Nigeria is set to displace all physical transactions involving cash. The country’s central bank has issued a new policy that is targeted at phasing out all transactions involving the movement of cash within the country. In simple language, the Central Bank of Nigeria is telling all businesses who rely on the country’s banking system to go digital or be fined for not doing so. This event is happening despite the fact that more than 4 % of the world’s financially excluded live in Nigeria.

Here Is All You Need To Know

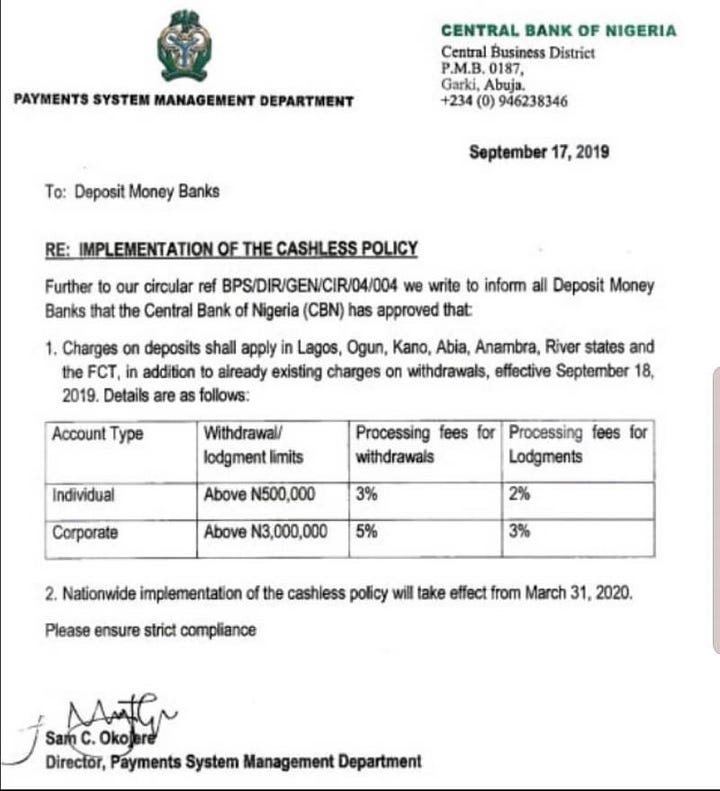

- From September 18 2019, withdrawals and deposits of physical cash in Nigeria will now attract processing fees payable by individuals or corporate owners of bank accounts involved where the transactions were carried out in Nigeria’s commercial capital Lagos; the Northern state of Kano; and the Southern states of Rivers, Ogun, Anambra and Abia; including Nigeria’s capital city Abuja.

- It will however become effective in all states of Nigeria on March 31, 2020.

- Nigeria’s central bank said the measure was put in place to encourage its cashless policy .

- Cash withdrawal by an individual from N500, 000 and above will attract 3% of the amount withdrawn while cash deposit of N500, 000 and above will attract 2% of the amount to be deposited.

- 5% processing fee will be levied on cash withdrawals from N3 million and above from a corporate account while cash deposits attract 3% processing fee.

- The charges are an addition to the already existing ones, the CBN’s Director of Payments System Management Department Sam Okojere, said in a memo to deposit banks on Tuesday.

| Account Type | Withdrawal/Lodgment Limits | Processing Fees for Withdrawals | Processing fees for lodgements |

| Individual | Above N500,000 | 3% (N15,000)$42 | 2% (N10,000) $28 |

| Corporate | Above N3,000,000 | 5% (N150,000) $417 | 3% (N90,000) $250 |

The Implication of This

Government Struggling to Shore Up A Struggling Economy?

- The imposition of extra charges by the CBN may not be unconnected to the President Muhammadu Buhari’s government struggles to boost non-oil revenue since oil sales make up 90% of foreign-exchange receipts.

Poor Financial Inclusion Rate

- The new policy is expected to be a major set back on CBN’s continued hype on financial inclusion. Many Nigerians, for numerous reasons are currently unbanked and lack access to formal financial services. The results of the EFInA Access to Financial Services in Nigeria 2012 survey, for instance, showed that 34.9 million adults representing 39.7% of the adult population were financially excluded. Only 28.6 million adults were banked, representing 32.5% of the adult population. Billions of Naira circulate through the informal sector and this has a negative impact on the country’s economic growth and development. The EFInA Access to Financial Services in Nigeria 2012 survey revealed that 23.0 million adults save at home. If 50.0% of these people were to save N1,000 per month with a bank, then up to N138 billion could be incorporated into the formal financial sector every year. With this new policy, expect financial inclusion rate in Nigeria to dive further low. The immediate impact of this is that in the absence of finance, people who are not connected with the formal financial system lack opportunities to maximise their income and expand their businesses. Again, vast unutilized resources, in the form of money in the hands of people who are in the informal sector could limit a country’s economic growth potential.

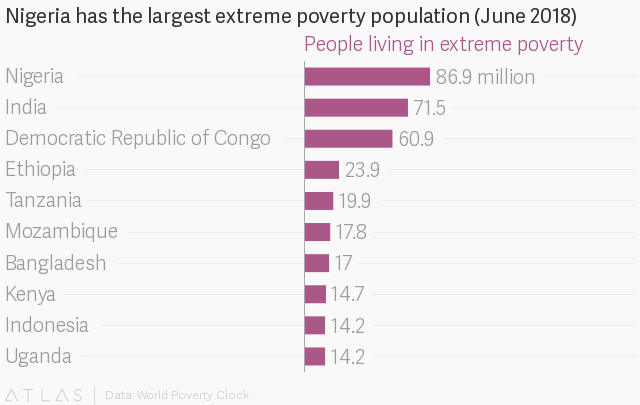

New Digital Tax

- Again once the old VAT Act is amended, and the new VAT rate becomes effective, the new rate will automatically be applicable to online transactions carried out in Nigeria. Nigeria ’s Federal Inland Revenue Service, the national tax agency has recently announced that digital tax will become effective January, 2020. This is expected to discourage online transactions and shrink the purchasing powers of Nigerians in a country where the gdp per capita is still less than $2000 ( one of the lowest in the world) and over 86.9, representing 50% of the population are still living below the global poverty line (the worst in the world).

Poor Internet Penetration Rate

- The Global State of Digital in 2019 report discovered that there are 98.39 million internet users in the country. Compared to January 2018, there has been a 4 million increase in the number of internet users. Despite this increase, overall internet penetration remains quite low, with only 50% of the population connected to the internet, compared to the global average of 57%. Unlike Nigeria, Kenya has a really high level of internet penetration (84%), South Africa 54%, and Ghana 35%. Of the 98.39 million Nigerian internet users, 54% access the internet on a daily basis. The new policy also brings to question the capacity of Nigeria’s banking sector and other digital services to effectively process payments, with less error and under good and steady power supply.

New Opportunities For Fintech Startups

With the new policy, expect increased activities for fintech startups in Nigeria who would be battling to capture the market share. This is therefore, a golden opportunity for startups in the financial services sector, although there is still a huge barrier of trust to overcome.

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based Lawyer with special focus on Business Law, Intellectual Property Rights, Entertainment and Technology Law. He is also an award-winning writer. Working for notable organizations so far has exposed him to some of industry best practices in business, finance strategies, law, dispute resolution, and data analytics both in Nigeria and across the world