6 Years After With $920K In Funding, Kenyan Ecommerce Startup Zumi Shuts Down

Zumi, a Kenyan e-commerce site that sold non-food items, has shut down after its funding ran out, adding to the increasing number of digital companies that have failed recently in Kenya.

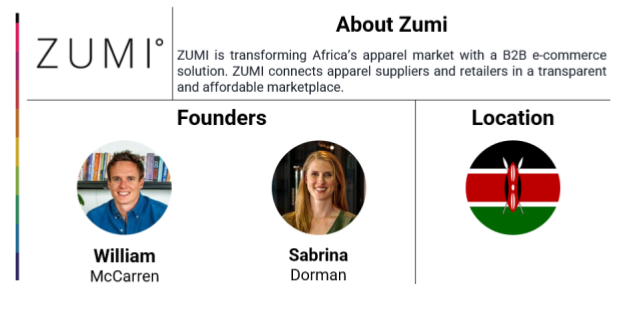

William McCarren, the co-founder and CEO of the company, said on LinkedIn that the move would result in at least 150 people being let go due to fundraising challenges that threatened viability.

“With a heavy heart, I share the news that Zumi will be closing its doors. The current macro environment has made fundraising extremely difficult, and unfortunately, our business was not able to achieve sustainability in time to survive,” wrote McCarren.

According to Crunchbase data, Zumi has raised more than $920,000 (Sh120 million) in investment since its founding in 2016, and according to McCarren, the company had 5,000 clients and over $20 million (Sh2.6 billion) in revenue during that time.

Zumi, which began as a women’s-focused digital magazine, withdrew from the media business and switched to e-commerce after experiencing difficulty generating enough cash from digital advertisements.

read alsoKenyan Recommerce Startup Badili Raises New Funding From Renew Capital

The company’s decision to shut down is part of an ongoing pattern in which promising digital firms have been going out of business one after another, with the majority of them claiming challenging market circumstances and financial challenges.

As Kune Foods, Notify Logistics, WeFarm, BRCK, and Sky-Garden closed their doors in the past year, hundreds of jobs were lost, making the latest shut down the seventh tech start-up with headquarters in Kenya.

Sendy, for its part, shut down Sendy Supply, a platform for trading between retailers and suppliers, and reduced its personnel by 20% in October.

Zumi ecommerce Zumi ecommerce

Charles Rapulu Udoh

Charles Rapulu Udoh is a Lagos-based lawyer, who has several years of experience working in Africa’s burgeoning tech startup industry. He has closed multi-million dollar deals bordering on venture capital, private equity, intellectual property (trademark, patent or design, etc.), mergers and acquisitions, in countries such as in the Delaware, New York, UK, Singapore, British Virgin Islands, South Africa, Nigeria etc. He’s also a corporate governance and cross-border data privacy and tax expert.

As an award-winning writer and researcher, he is passionate about telling the African startup story, and is one of the continent’s pioneers in this regard