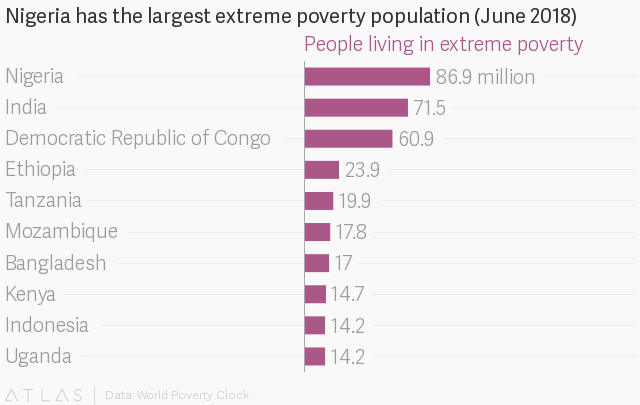

This implies that NRA’s contribution to financing the public budget has enhanced economic growth and reduced poverty through increased government spending in public infrastructure and human capital. By mobilising more revenue, the fiscal space for government to spend more in pro-poor sectors is enhanced. It is noteworthy that the function of the NRA is not limited to revenue mobilisation. Indeed, the reforms at the Customs Service Department through the implementation of an easy-to-use and more transparent ASYCUDA World system and its associated functionalities in January this year has made the clearance process easier and transparent, thus reducing cost to importers and facilitating trade.

The recent reforms which enable the Customs Service Department to operate on weekends and extend the banking hours have further helped facilitate trade since importers now have more time to clear and pay for their goods. This, indeed, has boost trade expansion and economic growth in the country.

Tax evaders normally channel their monies to tax havens. What measures are in place to stop them from avoiding paying taxes?

Despite the fact that many multinational corporations partake in stock exchange, some of them evade taxes. Base Erosion and Profit Shifting (BEPS) is one of the avenues that multinational companies have been using as tax planning measure to avoid paying taxes. In Africa where accessing information on the operations of such international companies is hard, it is difficult to tackle such practices. However, the African Union and the Africa Tax Administration Forum (ATAF) have been working to enhance the capacity of the region to tackle such practices. In Sierra Leone, we have signed up to the OECD’s Inclusive Framework on BEPS, which helps member-countries to collaborate on the measures to tackle tax avoidance, improve the coherence of international tax rules and promote a more transparent tax environment.

In addition, Sierra Leone through support from OXFAM and ATAF is on the verge of drafting a Transfer Pricing Regulation that will consolidate separate provisions of Transfer Pricing in different legislations and ensure the country has a reference document as a Transfer Pricing Regulation to handle transfer pricing attempts by multinational companies. We have also received approval from the Tax Inspectors Without Borders secretariat for experts in audits including transfer pricing audits to build the capacity of our tax auditors and provide hands-on support in complex audits especially of international transactions.

Read also : Businesses In Nigeria To Pay Extra Value-Added Tax (VAT) and New Police Fund Levy

Recently, government took a strong stance on controlling and monitoring repatriation of proceeds from economic activities in Sierra Leone to other countries. Collaboration, both domestically and internationally, is usually the preferred option to handle such practices. In this regard, the NRA is on the verge of signing an MOU with the Financial Intelligence Unit (FIU) to exchange information on financial intelligence including that on Multinational Enterprises (MNEs). Related to that is the recent collaboration between the NRA and FIU to strengthen currency declaration administration at the airport. Our next step is to sign up to the automatic exchange of information platform, which is crucial for tracking evaders.

Given the level of the informal economy, what is being done to expand the tax base?

In Sierra Leone, just as in many developing counties, the informal sector is quite large, therefore, getting them into the tax net helps in considerably expanding the tax base. The NRA is cognisant of this and has been working in several fronts to expand the tax base so as to boost domestic revenue.

Currently, the Authority is gathering data of registered businesses from several third party sources with a view to matching that information to identify taxpayers/businesses that may not have been registered with the NRA and, subsequently, get them registered. Going forward, the Authority has signed MoUs with various government agencies charged with the responsibility of registering businesses even as we intend to sign more.

Secondly, after the conclusion of the current Taxpayer Identification Number (TIN) verification, the NRA hopes to encourage voluntary registration of businesses into our taxpayer database at designated centres across major cities of the country. Once, this period expires, the Authority, with support from the Ministry of Finance, will undertake a nationwide block registration or business census, to identify any other businesses or potential taxpayers that may not have been verified or voluntarily registered, by going street-by-street or block-by-block to identify those without the NRA verification stickers affixed at their premises showing they have been registered. With this census or block registration exercise, we hope to get most, if not all, establishments into the NRA tax register, hence, expand the tax base.

Read also : Nigeria ’s Federal Tax Authority Will Go After Company Directors And Company Secretaries Going Forward

Interestingly too, the country recently signed a grant support with the African Development Bank (AfDB) to implement a tax compliance enhancement project, including the implementation of a Domestic Tax Preparer(DTP) scheme to support the record keeping and returns filing abilities of SMEs with a view to formalising their operations and expanding our taxpayer base

Kelechi Deca

Kelechi Deca has over two decades of media experience, he has traveled to over 77 countries reporting on multilateral development institutions, international business, trade, travels, culture, and diplomacy. He is also a petrol head with in-depth knowledge of automobiles and the auto industry.